Question: Please answer the question with full details 150% e asearch ml er 5 homework Saved Help Save& Exit Subm Check my work Dexcon Technologies, Inc.,

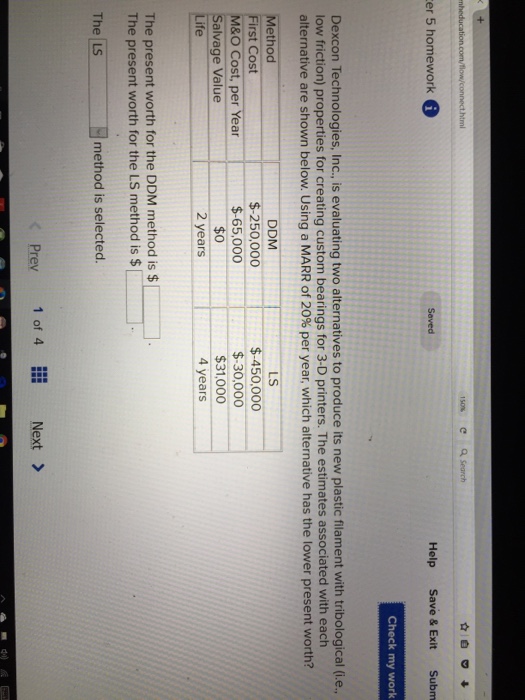

150% e asearch ml er 5 homework Saved Help Save& Exit Subm Check my work Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with tribological (i.e., low friction) properties for creating custom bearings for 3-D printers. The estimates associated with each alternative are shown below. Using a MARR of 20% per year, which alternative has the lower present worth? DDM $-250,000 $-65,000 $0 2 years LS ethod irst Cost &O Cost, per Year alvage Value ife -$450,000 $30,000 $31,000 4 years The present worth for the DDM method is $ The present worth for the LS method is $ L . The LS method is selected. Prev 1of 4 Next>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts