Question: Please answer the question number 1 from Group 2 6. Which depreciation method would you choose in order to decrease the income tax purposes (gives

Please answer the question number 1 from Group 2

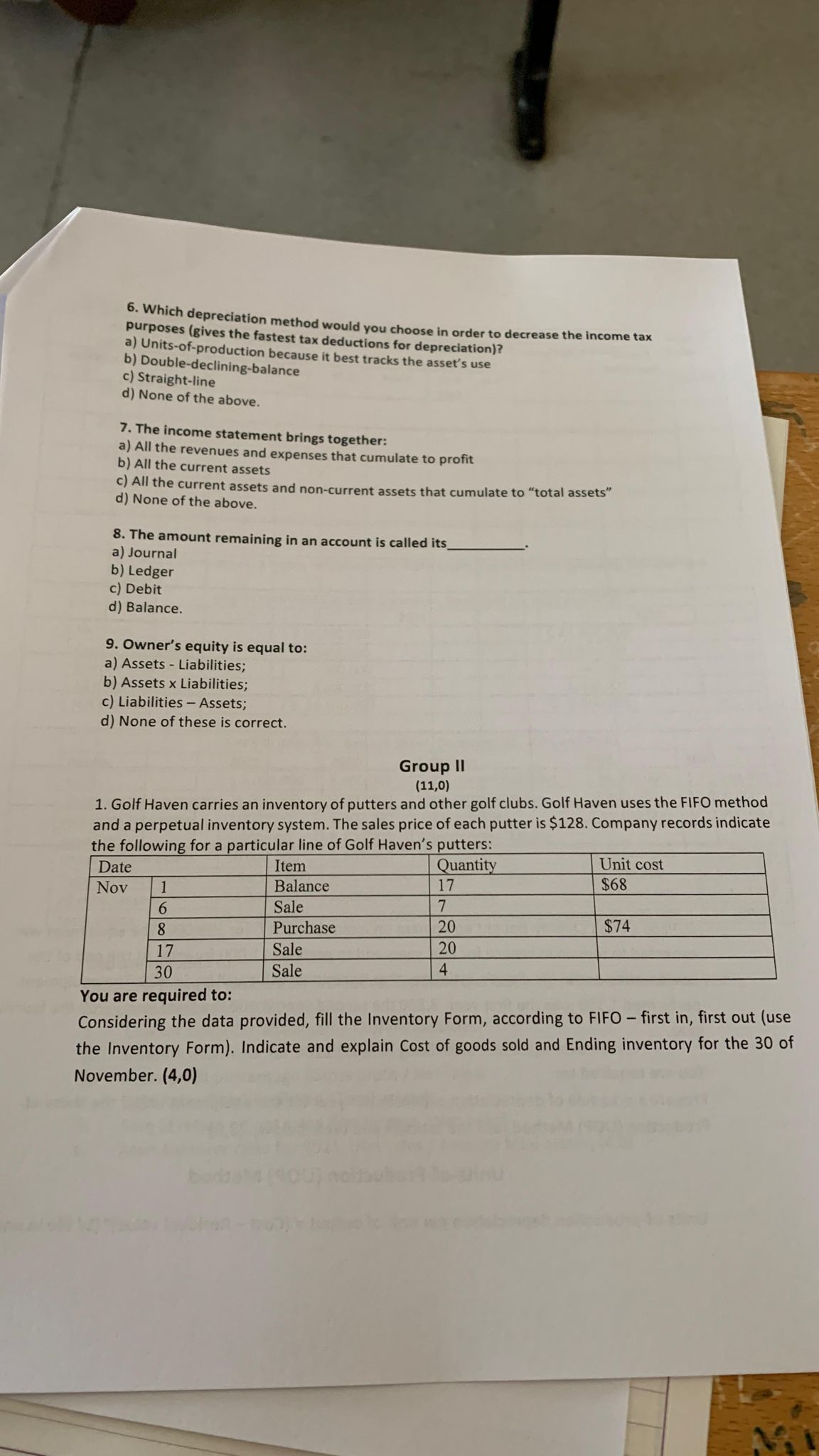

6. Which depreciation method would you choose in order to decrease the income tax purposes (gives the fastest tax deductions for depreciation)? a) Units-of-production because it best tracks the asset's use b) Double-declining-balance c) Straight-line d) None of the above. 7. The income statement brings together: a) All the revenues and expenses that cumulate to profit b) All the current assets c) All the current assets and non-current assets that cumulate to "total assets" d) None of the above. 8. The amount remaining in an account is called its a) Journal b) Ledger c) Debit d) Balance. 9. Owner's equity is equal to: a) Assets - Liabilities; b) Assets x Liabilities; c) Liabilities - Assets; d) None of these is correct. Group II (11,0) 1. Golf Haven carries an inventory of putters and other golf clubs. Golf Haven uses the FIFO method and a perpetual inventory system. The sales price of each putter is $128. Company records indicate tho followining for a nartisular line of Golf Haven's nutters: You are required to: Considering the data provided, fill the Inventory Form, according to FIFO - first in, first out (use the Inventory Form). Indicate and explain Cost of goods sold and Ending inventory for the 30 of November. (4,0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts