Question: Please answer the question, well explained, step by step with all the details.VERY IMPORTANT! Question 3 (A) Prior to the introduction of IAS 37 'Provisions,

Please answer the question, well explained, step by step with all the details.VERY IMPORTANT!

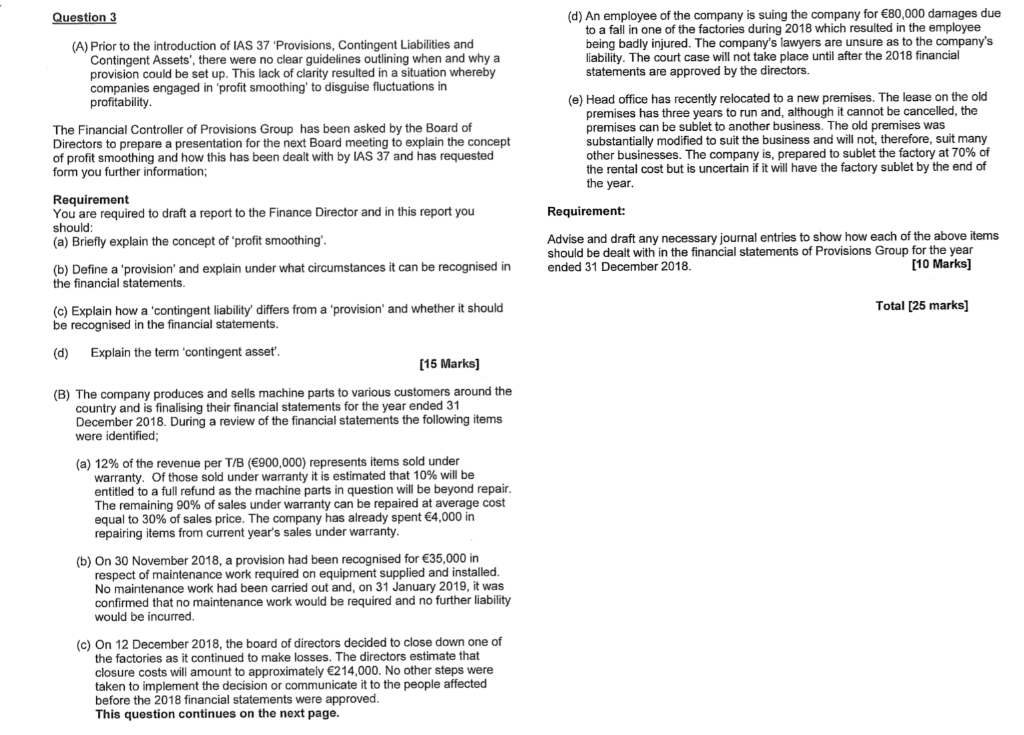

Question 3 (A) Prior to the introduction of IAS 37 'Provisions, Contingent Liabilities and Contingent Assets', there were no clear guidelines outlining when and why a provision could be set up. This lack of clarity resulted in a situation whereby companies engaged in profit smoothing to disguise fluctuations in profitability. (d) An employee of the company is suing the company for 80,000 damages due to a fall in one of the factories during 2018 which resulted in the employee being badly injured. The company's lawyers are unsure as to the company's liability. The court case will not take place until after the 2018 financial statements are approved by the directors. The Financial Controller of Provisions Group has been asked by the Board of Directors to prepare a presentation for the next Board meeting to explain the concept of profit smoothing and how this has been dealt with by IAS 37 and has requested form you further information; Office has recently relocated to a new premises. The lease on the old premises has three years to run and, although it cannot be cancelled, the premises can be sublet to another business. The old premises was substantially modified to suit the business and will not, therefore, suit many other businesses. The company is, prepared to sublet the factory at 70% of the rental cost but is uncertain if it will have the factory sublet by the end of the year. Requirement You are required to draft a report to the Finance Director and in this report you should (a) Briefly explain the concept of 'profit smoothing' Requirement: Advise and draft any necessary journal entries to show how each of the above items ended 31 December 2018. (b) Define a provision and explain under what circumstances it can be recognised in the financial statements. (10 Marks] Total [25 marks] be recognised in the financial statements (d) Explain the term 'contingent asset'. [15 Marks] (B) The company produces and sells machine parts to various customers around the country and is finalising their financial statements for the year ended 31 December 2018. During a review of the financial statements the following items were identified; (a) 12% of the revenue per T/B (900,000) represents items sold under warranty. Of those sold under warranty it is estimated that 10% will be entitled to a full refund as the machine parts in question will be beyond repair. The remaining 90% of sales under warranty can be repaired at average cost equal to 30% of sales price. The company has already spent 4,000 in repairing items from current year's sales under warranty. (b) On 30 November 2018, a provision had been recognised for 35,000 in respect of maintenance work required on equipment supplied and installed. No maintenance work had been carried out and, on 31 January 2019, it was confirmed that no maintenance work would be required and no further liability would be incurred. (c) On 12 December 2018, the board of directors decided to close down one of the factories as it continued to make losses. The directors estimate that closure costs will amount to approximately 214,000. No other steps were taken to implement the decision or communicate it to the people affected before the 2018 financial statements were approved This question continues on the next page. Question 3 (A) Prior to the introduction of IAS 37 'Provisions, Contingent Liabilities and Contingent Assets', there were no clear guidelines outlining when and why a provision could be set up. This lack of clarity resulted in a situation whereby companies engaged in profit smoothing to disguise fluctuations in profitability. (d) An employee of the company is suing the company for 80,000 damages due to a fall in one of the factories during 2018 which resulted in the employee being badly injured. The company's lawyers are unsure as to the company's liability. The court case will not take place until after the 2018 financial statements are approved by the directors. The Financial Controller of Provisions Group has been asked by the Board of Directors to prepare a presentation for the next Board meeting to explain the concept of profit smoothing and how this has been dealt with by IAS 37 and has requested form you further information; Office has recently relocated to a new premises. The lease on the old premises has three years to run and, although it cannot be cancelled, the premises can be sublet to another business. The old premises was substantially modified to suit the business and will not, therefore, suit many other businesses. The company is, prepared to sublet the factory at 70% of the rental cost but is uncertain if it will have the factory sublet by the end of the year. Requirement You are required to draft a report to the Finance Director and in this report you should (a) Briefly explain the concept of 'profit smoothing' Requirement: Advise and draft any necessary journal entries to show how each of the above items ended 31 December 2018. (b) Define a provision and explain under what circumstances it can be recognised in the financial statements. (10 Marks] Total [25 marks] be recognised in the financial statements (d) Explain the term 'contingent asset'. [15 Marks] (B) The company produces and sells machine parts to various customers around the country and is finalising their financial statements for the year ended 31 December 2018. During a review of the financial statements the following items were identified; (a) 12% of the revenue per T/B (900,000) represents items sold under warranty. Of those sold under warranty it is estimated that 10% will be entitled to a full refund as the machine parts in question will be beyond repair. The remaining 90% of sales under warranty can be repaired at average cost equal to 30% of sales price. The company has already spent 4,000 in repairing items from current year's sales under warranty. (b) On 30 November 2018, a provision had been recognised for 35,000 in respect of maintenance work required on equipment supplied and installed. No maintenance work had been carried out and, on 31 January 2019, it was confirmed that no maintenance work would be required and no further liability would be incurred. (c) On 12 December 2018, the board of directors decided to close down one of the factories as it continued to make losses. The directors estimate that closure costs will amount to approximately 214,000. No other steps were taken to implement the decision or communicate it to the people affected before the 2018 financial statements were approved This question continues on the next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts