Question: please answer the questions based on the format. Instructions. Please prepare the following reports in the assigned tabs of the excel file: Sheet 1. Calculate

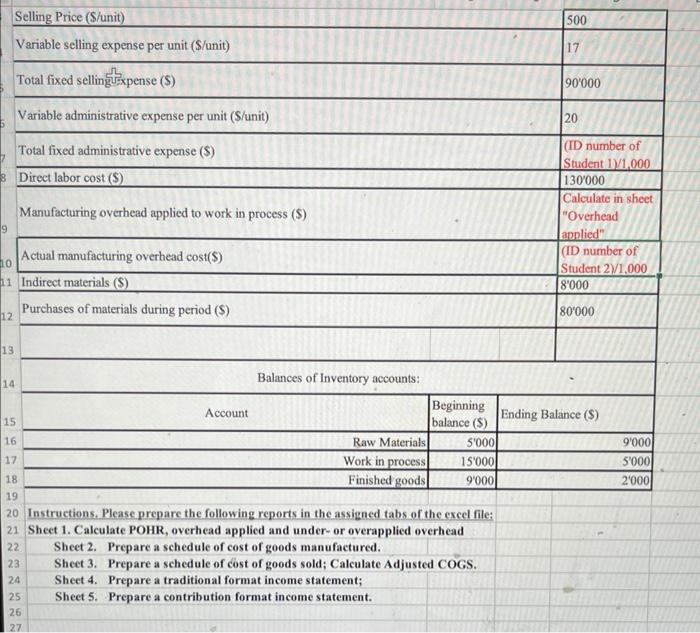

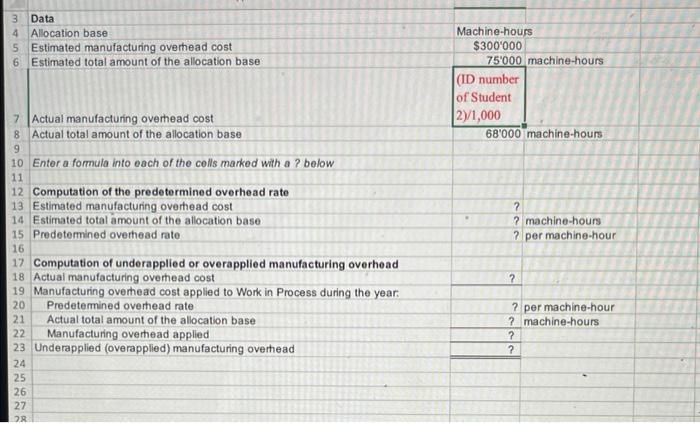

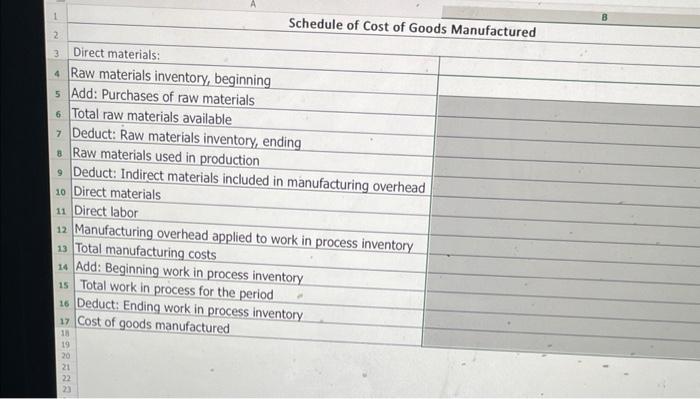

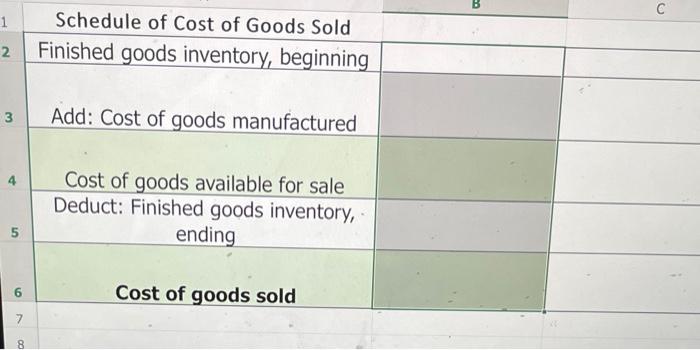

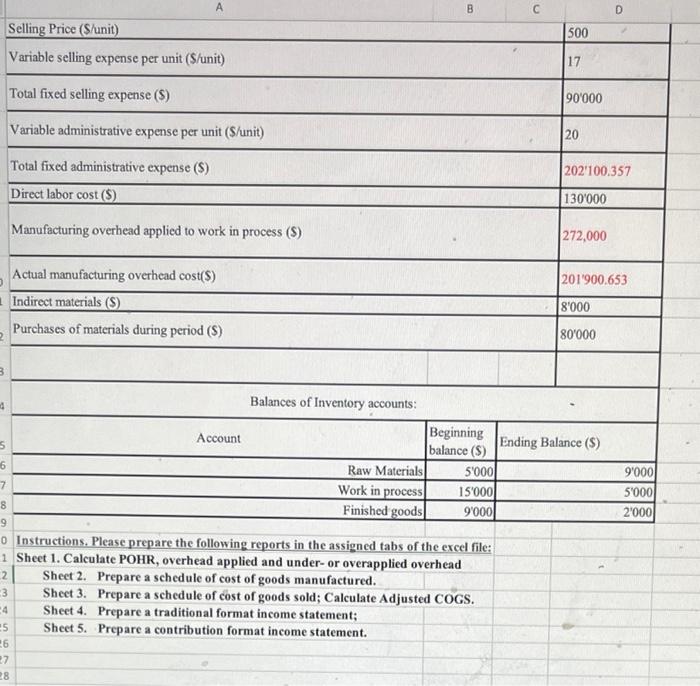

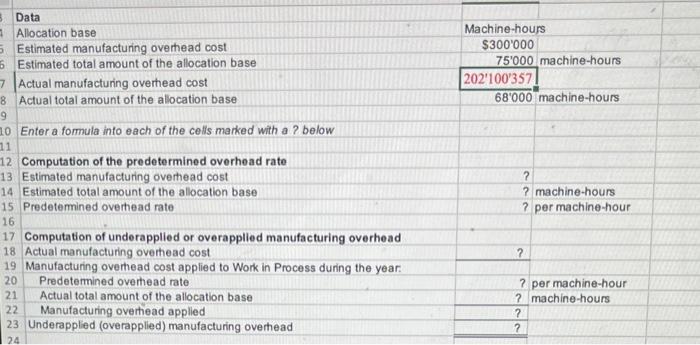

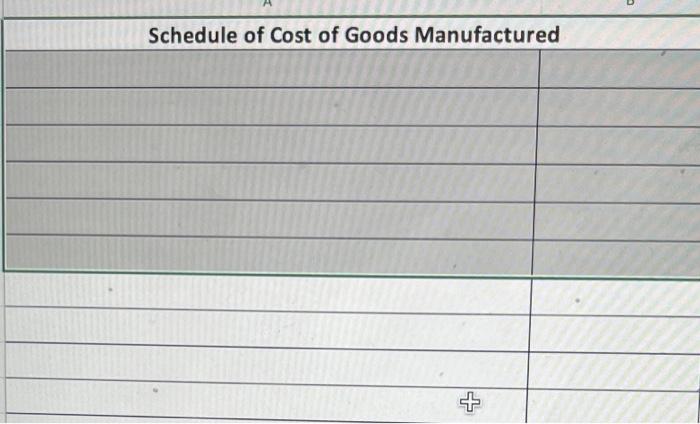

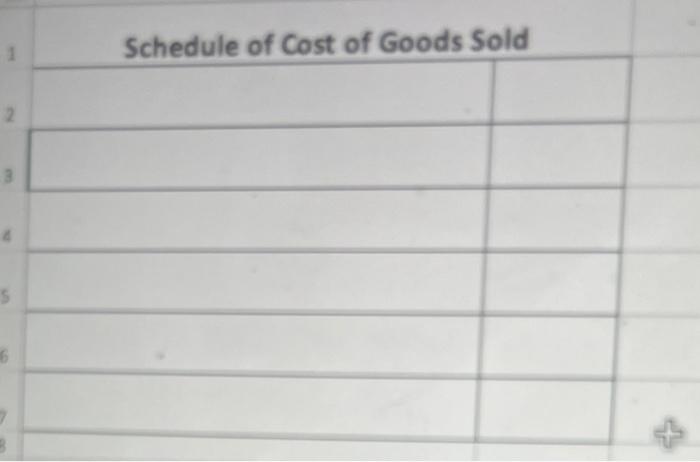

Instructions. Please prepare the following reports in the assigned tabs of the excel file: Sheet 1. Calculate POHR, overhead applied and under- or overapplied overhead Sheet 2. Prepare a schedule of cost of goods manufactured. Sheet 3. Prepare a schedule of cost of goods sold; Calculate Adjusted COGS. Sheet 4. Prepare a traditional format income statement; Sheet 5. Prepare a contribution format income statement. \begin{tabular}{|l|l|c|} \hline 3 & Data & \\ 44 & Allocation base & Machine-hours \\ 5 & Estimated manufacturing overhead cost & $300000 \\ 6 & Estimated total amount of the allocation base & 750000 machine-hours \\ \hline & & (ID number \\ 7 & Actual manufacturing overhead cost & of Student \\ 8 & Actual total amount of the allocation base & 2)/1,000 \\ \hline \end{tabular} Enter a formula into each of the colls marked with a ? bolow Computation of the predetermined overhead rate Estimated manufacturing overhead cost ? Estimated total amount of the allocation base ? machine-hours Predetermined overhead rate ? per machine-hour Computation of underapplied or overapplied manufacturing overhead Actual manufacturing overhead cost ? Manufacturing overhead cost applied to Work in Process during the year: Predetermined overhead rate ? per machine-hour Actual total amount of the allocation base Manufacturing overhead applied Underapplied (overapplied) manufacturing overhead ?? Schedule of Cost of Goods Manufactured Direct materials: 4 Raw materials inventory, beginning 5 Add: Purchases of raw materials 6 . Total raw materials available 7 Deduct: Raw materials inventory, ending 8 Raw materials used in production 9 Deduct: Indirect materials included in manufacturing overhead 10 Direct materials 11 Direct labor 12 Manufacturing overhead applied to work in process inventory 13 Total manufacturing costs 14 Add: Beginning work in process inventory 15 Total work in process for the period 16 Deduct: Ending work in process inventory Cost of goods manufactured 1 Schedule of Cost of Goods Sold Finished goods inventory, beginning 3 Add: Cost of goods manufactured 4 Cost of goods available for sale Deduct: Finished goods inventory, ending Cost of goods sold Instructions. Please prepare the following reports in the assigned tabs of the excel file: Sheet 1. Calculate POHR, overhead applied and under- or overapplied overhead Sheet 2. Prepare a schedule of cost of goods manu factured. Sheet 3. Prepare a schedule of cost of goods sold; Calculate Adjusted COGS. Sheet 4. Prepare a traditional format income statement; Sheet 5. Prepare a contribution format income statement. Data Allocation base Estimated manufacturing overhead cost Estimated total amount of the allocation base Actual manufacturing overhead cost Actual total amount of the allocation base Enter a formula into each of the cells marked with a ? below Computation of the predetermined overhead rate Estimated manufacturing overhead cost ? Estimated total amount of the allocation base ? machine-hours Predetemined overhead rate ? per machine-hour Computation of underapplied or overapplied manufacturing overhead Actual manufacturing overhead cost Manufacturing overhead cost applied to Work in Process during the year: Predetermined overhead rate ? per machine-hour Actual total amount of the allocation base ? machine-hours Manufacturing overtiead applied Underapplied (overapplied) manufacturing overhead Schedule of Cost of Goods Manufactured Schedule of Cost of Goods Sold 2 A Traditional Format Income Statement 1 Contribution Format Income Statement 2 3 4 5 6 Instructions. Please prepare the following reports in the assigned tabs of the excel file: Sheet 1. Calculate POHR, overhead applied and under- or overapplied overhead Sheet 2. Prepare a schedule of cost of goods manufactured. Sheet 3. Prepare a schedule of cost of goods sold; Calculate Adjusted COGS. Sheet 4. Prepare a traditional format income statement; Sheet 5. Prepare a contribution format income statement. \begin{tabular}{|l|l|c|} \hline 3 & Data & \\ 44 & Allocation base & Machine-hours \\ 5 & Estimated manufacturing overhead cost & $300000 \\ 6 & Estimated total amount of the allocation base & 750000 machine-hours \\ \hline & & (ID number \\ 7 & Actual manufacturing overhead cost & of Student \\ 8 & Actual total amount of the allocation base & 2)/1,000 \\ \hline \end{tabular} Enter a formula into each of the colls marked with a ? bolow Computation of the predetermined overhead rate Estimated manufacturing overhead cost ? Estimated total amount of the allocation base ? machine-hours Predetermined overhead rate ? per machine-hour Computation of underapplied or overapplied manufacturing overhead Actual manufacturing overhead cost ? Manufacturing overhead cost applied to Work in Process during the year: Predetermined overhead rate ? per machine-hour Actual total amount of the allocation base Manufacturing overhead applied Underapplied (overapplied) manufacturing overhead ?? Schedule of Cost of Goods Manufactured Direct materials: 4 Raw materials inventory, beginning 5 Add: Purchases of raw materials 6 . Total raw materials available 7 Deduct: Raw materials inventory, ending 8 Raw materials used in production 9 Deduct: Indirect materials included in manufacturing overhead 10 Direct materials 11 Direct labor 12 Manufacturing overhead applied to work in process inventory 13 Total manufacturing costs 14 Add: Beginning work in process inventory 15 Total work in process for the period 16 Deduct: Ending work in process inventory Cost of goods manufactured 1 Schedule of Cost of Goods Sold Finished goods inventory, beginning 3 Add: Cost of goods manufactured 4 Cost of goods available for sale Deduct: Finished goods inventory, ending Cost of goods sold Instructions. Please prepare the following reports in the assigned tabs of the excel file: Sheet 1. Calculate POHR, overhead applied and under- or overapplied overhead Sheet 2. Prepare a schedule of cost of goods manu factured. Sheet 3. Prepare a schedule of cost of goods sold; Calculate Adjusted COGS. Sheet 4. Prepare a traditional format income statement; Sheet 5. Prepare a contribution format income statement. Data Allocation base Estimated manufacturing overhead cost Estimated total amount of the allocation base Actual manufacturing overhead cost Actual total amount of the allocation base Enter a formula into each of the cells marked with a ? below Computation of the predetermined overhead rate Estimated manufacturing overhead cost ? Estimated total amount of the allocation base ? machine-hours Predetemined overhead rate ? per machine-hour Computation of underapplied or overapplied manufacturing overhead Actual manufacturing overhead cost Manufacturing overhead cost applied to Work in Process during the year: Predetermined overhead rate ? per machine-hour Actual total amount of the allocation base ? machine-hours Manufacturing overtiead applied Underapplied (overapplied) manufacturing overhead Schedule of Cost of Goods Manufactured Schedule of Cost of Goods Sold 2 A Traditional Format Income Statement 1 Contribution Format Income Statement 2 3 4 5 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts