Question: please answer the question Required: A. Calculate the payback period. B. Should O'Dell buy the new machine? Why? (43) P12.5 Lonny Radford, a manager for

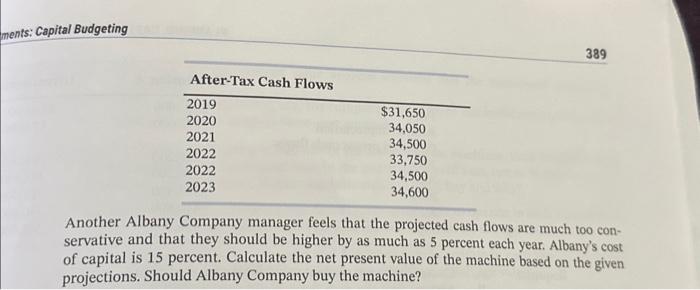

Required: A. Calculate the payback period. B. Should O'Dell buy the new machine? Why? (43) P12.5 Lonny Radford, a manager for the Albany Company, has projected these after-tax cash flows for a 5131,000 machine he wants to buy in December 2018. The cash flows represent a wost: case scenario for the machine on December 31 of the following years. ments: Capital Budgeting 389 Another Albany Company manager feels that the projected cash flows are much too conservative and that they should be higher by as much as 5 percent each year. Albany's cost of capital is 15 percent. Calculate the net present value of the machine based on the given projections. Should Albany Company buy the machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts