Question: Please answer the questions below : 1. You are the project manager for Eagle Golf Corporation. You are considering manufacturing a new golf wedge with

Please answer the questions below :

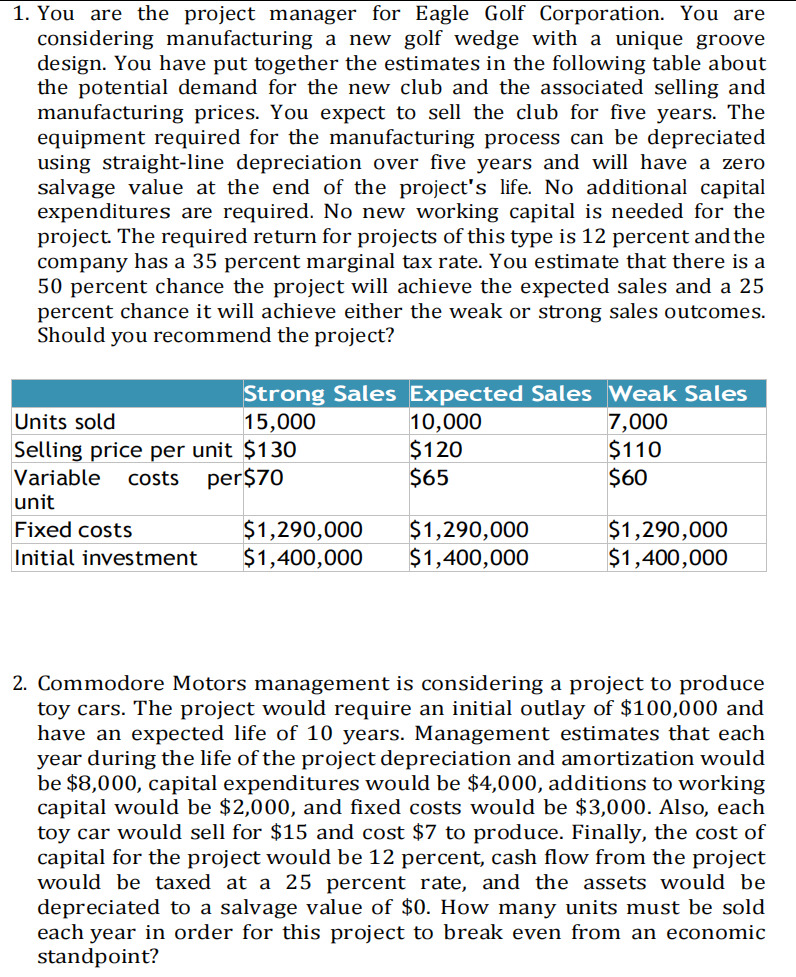

1. You are the project manager for Eagle Golf Corporation. You are considering manufacturing a new golf wedge with a unique groove design. You have put together the estimates in the following table about the potential demand for the new club and the associated selling and manufacturing prices. You expect to sell the club for ve years. The equipment required for the manufacturing process can be depreciated using straight-line depreciation over ve years and will have a zero salvage value at the end of the project's life. No additional capital expenditures are required. No new working capital is needed for the project The required return for projects of this type is 12 percent andthe company has a 35 percent marginal tax rate. You estimate that there is a 50 percent chance the project will achieve the expected sales and a 25 percent chance it will achieve either the weak or strong sales outcomes. Should you recommend the project? Strong Sales Expected Sales _Weak Sales 5 000 10 000 120 -er unit. 130 Variable costs per 70 $65 unit Fixed costs 1 ,290, 000 1,2_90, 000 lnitiai investment '51, 400, 000 1 40,0, 000 2. Commodore Motors management is considering a project to produce toy cars. The project would require an initial outlay of $100,000 and have an expected life of 10 years. Management estimates that each year during the life of the project depreciation and amortization would be $8,000, capital expenditures would be $4,000, additions to working capital would be $2,000, and xed costs would be $3,000. Also, each toy car would sell for $15 and cost $7 to produce. Finally, the cost of capital for the project would be 12 percent, cash ow from the project would be taxed at a 25 percent rate, and the assets would be depreciated to a salvage value of $0. How many units must be sold each year in order for this project to break even from an economic standpoint

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts