Question: Please answer the questions (a) & (b), many thanks. Suppose that two investors in the economy: A and B, whose initial wealth levels given by

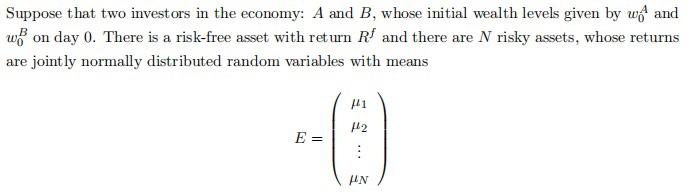

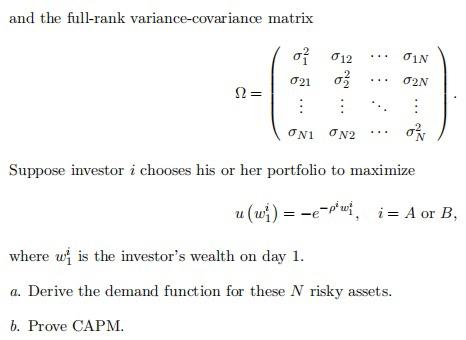

Suppose that two investors in the economy: A and B, whose initial wealth levels given by w0A and w0B on day 0 . There is a risk-free asset with return Rf and there are N risky assets, whose returns are jointly normally distributed random variables with means E=12N and the full-rank variance-covariance matrix =1221N11222N21N2NN2 Suppose investor i chooses his or her portfolio to maximize u(w1i)=eiw1i,i=AorB where w1i is the investor's wealth on day 1 . a. Derive the demand function for these N risky assets. b. Prove CAPM. Suppose that two investors in the economy: A and B, whose initial wealth levels given by w0A and w0B on day 0 . There is a risk-free asset with return Rf and there are N risky assets, whose returns are jointly normally distributed random variables with means E=12N and the full-rank variance-covariance matrix =1221N11222N21N2NN2 Suppose investor i chooses his or her portfolio to maximize u(w1i)=eiw1i,i=AorB where w1i is the investor's wealth on day 1 . a. Derive the demand function for these N risky assets. b. Prove CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts