Question: Please answer the questions below. Please write a very detailed and bigger paragraph if you can. Thank you very much!! 1. How was it possible

3. Study and discuss Italy's corporate governance regime and its role in the failure of Parmalat.

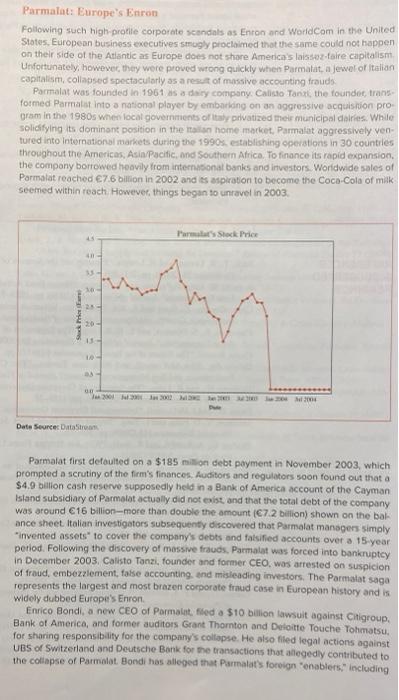

Parmalat: Europe's Enron Following such high-profile corporate scandals as Enron and World Com in the United States. European business executives stogly proclaimed that the same could not happen on their side of the Atlantic as Europe does not share America's laissez-faire capitalism Unfortunately, however they were proved wrong quickly when Parmalat, a Jewel or Italian capitalism, collapsed spectacularly as a result of massive accounting frauds Parmalat was founded in 1961 as a dry company. Calisto Tant the founder trans formed Parmalat into a national player by embaring on an aggressive acquisition pro gram in the 1980s when local governments of Italy privatized the municipal delries. While solidifying its dominant position in the home market, Parmalat aggressively ven tured into International markets during the 1990s establishing operations in 30 countries throughout the Americas, Asia Pacific, and Southern Africa. To finance its rapid expansion the company borrowed heavily from international banks and investors. Worldwide sales of Parmalat reached 7.6 billion in 2002 and its aspiration to become the Coca-Cola of milk seemed within reach However, things began to unravel in 2003 Parm's Shock Price 41 25 Sakit 20 11 W 2001 2002 M Date Source Data Stro Parmalat first defaulted on a $185 million debt payment in November 2003, which prompted a scrutiny of the firm's finances. Auditors and regulators soon found out that a $4.9 billion cash reserve supposedly held in a Bank of America account of the Cayman Island Subsidiary of Parmalat actually did not exist, and that the total debt of the company was around 16 billion--more than double the amount (7.2 billion) shown on the bal ance sheet Italian investigators subsequently discovered that Parmalat managers simply "invented assets" to cover the company's debts and falsified accounts over a 15-year period. Following the discovery of massive frauds. Parmalat was forced into bankruptcy in December 2003. Calisto Tanzi, founder and former CEO, was arrested on suspicion of fraud, embezzlement, false accounting and misleading investors. The Parmalat saga represents the largest and most brazen corporate fraud case in European history and is widely dubbed Europe's Enron Enrico Bondi, a new CEO of Parmalat, fed a $10 billion lawsuit against Citigroup. Bank of America, and former auditors Grant Thornton and Deloitte Touche Tohmatsu. for sharing responsibility for the company's collapse. He also filed legal actions against UBS of Switzerland and Deutsche Bank for the transactions that allegedly contributed to the collapse of Parmalat Bondi hos alleged that Parmalat's foreign onablers," including international banks and auditors, were complicit in the frauds. He maintained that they knew about Parmalat's fraudulent finances and helped the company to disguise them in exchange for fat fees. Bondi effectively declared a war on Parmalat's international bankers and creditors. The accompanying graph illustrates Parmalat's share price behavior. Following a sharp drop in share price, trading of the company's shares was suspended on December 22, 2003 Discussion Points 1. How was it possible for Parmalat managers to "cook the books" and hide it for so long? 2. Investigate and discuss the role that international banks and auditors might have played in Parmalat's collapse. 3. Study and discuss Italy's corporate governance regime and its role in the failure of Parmalat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts