Question: please answer the question number 14,15 and 16 14. The unmodified standard audit report of a nonpublic company does not explicitly state that: A. The

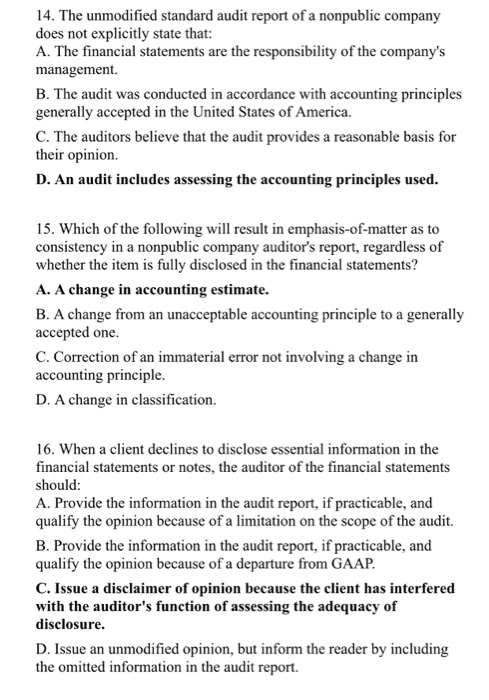

14. The unmodified standard audit report of a nonpublic company does not explicitly state that: A. The financial statements are the responsibility of the company's management. B. The audit was conducted in accordance with accounting principles generally accepted in the United States of America. C. The auditors believe that the audit provides a reasonable basis for their opinion. D. An audit includes assessing the accounting principles used. 15. Which of the following will result in emphasis-of-matter as to consistency in a nonpublic company auditor's report, regardless of whether the item is fully disclosed in the financial statements? A. A change in accounting estimate. B. A change from an unacceptable accounting principle to a generally accepted one. C. Correction of an immaterial error not involving a change in accounting principle. D. A change in classification. 16. When a client declines to disclose essential information in the financial statements or notes, the auditor of the financial statements should: A. Provide the information in the audit report, if practicable, and qualify the opinion because of a limitation on the scope of the audit. B. Provide the information in the audit report, if practicable, and qualify the opinion because of a departure from GAAP. C. Issue a disclaimer of opinion because the client has interfered with the auditor's function of assessing the adequacy of disclosure. D. Issue an unmodified opinion, but inform the reader by including the omitted information in the audit report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts