Question: Please answer the questions below on separate sheets and show your steps (no step, no score). 1. Suppose Sunshine Inc. has a $1 million per

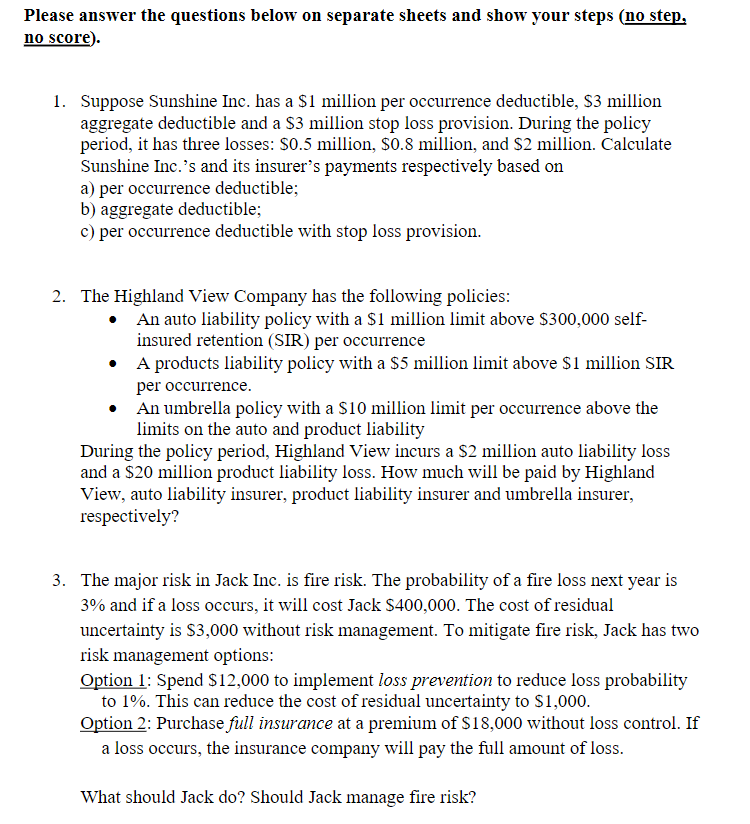

Please answer the questions below on separate sheets and show your steps (no step, no score). 1. Suppose Sunshine Inc. has a $1 million per occurrence deductible, $3 million aggregate deductible and a $3 million stop loss provision. During the policy period, it has three losses: 50.5 million, $0.8 million, and $2 million. Calculate Sunshine Inc.'s and its insurer's payments respectively based on a) per occurrence deductible; b) aggregate deductible; c) per occurrence deductible with stop loss provision. 2. The Highland View Company has the following policies: An auto liability policy with a $1 million limit above $300,000 self- insured retention (SIR) per occurrence A products liability policy with a $5 million limit above $1 million SIR per occurrence. An umbrella policy with a $10 million limit per occurrence above the limits on the auto and product liability During the policy period, Highland View incurs a $2 million auto liability loss and a $20 million product liability loss. How much will be paid by Highland View, auto liability insurer, product liability insurer and umbrella insurer, respectively? 3. The major risk in Jack Inc. is fire risk. The probability of a fire loss next year is 3% and if a loss occurs, it will cost Jack $400,000. The cost of residual uncertainty is $3,000 without risk management. To mitigate fire risk, Jack has two risk management options: Option 1: Spend $12,000 to implement loss prevention to reduce loss probability to 1%. This can reduce the cost of residual uncertainty to $1,000. Option 2: Purchase full insurance at a premium of $18,000 without loss control. If a loss occurs, the insurance company will pay the full amount of loss. What should Jack do? Should Jack manage fire risk? Please answer the questions below on separate sheets and show your steps (no step, no score). 1. Suppose Sunshine Inc. has a $1 million per occurrence deductible, $3 million aggregate deductible and a $3 million stop loss provision. During the policy period, it has three losses: 50.5 million, $0.8 million, and $2 million. Calculate Sunshine Inc.'s and its insurer's payments respectively based on a) per occurrence deductible; b) aggregate deductible; c) per occurrence deductible with stop loss provision. 2. The Highland View Company has the following policies: An auto liability policy with a $1 million limit above $300,000 self- insured retention (SIR) per occurrence A products liability policy with a $5 million limit above $1 million SIR per occurrence. An umbrella policy with a $10 million limit per occurrence above the limits on the auto and product liability During the policy period, Highland View incurs a $2 million auto liability loss and a $20 million product liability loss. How much will be paid by Highland View, auto liability insurer, product liability insurer and umbrella insurer, respectively? 3. The major risk in Jack Inc. is fire risk. The probability of a fire loss next year is 3% and if a loss occurs, it will cost Jack $400,000. The cost of residual uncertainty is $3,000 without risk management. To mitigate fire risk, Jack has two risk management options: Option 1: Spend $12,000 to implement loss prevention to reduce loss probability to 1%. This can reduce the cost of residual uncertainty to $1,000. Option 2: Purchase full insurance at a premium of $18,000 without loss control. If a loss occurs, the insurance company will pay the full amount of loss. What should Jack do? Should Jack manage fire risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts