Question: Please answer the question with full details Question 5 Section 130 of the Companies Act states that where a company issues shares at a premium,

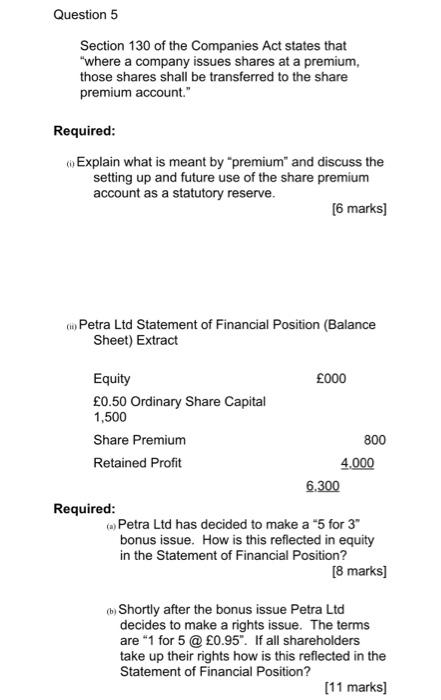

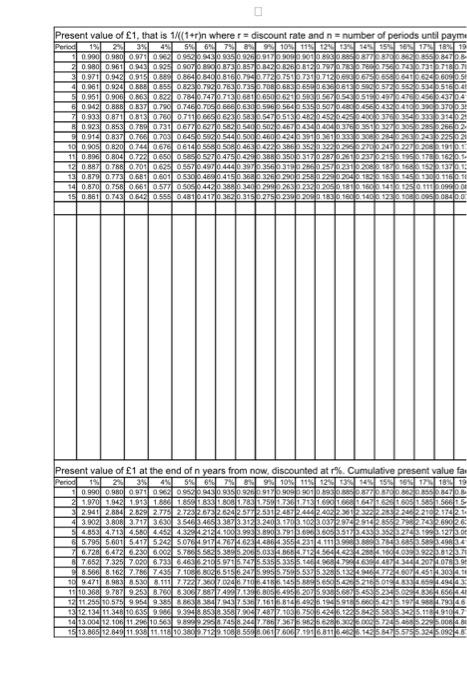

Question 5 Section 130 of the Companies Act states that "where a company issues shares at a premium, those shares shall be transferred to the share premium account." Required: Explain what is meant by "premium" and discuss the setting up and future use of the share premium account as a statutory reserve. [6 marks) Petra Ltd Statement of Financial Position (Balance Sheet) Extract Equity 000 0.50 Ordinary Share Capital 1,500 Share Premium 800 Retained Profit 4,000 6.300 Required: Petra Ltd has decided to make a "5 for 3" bonus issue. How is this reflected in equity in the Statement of Financial Position? [8 marks) (Shortly after the bonus issue Petra Ltd decides to make a rights issue. The terms are "1 for 5 @ 0.95". If all shareholders take up their rights how is this reflected in the Statement of Financial Position? [11 marks] Present value of 1, that is 1/((1+r)n where r = discount rate and n = number of periods until payme Period 19:1 2390 495679899109119120139 54 15 16 17 18 19 0.900 0.980 0.078 0.963.98329 0985 0.9280.919.308 308 3838 870 9.84708 0.980 0.961 2.943.925 0.90708900B780.8570.B48 0.025 0.618 2.7977EETS 7560743073571807 0.970 0.942 0.915 08880854 2846 0.816 0.74 0.71207510731 2712 DECE65836482.62 260905 0.961 0.824 0.888 0.85 0.8286.790 0.763 0.735 0.708 0.6833.652.638 0.615 DSTO STESSE D5320516 0.6 50.951 0.906 0.868 0.22 0.78410747071306810650.621 SRO S6710580515 0.45704763456 34370 60.942 0.888 0.837 0.750 0.746 70606660.630 0.5060 556.515 0.507.48580433 0.410 2300 2370 0.933 0.871 0.813 0.760 0711.665 0.623 0.5830.547 0.518 0 483 453 3.425 4000378 0.354333 0.354 B 0.923 0,853 Q.TP 0731 0.677 0.62 0.5820540 0.50 0.253 254 2.404 :37 5532323230 2203 226602 E 0.914 0.837 0.768 0.708 0.6450550 0.544 0.500 2.460 424 2391 036133233348928528228322592 100,905 0.820 0.746 0.67 0614 0.5580508 0.4680422 386 355 2:32. De 27002452212 19001 110.896 0.804 0.722 0.650 0.50 0.5270475 0.429 0.388 0.350 0:3170 287 0261 0237 02152.1983 16201 120.887 0.788 0.701 0.629 0.55704920444 0.39 0.356 0310 286 257 92010208.183.168.2.153.1380 15 0.879 0.778 0.681 0.601 0530 3.468 0.415 0.368 0.326290 258 228 02042-1853 188 189 190 116 0.1 14 0.870 0.758 0.663 0.577 0.50604420389 0.340 0.299 0.265 2320208 0.18 0.160.148 128 0.610.0960.00 15 0.861 0.748 0.643 0.556 0481 0.417 0.362 0.315 0.275 0.2300 205.188 D 160-1660.128.13 00 2 Present value of 1 at the end of n years from now, discounted at %. Cumulative present value fa Period 141 34% 5 6 7 9 10 11 12 13 14 15 16 17 18 19 0 990 0.980 971 096 098601808350328 917 99099010385 386 387 2 1.970 1942 1913 1884 1858 1838 1.800 1.783 1758 1736 1713 1.00 1.000 1647 2028 11.608 1585 1.566 15- 2.9412.884 2.628 2778 2728 267 2626 257 2501 245 246 240 3.902 3.808 3.717 3.600354634653.387 3.312.3.240 3.70 3:102 3.037 297 25142858 27982782.690 4.858 4.718 4.580 4.4584328 921 4.100 3.9983.8903 783 3603 65.795 5.601 5.412 5242 5.07649174767 4.628 4.4864.355 4 231 411 6.728 6.472 0.250 6.000 5.708 3:5833.389 5.2003.038.366.7139 676527,325 7,020 6.733 6.463 32105.9715.7475 535 5335 5.148 968 4798 14078 8.588 8.162 Z.TEC 4S 7.108 380g 6.515 6.245.995 57505537 53285.1333 109.471 8.983 8.530 8.110 7.722 7 380 7.0246710 6.4166.1455.60 5.5 21 10 10.368 9.787 9.250 8.700 6.30378877499 71396.805 3.495 3200 5.930 5.685 12 11.255 10.575995093858.88333847.93 75367161 5.8145.4928 1905 5.997 13 12. 134 11.348 10.635 9.988 9.3943.8583 3587.900 74877 103 3750 3.426 14 13.000 12.106 11 296 10.565 9.898 29987458.2007.786 367 3.9 3.6286 $72.22 15 13.885 12.8401193811.118 10 380 27121088.5598.0617.6067195 Question 5 Section 130 of the Companies Act states that "where a company issues shares at a premium, those shares shall be transferred to the share premium account." Required: Explain what is meant by "premium" and discuss the setting up and future use of the share premium account as a statutory reserve. [6 marks) Petra Ltd Statement of Financial Position (Balance Sheet) Extract Equity 000 0.50 Ordinary Share Capital 1,500 Share Premium 800 Retained Profit 4,000 6.300 Required: Petra Ltd has decided to make a "5 for 3" bonus issue. How is this reflected in equity in the Statement of Financial Position? [8 marks) (Shortly after the bonus issue Petra Ltd decides to make a rights issue. The terms are "1 for 5 @ 0.95". If all shareholders take up their rights how is this reflected in the Statement of Financial Position? [11 marks] Present value of 1, that is 1/((1+r)n where r = discount rate and n = number of periods until payme Period 19:1 2390 495679899109119120139 54 15 16 17 18 19 0.900 0.980 0.078 0.963.98329 0985 0.9280.919.308 308 3838 870 9.84708 0.980 0.961 2.943.925 0.90708900B780.8570.B48 0.025 0.618 2.7977EETS 7560743073571807 0.970 0.942 0.915 08880854 2846 0.816 0.74 0.71207510731 2712 DECE65836482.62 260905 0.961 0.824 0.888 0.85 0.8286.790 0.763 0.735 0.708 0.6833.652.638 0.615 DSTO STESSE D5320516 0.6 50.951 0.906 0.868 0.22 0.78410747071306810650.621 SRO S6710580515 0.45704763456 34370 60.942 0.888 0.837 0.750 0.746 70606660.630 0.5060 556.515 0.507.48580433 0.410 2300 2370 0.933 0.871 0.813 0.760 0711.665 0.623 0.5830.547 0.518 0 483 453 3.425 4000378 0.354333 0.354 B 0.923 0,853 Q.TP 0731 0.677 0.62 0.5820540 0.50 0.253 254 2.404 :37 5532323230 2203 226602 E 0.914 0.837 0.768 0.708 0.6450550 0.544 0.500 2.460 424 2391 036133233348928528228322592 100,905 0.820 0.746 0.67 0614 0.5580508 0.4680422 386 355 2:32. De 27002452212 19001 110.896 0.804 0.722 0.650 0.50 0.5270475 0.429 0.388 0.350 0:3170 287 0261 0237 02152.1983 16201 120.887 0.788 0.701 0.629 0.55704920444 0.39 0.356 0310 286 257 92010208.183.168.2.153.1380 15 0.879 0.778 0.681 0.601 0530 3.468 0.415 0.368 0.326290 258 228 02042-1853 188 189 190 116 0.1 14 0.870 0.758 0.663 0.577 0.50604420389 0.340 0.299 0.265 2320208 0.18 0.160.148 128 0.610.0960.00 15 0.861 0.748 0.643 0.556 0481 0.417 0.362 0.315 0.275 0.2300 205.188 D 160-1660.128.13 00 2 Present value of 1 at the end of n years from now, discounted at %. Cumulative present value fa Period 141 34% 5 6 7 9 10 11 12 13 14 15 16 17 18 19 0 990 0.980 971 096 098601808350328 917 99099010385 386 387 2 1.970 1942 1913 1884 1858 1838 1.800 1.783 1758 1736 1713 1.00 1.000 1647 2028 11.608 1585 1.566 15- 2.9412.884 2.628 2778 2728 267 2626 257 2501 245 246 240 3.902 3.808 3.717 3.600354634653.387 3.312.3.240 3.70 3:102 3.037 297 25142858 27982782.690 4.858 4.718 4.580 4.4584328 921 4.100 3.9983.8903 783 3603 65.795 5.601 5.412 5242 5.07649174767 4.628 4.4864.355 4 231 411 6.728 6.472 0.250 6.000 5.708 3:5833.389 5.2003.038.366.7139 676527,325 7,020 6.733 6.463 32105.9715.7475 535 5335 5.148 968 4798 14078 8.588 8.162 Z.TEC 4S 7.108 380g 6.515 6.245.995 57505537 53285.1333 109.471 8.983 8.530 8.110 7.722 7 380 7.0246710 6.4166.1455.60 5.5 21 10 10.368 9.787 9.250 8.700 6.30378877499 71396.805 3.495 3200 5.930 5.685 12 11.255 10.575995093858.88333847.93 75367161 5.8145.4928 1905 5.997 13 12. 134 11.348 10.635 9.988 9.3943.8583 3587.900 74877 103 3750 3.426 14 13.000 12.106 11 296 10.565 9.898 29987458.2007.786 367 3.9 3.6286 $72.22 15 13.885 12.8401193811.118 10 380 27121088.5598.0617.6067195

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts