Question: *PLEASE ANSWER THE QUESTION IN THE FORMAT TABLE PROVIDED* *PLEASE ANSWER THE QUESTION IN THE FORMAT TABLE PROVIDED* Hudson Partners provides management consulting services to

*PLEASE ANSWER THE QUESTION IN THE FORMAT TABLE PROVIDED*

*PLEASE ANSWER THE QUESTION IN THE FORMAT TABLE PROVIDED*

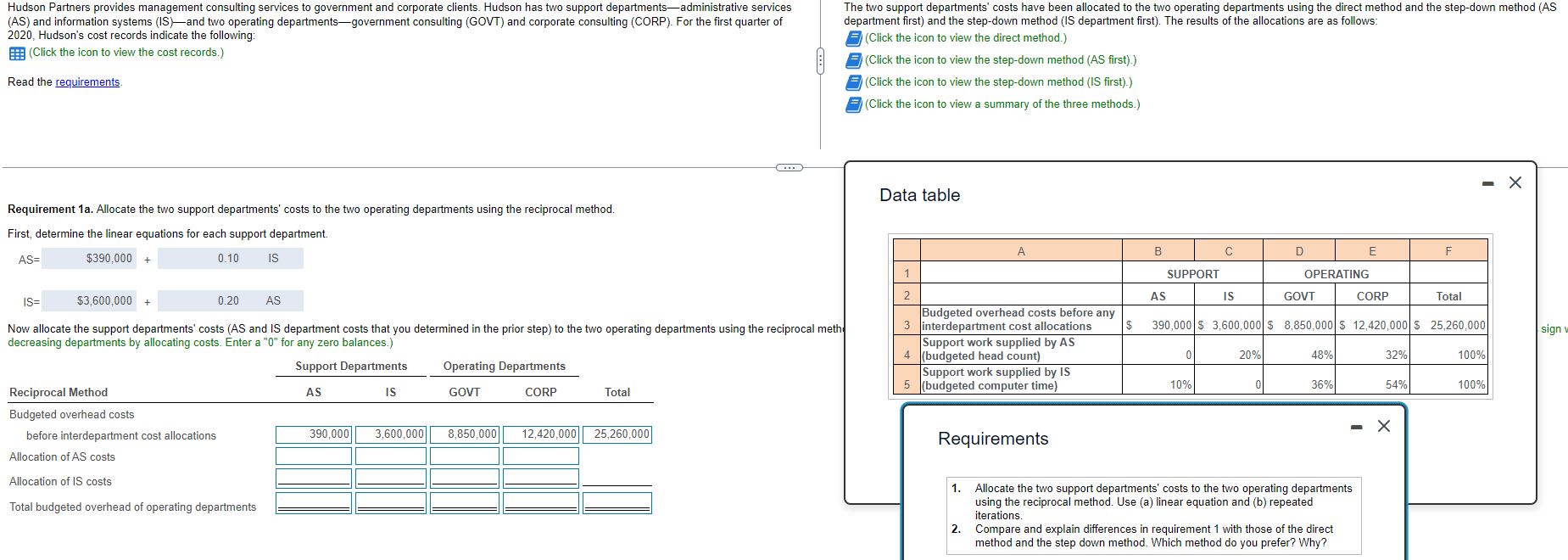

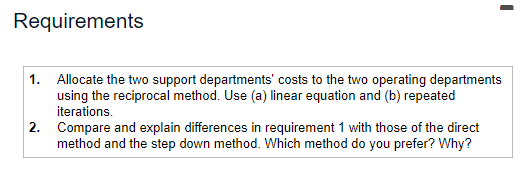

Hudson Partners provides management consulting services to government and corporate clients. Hudson has two support departmentsadministrative services (AS) and information systems (IS)and two operating departmentsgovernment consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2020, Hudson's cost records indicate the following: :: (Click the icon to view the cost records.) The two support departments' costs have been allocated to the two operating departments using the direct method and the step-down method (AS department first) and the step-down method (IS department first). The results of the allocations are as follows: 2 (Click the icon to view the direct method.) (Click the icon to view the step-down method (AS first).) (Click the icon to view the step-down method (IS first).) (Click the icon to view a summary of the three methods.) Read the requirements .. - X Data table Requirement 1a. Allocate the two support departments' costs to the two operating departments using the reciprocal method. First, determine the linear equations for each support department. AS= $390,000 + 0.10 IS A B D E F 1 SUPPORT OPERATING 0.20 AS AS $3,600,000 + IS IS= GOVT CORP Total $ 390,000 $ 3,600,000 $ 8,850,000 $ 12,420,000 $ 25,260,000 sign Now allocate the support departments' costs (AS and IS department costs that you determined in the prior step) to the two operating departments using the reciprocal meth decreasing departments by allocating costs. Enter a "0" for any zero balances.) Support Departments Operating Departments 2 Budgeted overhead costs before any 3 interdepartment cost allocations Support work supplied by AS 4 (budgeted head count) Support work supplied by IS 5 (budgeted computer time) 20% 48% 32% 100% 10% 36% 54% 100% AS IS GOVT CORP Total Reciprocal Method Budgeted overhead costs before interdepartment cost allocations Allocation of AS costs 390,000 3,600,000 - x 8,850,000 12,420,000|| 25,260,000 Requirements Allocation of IS costs Total budgeted overhead of operating departments 1. Allocate the two support departments' costs to the two operating departments using the reciprocal method. Use (a) linear equation and (b) repeated iterations. 2. Compare and explain differences in requirement 1 with those of the direct method and the step down method. Which method do you prefer? Why? . Requirements 1. Allocate the two support departments' costs to the two operating departments using the reciprocal method. Use (a) linear equation and (b) repeated iterations. 2. Compare and explain differences in requirement 1 with those of the direct method and the step down method. Which method do you prefer? Why? Direct method Step-down method (IS first) Support Departments Operating Departments Support Departments Operating Departments AS IS GOVT CORP Total AS IS GOVT CORP Total Direct Method Budgeted overhead costs before interdepartment cost allocations Allocation of AS costs Step-down Method Budgeted overhead costs before interdepartment cost allocations $ $ 390,000 $ 3,600,000 $ 8,850,000 $ 12,420,000 $ 25,260,000 (390,000) 234.000 156,000 (3,600,000) 1,440,000 2.160.000 390,000 $3,600,000 $ 8,850,000 $ 12,420,000 $ 25,260,000 360,000 (3,600,000) 1,296,000 1,944.000 Allocation of IS costs Allocation of IS costs 0 $ 0 $ 0 $ 10,524,000 $ 14,736,000 $ 25,260,000 $ 750,000 Total budgeted overhead of operating departments Allocation of AS costs (750,000) 450,000 300,000 $ 10,596,000 $ 14,664,000 $ 25,260,000 $ 0 Total budgeted overhead of operating departments Step-down method (AS first) - X Reference Support Departments Operating Departments AS IS GOVT CORP Total GOVT CORP Step-down Method - Budgeted overhead costs before interdepartment cost allocations Allocation of AS costs $ $ Direct method Step-down (AS first) Step-down (IS first) 1,674,000 $ 1,658,400 2,316,000 2,331,600 390,000 $3,600,000 $ 8,850,000 $ 12,420,000 $ 25,260,000 (390,000) 78,000 187,200 124,800 0 3,678,000 (3,678,000) 1,471,200 2,206.800 1,746,000 2,244,000 $ Allocation of IS costs $ 0 $ 10,508,400 $ 14,751,600 $ 25,260,000 Total budgeted overhead of operating departments Print Done Hudson Partners provides management consulting services to government and corporate clients. Hudson has two support departmentsadministrative services (AS) and information systems (IS)and two operating departmentsgovernment consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2020, Hudson's cost records indicate the following: :: (Click the icon to view the cost records.) The two support departments' costs have been allocated to the two operating departments using the direct method and the step-down method (AS department first) and the step-down method (IS department first). The results of the allocations are as follows: 2 (Click the icon to view the direct method.) (Click the icon to view the step-down method (AS first).) (Click the icon to view the step-down method (IS first).) (Click the icon to view a summary of the three methods.) Read the requirements .. - X Data table Requirement 1a. Allocate the two support departments' costs to the two operating departments using the reciprocal method. First, determine the linear equations for each support department. AS= $390,000 + 0.10 IS A B D E F 1 SUPPORT OPERATING 0.20 AS AS $3,600,000 + IS IS= GOVT CORP Total $ 390,000 $ 3,600,000 $ 8,850,000 $ 12,420,000 $ 25,260,000 sign Now allocate the support departments' costs (AS and IS department costs that you determined in the prior step) to the two operating departments using the reciprocal meth decreasing departments by allocating costs. Enter a "0" for any zero balances.) Support Departments Operating Departments 2 Budgeted overhead costs before any 3 interdepartment cost allocations Support work supplied by AS 4 (budgeted head count) Support work supplied by IS 5 (budgeted computer time) 20% 48% 32% 100% 10% 36% 54% 100% AS IS GOVT CORP Total Reciprocal Method Budgeted overhead costs before interdepartment cost allocations Allocation of AS costs 390,000 3,600,000 - x 8,850,000 12,420,000|| 25,260,000 Requirements Allocation of IS costs Total budgeted overhead of operating departments 1. Allocate the two support departments' costs to the two operating departments using the reciprocal method. Use (a) linear equation and (b) repeated iterations. 2. Compare and explain differences in requirement 1 with those of the direct method and the step down method. Which method do you prefer? Why? . Requirements 1. Allocate the two support departments' costs to the two operating departments using the reciprocal method. Use (a) linear equation and (b) repeated iterations. 2. Compare and explain differences in requirement 1 with those of the direct method and the step down method. Which method do you prefer? Why? Direct method Step-down method (IS first) Support Departments Operating Departments Support Departments Operating Departments AS IS GOVT CORP Total AS IS GOVT CORP Total Direct Method Budgeted overhead costs before interdepartment cost allocations Allocation of AS costs Step-down Method Budgeted overhead costs before interdepartment cost allocations $ $ 390,000 $ 3,600,000 $ 8,850,000 $ 12,420,000 $ 25,260,000 (390,000) 234.000 156,000 (3,600,000) 1,440,000 2.160.000 390,000 $3,600,000 $ 8,850,000 $ 12,420,000 $ 25,260,000 360,000 (3,600,000) 1,296,000 1,944.000 Allocation of IS costs Allocation of IS costs 0 $ 0 $ 0 $ 10,524,000 $ 14,736,000 $ 25,260,000 $ 750,000 Total budgeted overhead of operating departments Allocation of AS costs (750,000) 450,000 300,000 $ 10,596,000 $ 14,664,000 $ 25,260,000 $ 0 Total budgeted overhead of operating departments Step-down method (AS first) - X Reference Support Departments Operating Departments AS IS GOVT CORP Total GOVT CORP Step-down Method - Budgeted overhead costs before interdepartment cost allocations Allocation of AS costs $ $ Direct method Step-down (AS first) Step-down (IS first) 1,674,000 $ 1,658,400 2,316,000 2,331,600 390,000 $3,600,000 $ 8,850,000 $ 12,420,000 $ 25,260,000 (390,000) 78,000 187,200 124,800 0 3,678,000 (3,678,000) 1,471,200 2,206.800 1,746,000 2,244,000 $ Allocation of IS costs $ 0 $ 10,508,400 $ 14,751,600 $ 25,260,000 Total budgeted overhead of operating departments Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts