Question: Please answer the questions below: 1. Construct a statement of financial position (balance sheet) for the Humperdink family using the following information: cash $50 Checking

Please answer the questions below:

1. Construct a statement of financial position (balance sheet) for the Humperdink family using the following information:

| cash | $50 |

| Checking account | $2,500 |

| student loan balance | $6,000 |

| stocks and bonds | $2,600 |

| savings account | $5,850 |

| residence | $110,000 |

| automobile | $12,000 |

| savings account | $5,800 |

| automobile loan balance | $12,000 |

| 401K retirement account | $15,000 |

| furniture, clothing, jewelry | $8,000 |

| credit card balance | $4,000 |

| mortgage loan balance | $99,000 |

2. What is the purpose of financial statement analysis? How do the three types of financial statement analysis differ from each other and when is each used?

3. Samantha Knight is applying for a small-business loan. She provides the bank with the following information:

| cash in checking accounts | $5,000 |

| cash in savings | $10,350 |

| home market value | $145,500 |

| first mortgage on house | $25,000 |

| home equity loan limit | $70,000 |

| home equity loan | $10,000 |

| automobile market value | $19,000 |

| automobile loan outstanding | $15,000 |

| credit card debt | $1,500 |

a. Calculate the debt-to-asset ratio.

b. Calculate the debt-to-equity ratio.

c. What percentage of Samantha's assets is owned by others?

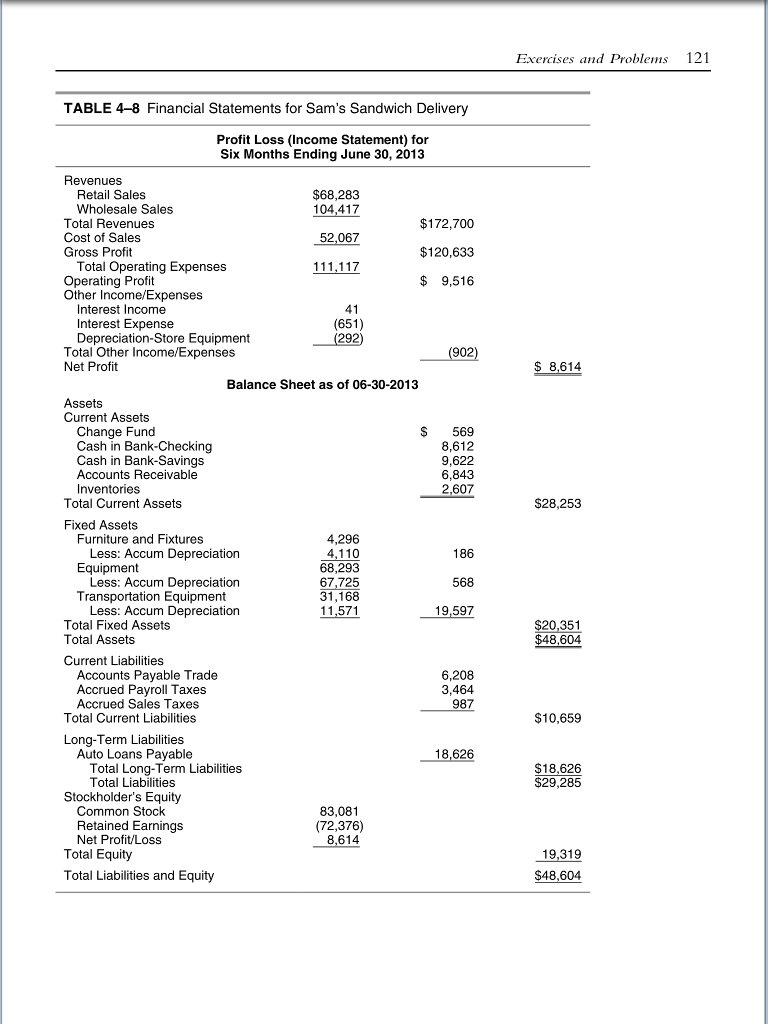

4. Given the profit loss (income statement) and balance sheet for Sam's Sandwich Delivery (see attached picture below), answer the following:

a. Calculate the following ratios: current, quick, accounts receivable turnover, fixed asset turnover.

b. Using the inventory figure on the balance sheet as average inventory, calculate the inventory turnover ratio.

c. Calculate the debt-to-equity ratio, debt-to-total asset ratio, and operating profit margin ratio.

d. Perform a vertical analysis of the income statement.

e. Perform a vertical analysis of the balance sheet.

f. Based on your analysis, would you consider investing in Sam's Sandwich Delivery?

Exercises and Probs 121 TABLE 4-8 Financial Statements for Sam's Sandwich Delivery Profit Loss (Income Statement) for Six Months Ending June 30, 2013 Revenues Retail Sales $68,283 Wholesale Sales Total Revenues Cost of Sales Gross Profit 104,417 52,067 111,117 $172,700 $120,633 $ 9,516 Total Operating Expenses Operating Profit Other Income/Expenses Interest Income Interest Expense Depreciation-Store Equipment (651) 902 Total Other Income/Expenses Net Profit 8,614 Balance Sheet as of 06-30-2013 Assets Current Assets Change Fund Cash in Bank-Checking Cash in Bank-Savings Accounts Receivable Inventories $ 569 8,612 9,622 6,843 2,607 $28,253 Total Current Assets Fixed Assets 4,296 4,110 68,293 67,725 31,168 11,571 Furniture and Fixtures Less: Accum Depreciation Equipment 186 568 19,597 Less: Accum Depreciation Transportation Equipment Less: Accum Depreciation Total Fixed Assets Total Assets $20,351 $48,604 Current Liabilities Accounts Payable Trade Accrued Payroll Taxes Accrued Sales Taxes 6,208 3,464 987 Total Current Liabilities $10,659 Long-Term Liabilities Auto Loans Payable 18,626 Total Long-Term Liabilities $18,626 $29,285 Total Liabilities Stockholder's Equity 83,081 (72,376) 8,614 Common Stock Retained Earnings Net Profit/Loss Total Equity Total Liabilities and Equity 19,319 48,604

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts