Question: please answer the question The following table displays the yield to maturity on 1-year and 2-year zero-coupon bonds today. The treasury plans to issue a

please answer the question

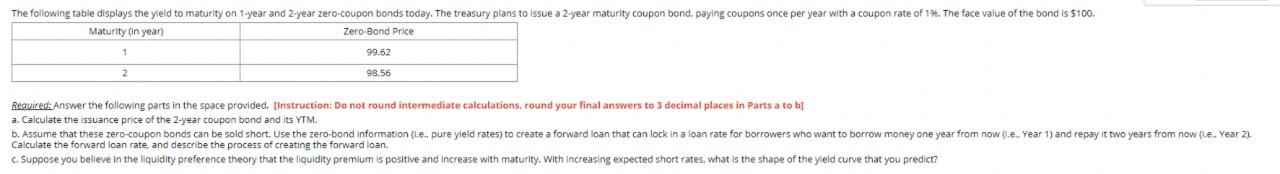

The following table displays the yield to maturity on 1-year and 2-year zero-coupon bonds today. The treasury plans to issue a 2-year maturity coupon bond paying coupons once per year with a coupon rate of 19. The face value of the bond is 5100. Maturity in year) Zero-Bond Price 1 99.62 98.56 Required: Answer the following parts in the space provided. [Instruction: Do not round intermediate calculations, round your final answers to 3 decimal places in Parts a to bi a. Calculate the issuance price of the 2-year coupon bond and its YTM. b. Assume that these zero-coupon bonds can be sold short. Use the zero-bond Information i.e., pure yield rates) to create a forward loan that can lock in a loan rate for borrowers who want to borrow money one year from now (.e., Year 1) and repay it two years from now (.e.. Year 2). Calculate the forward loan rate and describe the process of creating the forward loan Suppose you believe in the liquidity preference theory that the liquidity premium is positive and increase with maturity. With increasing expected short rates, what is the shape of the yield curve that you predict

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts