Question: Please answer the question with excel and specify it beside for explanations :) Thanks Heavy Metal Corporation is expected to generate the following free cash

Please answer the question with excel and specify it beside for explanations :) Thanks

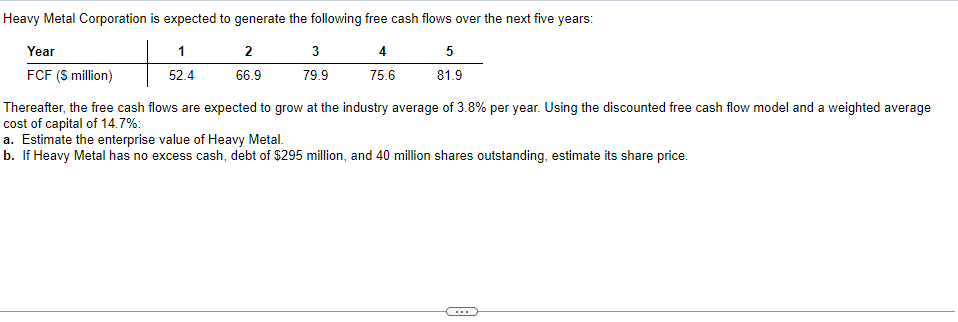

Heavy Metal Corporation is expected to generate the following free cash flows over the next five years: Year 1 2 3 4 5 FCF (S million) 52.4 66.9 79.9 75.6 81.9 Thereafter, the free cash flows are expected to grow at the industry average of 3.8% per year. Using the discounted free cash flow model and a weighted average cost of capital of 14.7%: a. Estimate the enterprise value of Heavy Metal. b. If Heavy Metal has no excess cash, debt of $295 million, and 40 million shares outstanding, estimate its share price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts