Question: Please answer the questions 1 and 2 by using the information given below: Tapscott Company reports the following financial information before adjustments: DEBIT CREDIT Accounts

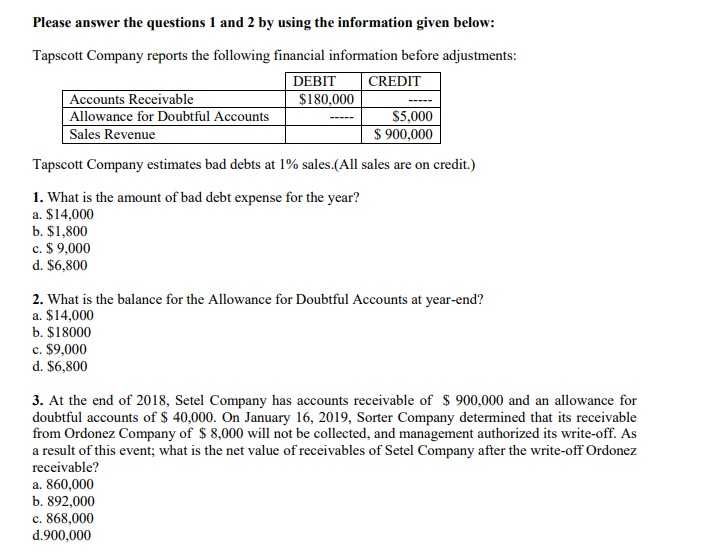

Please answer the questions 1 and 2 by using the information given below: Tapscott Company reports the following financial information before adjustments: DEBIT CREDIT Accounts Receivable $180,000 Allowance for Doubtful Accounts $5,000 Sales Revenue $ 900,000 Tapscott Company estimates bad debts at 1% sales.(All sales are on credit.) 1. What is the amount of bad debt expense for the year? a. $14,000 b. $1,800 c. $ 9,000 d. $6,800 2. What is the balance for the Allowance for Doubtful Accounts at year-end? a. $14,000 b. $18000 c. $9,000 d. $6,800 3. At the end of 2018, Setel Company has accounts receivable of $ 900,000 and an allowance for doubtful accounts of $ 40,000. On January 16, 2019, Sorter Company determined that its receivable from Ordonez Company of $8,000 will not be collected, and management authorized its write-off. As a result of this event; what is the net value of receivables of Setel Company after the write-off Ordonez receivable? a. 860,000 b. 892,000 c. 868,000 d.900,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts