Question: please answer the question within 30 minutes. make sure the calculations are explained in very detailed manner also formatting is proper, Attempt the answer only

please answer the question within 30 minutes. make sure the calculations are explained in very detailed manner also formatting is proper, Attempt the answer only if your are 100% sure that its correct. else leave it for other tutore otherwise i will give negative ratings and will also report your answer for unprofessionalism. Make sure the answer shows detailed calculations and is 100% correct.

ATTEMPT THE QUESTION ONLY IF YOU ARE 100% CORRECT AND SURE. ELSE LEAVE IT FOR ANOTHER TUTOR. BUT PLEASE DONT PUT WRONG ANSWER ELSE I WILL REPORT.

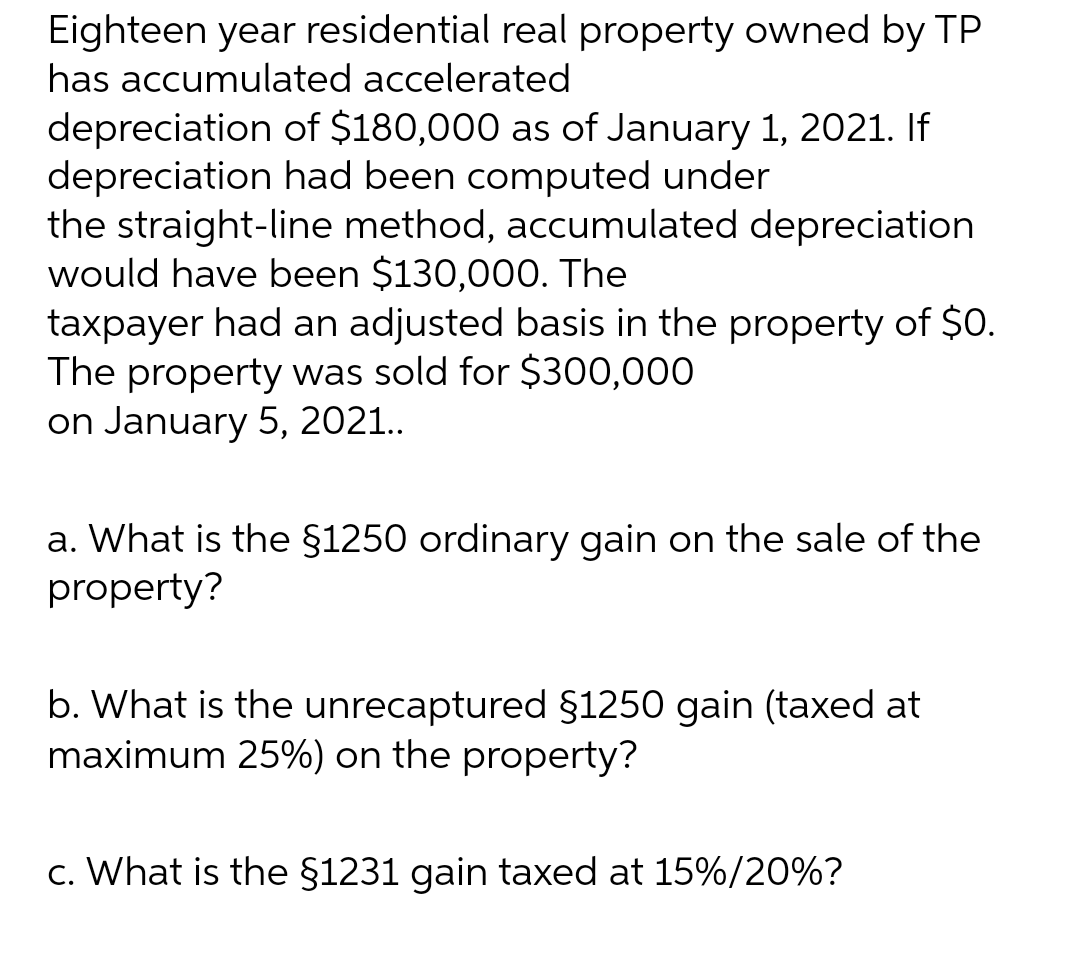

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts