Question: please answer the questions according to the marks appointed per question and sub question. this is a banking and finance question so please answer it

please answer the questions according to the marks appointed per question and sub question. this is a banking and finance question so please answer it accordingly. please see the marks of the questions given and give a detailed answer.

please answer the questions according to the marks appointed per question and sub question. this is a banking and finance question so please answer it accordingly. please see the marks of the questions given and give a detailed answer.

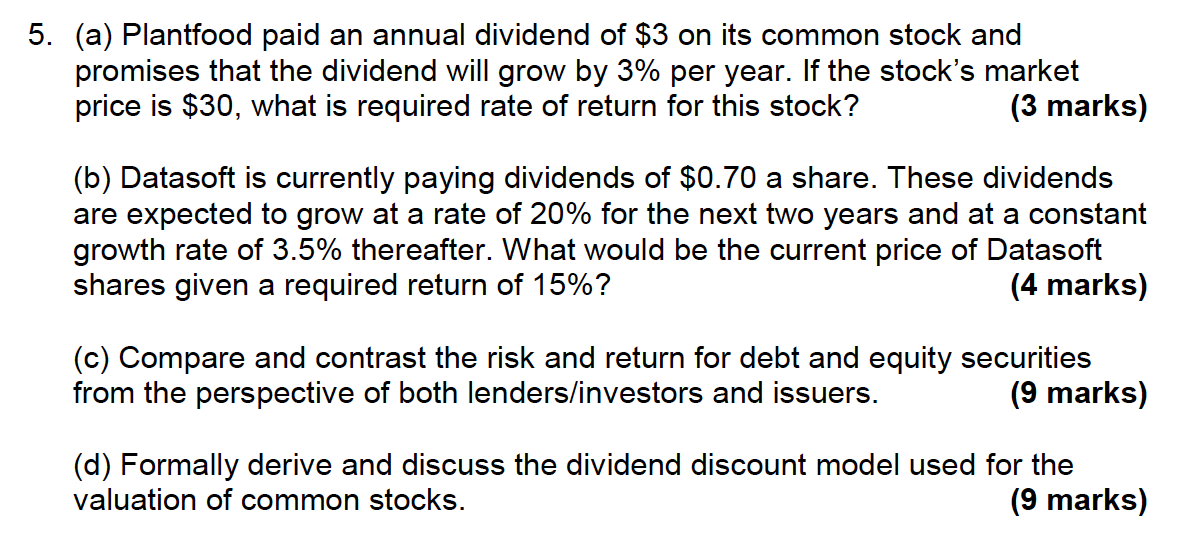

5. (a) Plantfood paid an annual dividend of $3 on its common stock and promises that the dividend will grow by 3% per year. If the stock's market price is $30, what is required rate of return for this stock? (3 marks) (b) Datasoft is currently paying dividends of $0.70 a share. These dividends are expected to grow at a rate of 20% for the next two years and at a constant growth rate of 3.5% thereafter. What would be the current price of Datasoft shares given a required return of 15%? (4 marks) (c) Compare and contrast the risk and return for debt and equity securities from the perspective of both lenders/investors and issuers. (9 marks) (d) Formally derive and discuss the dividend discount model used for the valuation of common stocks. (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts