Question: Please answer the questions below with Juniper networks financial statement 2021. You will be able to find thier 2021 annual report by Googling Juniper networks

Please answer the questions below with

Juniper networks financial statement 2021.

You will be able to find thier 2021 annual report by Googling Juniper networks financial statement 2021.

Thanks.

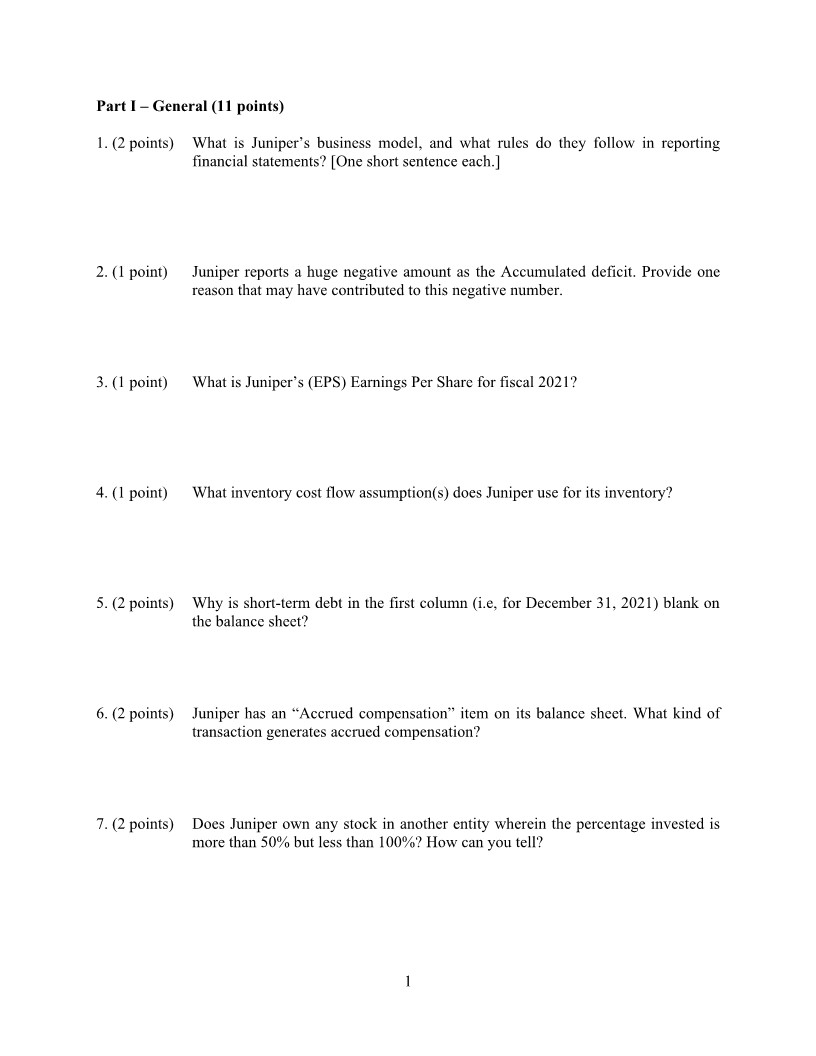

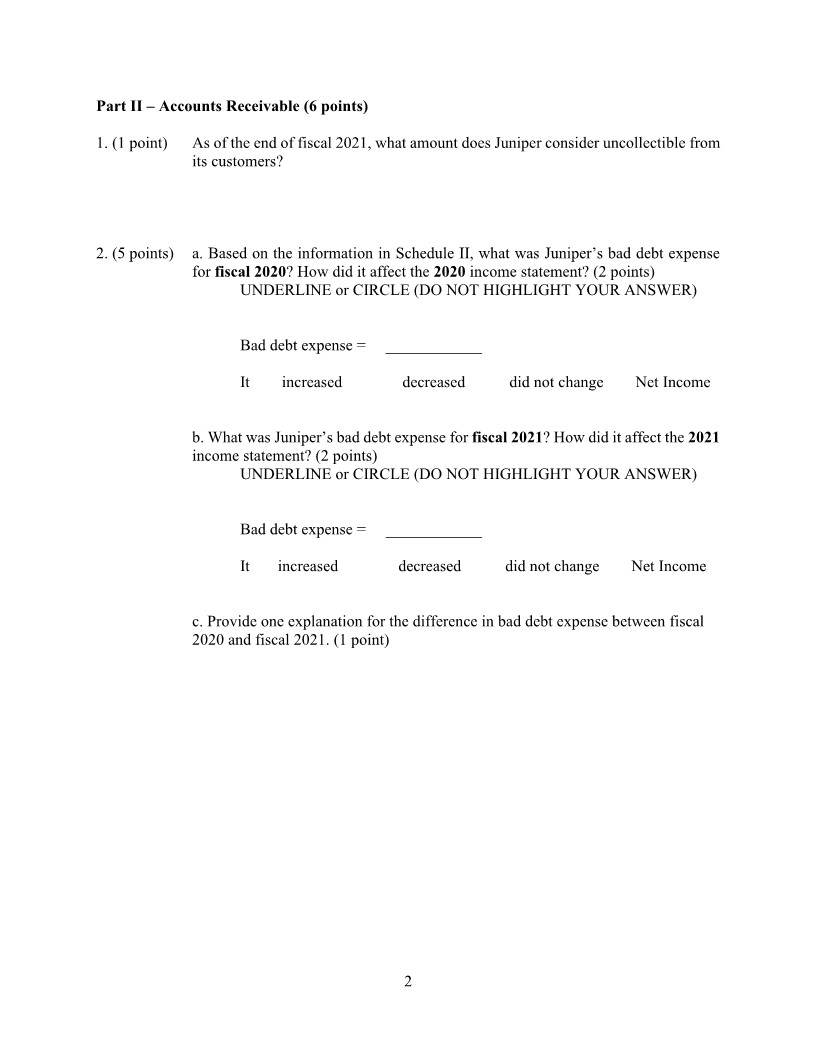

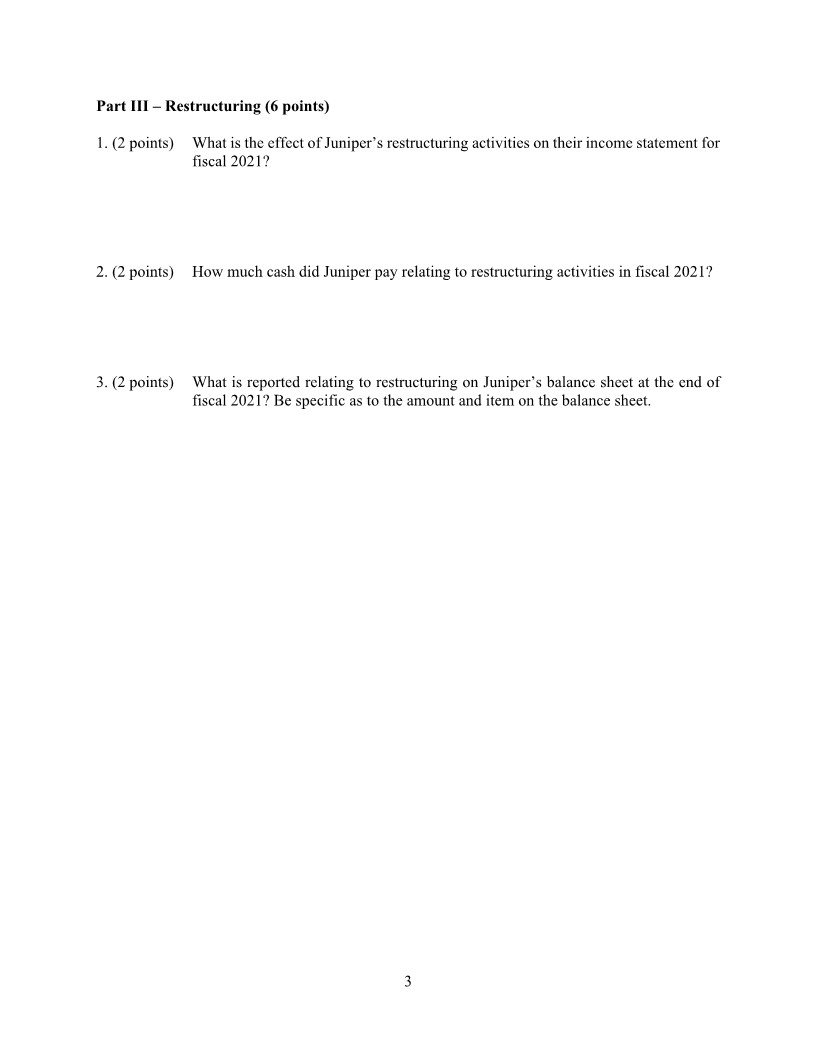

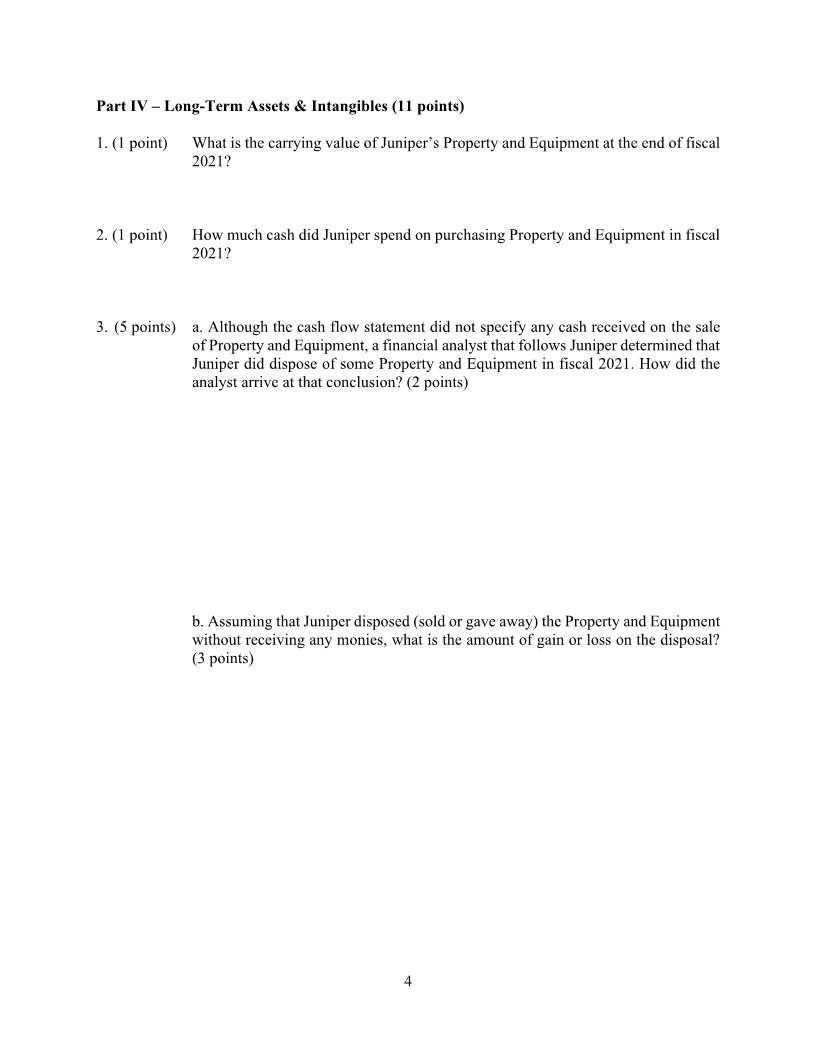

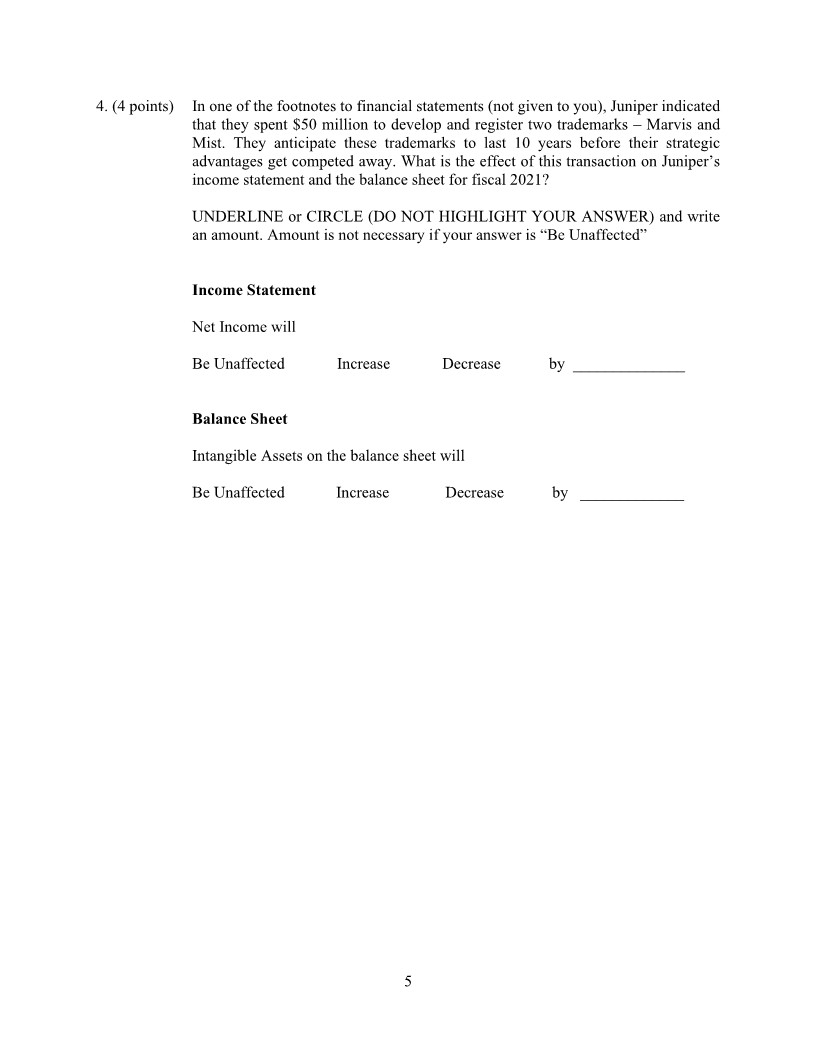

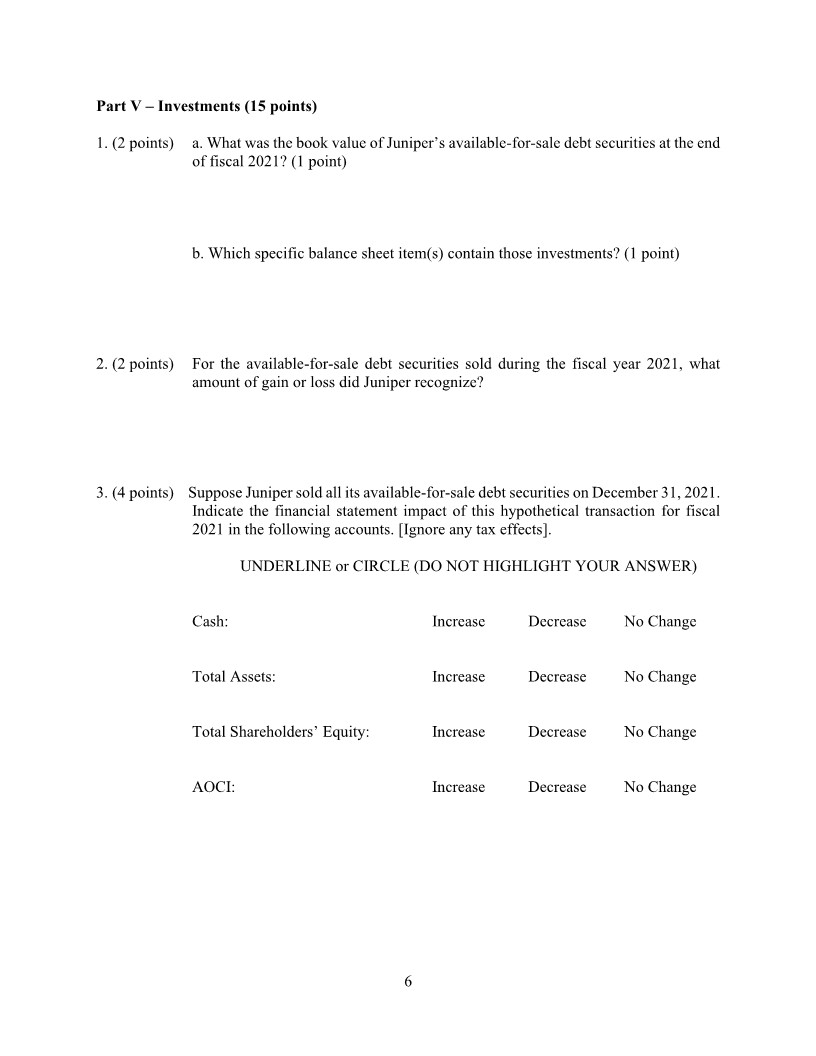

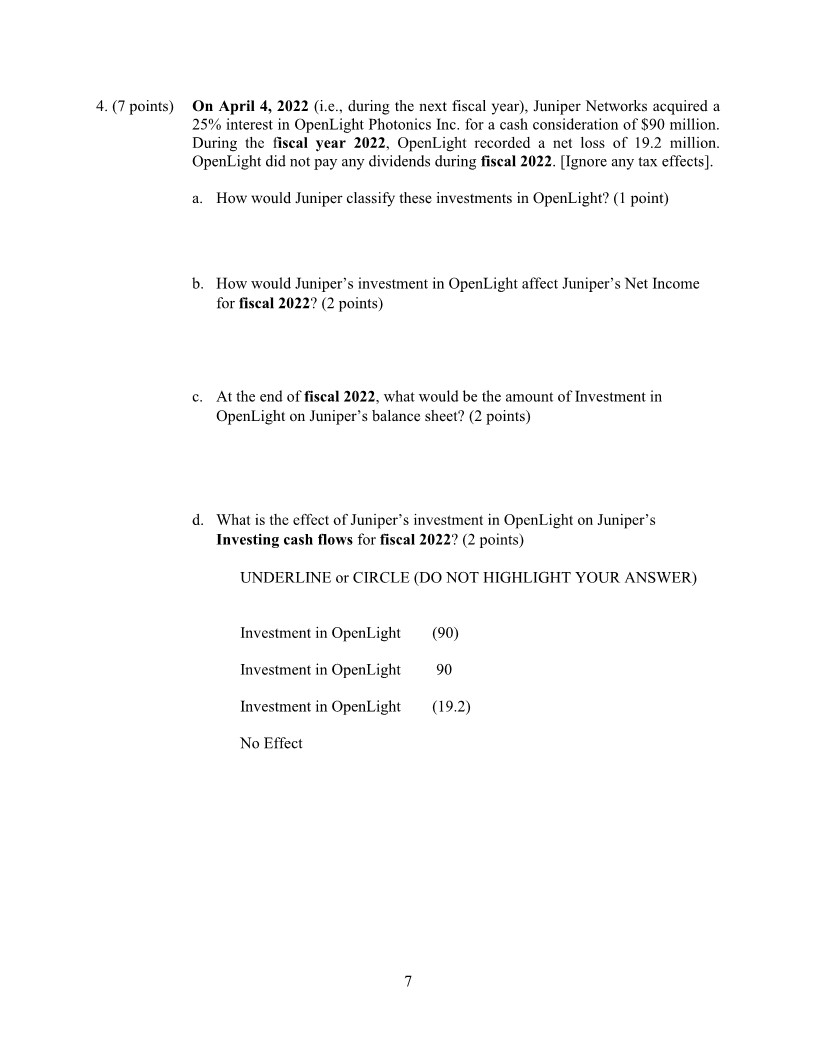

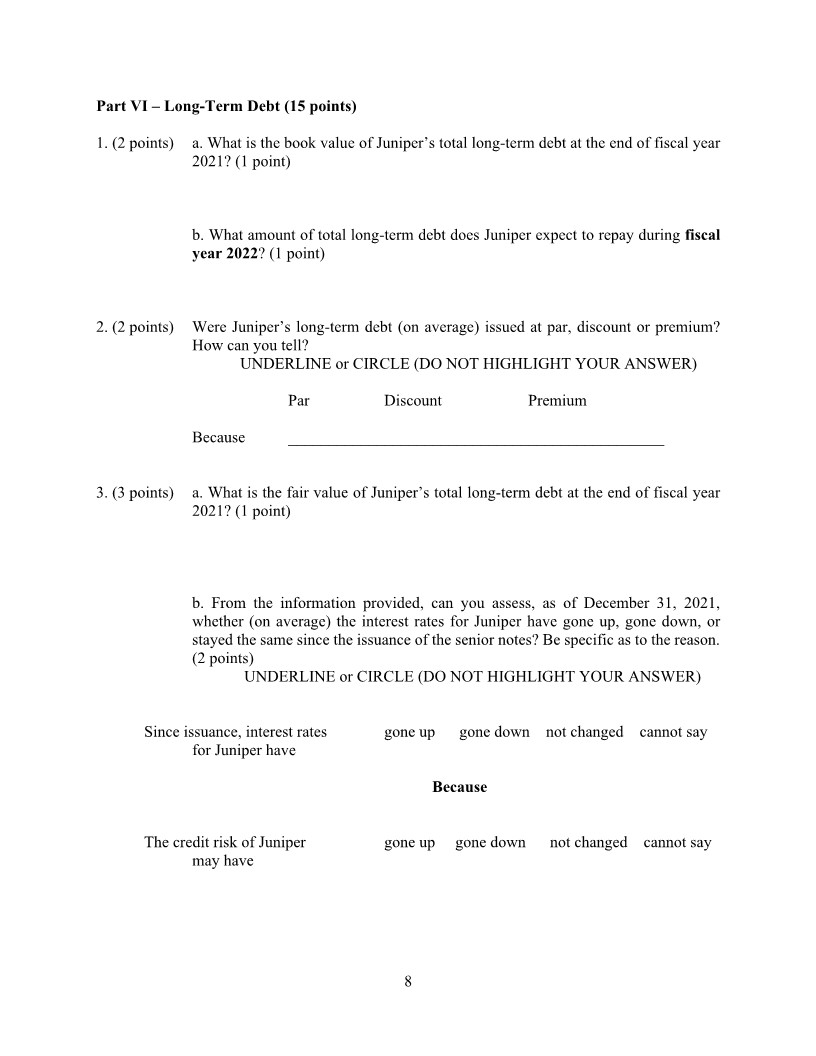

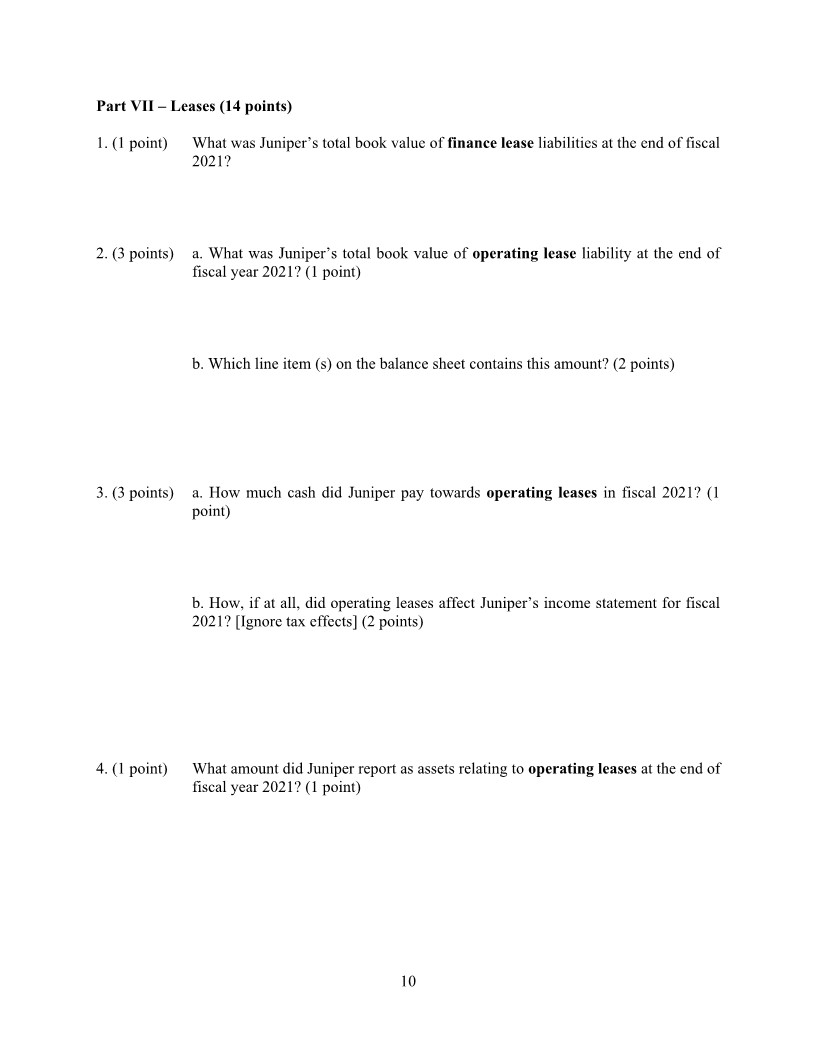

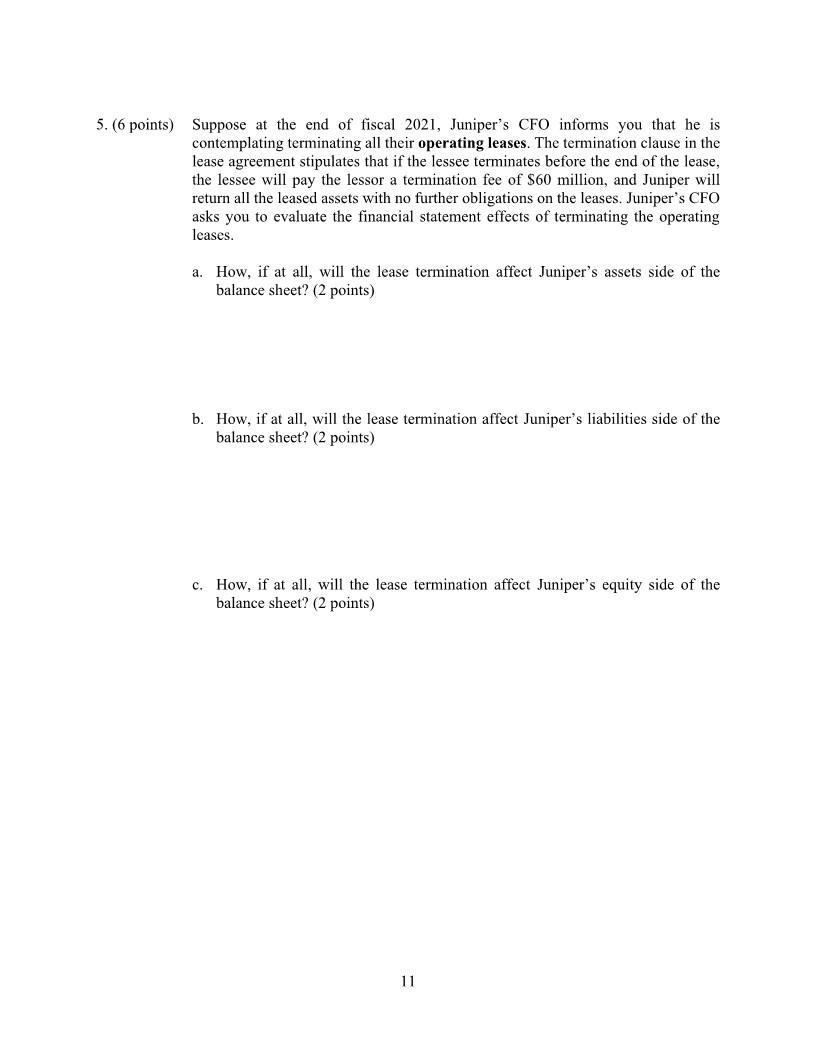

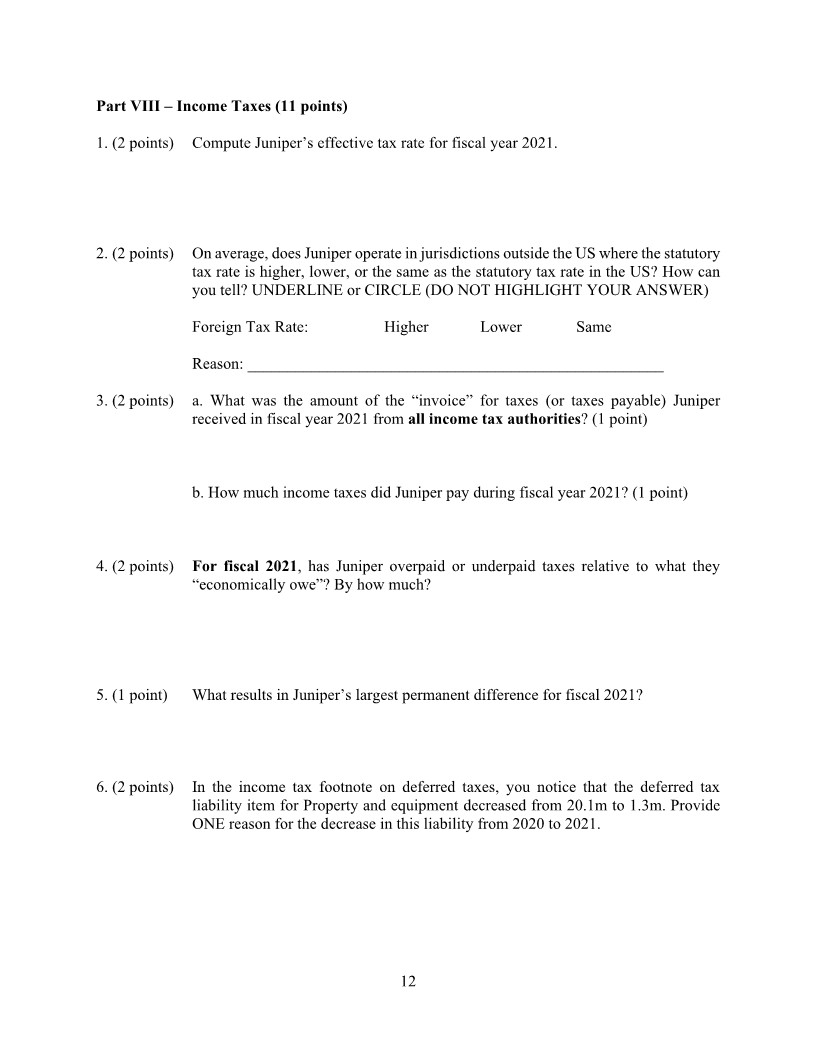

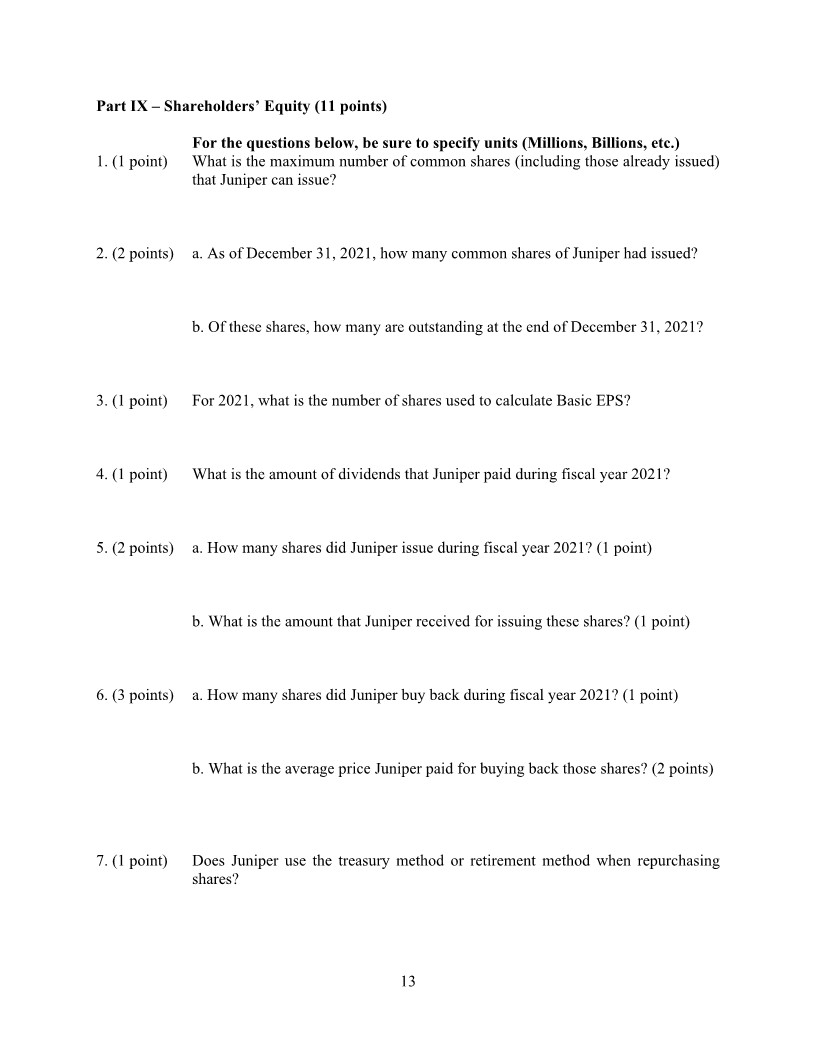

1. (1 point) What is the carrying value of Juniper's Property and Equipment at the end of fiscal 2021 ? 2. (1 point) How much cash did Juniper spend on purchasing Property and Equipment in fiscal 2021 ? 3. (5 points) a. Although the cash flow statement did not specify any cash received on the sale of Property and Equipment, a financial analyst that follows Juniper determined that Juniper did dispose of some Property and Equipment in fiscal 2021. How did the analyst arrive at that conclusion? ( 2 points) b. Assuming that Juniper disposed (sold or gave away) the Property and Equipment without receiving any monies, what is the amount of gain or loss on the disposal? (3 points) point) What was Juniper's total book value of finance lease liabilities at the end of fiscal 2021 ? points) a. What was Juniper's total book value of operating lease liability at the end of fiscal year 2021? (1 point) b. Which line item (s) on the balance sheet contains this amount? (2 points) points) a. How much cash did Juniper pay towards operating leases in fiscal 2021? (1 point) b. How, if at all, did operating leases affect Juniper's income statement for fiscal 2021? [Ignore tax effects] ( 2 points) point) What amount did Juniper report as assets relating to operating leases at the end of fiscal year 2021? (1 point) points) a. What is the amount of debt that Juniper repaid during fiscal 2021 ? (1 point) b. Is the amount that Juniper repaid greater than, smaller than, or the same as the carrying value at the time of repayment? By how much ( 2 points) UNDERLINE or CIRCLE (DO NOT HIGHLIGHT YOUR ANSWER) The carrying value was greater smaller the same Amount following question pertains solely to Juniper's " 5.950% fixed rate notes" ("2041 Notes") points) a. What is the effective interest rate on these notes? ( 1 point) b. What is the interest paid on these notes? (2 points) UNDERLINE or CIRCLE (DO NOT HIGHLIGHT YOUR ANSWER) 0m 23.8m 24.12m Not easy to compute with information provided ints) In one of the footnotes to financial statements (not given to you), Juniper indicated that they spent $50 million to develop and register two trademarks - Marvis and Mist. They anticipate these trademarks to last 10 years before their strategic advantages get competed away. What is the effect of this transaction on Juniper's income statement and the balance sheet for fiscal 2021 ? UNDERLINE or CIRCLE (DO NOT HIGHLIGHT YOUR ANSWER) and write an amount. Amount is not necessary if your answer is "Be Unaffected" Part IX - Shareholders' Equity (11 points) For the questions below, be sure to specify units (Millions, Billions, etc.) 1. (1 point) What is the maximum number of common shares (including those already issued) that Juniper can issue? 2. (2 points) a. As of December 31, 2021, how many common shares of Juniper had issued? b. Of these shares, how many are outstanding at the end of December 31, 2021 ? 3. (1 point) For 2021, what is the number of shares used to calculate Basic EPS? 4. (1 point) What is the amount of dividends that Juniper paid during fiscal year 2021 ? 5. (2 points) a. How many shares did Juniper issue during fiscal year 2021? (1 point) b. What is the amount that Juniper received for issuing these shares? (1 point) 6. (3 points) a. How many shares did Juniper buy back during fiscal year 2021? (1 point) b. What is the average price Juniper paid for buying back those shares? ( 2 points) 7. (1 point) Does Juniper use the treasury method or retirement method when repurchasing shares? Part V - Investments (15 points) 1. (2 points) a. What was the book value of Juniper's available-for-sale debt securities at the end of fiscal 2021? (1 point) b. Which specific balance sheet item(s) contain those investments? (1 point) 2. (2 points) For the available-for-sale debt securities sold during the fiscal year 2021, what amount of gain or loss did Juniper recognize? 3. (4 points) Suppose Juniper sold all its available-for-sale debt securities on December 31, 2021. Indicate the financial statement impact of this hypothetical transaction for fiscal 2021 in the following accounts. [Ignore any tax effects]. UNDERLINE or CIRCLE (DO NOT HIGHLIGHT YOUR ANSWER) 1. (2 points) What is the effect of Juniper's restructuring activities on their income statement for fiscal 2021 ? 2. (2 points) How much cash did Juniper pay relating to restructuring activities in fiscal 2021 ? 3. (2 points) What is reported relating to restructuring on Juniper's balance sheet at the end of fiscal 2021 ? Be specific as to the amount and item on the balance sheet. Part VIII - Income Taxes (11 points) 1. (2 points) Compute Juniper's effective tax rate for fiscal year 2021. 2. (2 points) On average, does Juniper operate in jurisdictions outside the US where the statutory tax rate is higher, lower, or the same as the statutory tax rate in the US? How can you tell? UNDERLINE or CIRCLE (DO NOT HIGHLIGHT YOUR ANSWER) Foreign Tax Rate: Higher Lower Same Reason: 3. (2 points) a. What was the amount of the "invoice" for taxes (or taxes payable) Juniper received in fiscal year 2021 from all income tax authorities? (1 point) b. How much income taxes did Juniper pay during fiscal year 2021? (1 point) 4. (2 points) For fiscal 2021, has Juniper overpaid or underpaid taxes relative to what they "economically owe"? By how much? 5. (1 point) What results in Juniper's largest permanent difference for fiscal 2021 ? 6. (2 points) In the income tax footnote on deferred taxes, you notice that the deferred tax liability item for Property and equipment decreased from 20.1m to 1.3m. Provide ONE reason for the decrease in this liability from 2020 to 2021 . 1. ( 2 points) What is Juniper's business model, and what rules do they follow in reporting financial statements? [One short sentence each.] 2. (1 point) Juniper reports a huge negative amount as the Accumulated deficit. Provide one reason that may have contributed to this negative number. 3. (1 point) What is Juniper's (EPS) Earnings Per Share for fiscal 2021? 4. (1 point) What inventory cost flow assumption(s) does Juniper use for its inventory? 5. (2 points) Why is short-term debt in the first column (i.e, for December 31, 2021) blank on the balance sheet? 6. ( 2 points) Juniper has an "Accrued compensation" item on its balance sheet. What kind of transaction generates accrued compensation? 7. ( 2 points) Does Juniper own any stock in another entity wherein the percentage invested is more than 50% but less than 100% ? How can you tell? Suppose at the end of fiscal 2021, Juniper's CFO informs you that he is contemplating terminating all their operating leases. The termination clause in the lease agreement stipulates that if the lessee terminates before the end of the lease, the lessee will pay the lessor a termination fee of $60 million, and Juniper will return all the leased assets with no further obligations on the leases. Juniper's CFO asks you to evaluate the financial statement effects of terminating the operating leases. a. How, if at all, will the lease termination affect Juniper's assets side of the balance sheet? ( 2 points) b. How, if at all, will the lease termination affect Juniper's liabilities side of the balance sheet? ( 2 points) c. How, if at all, will the lease termination affect Juniper's equity side of the balance sheet? ( 2 points) Part VI - Long-Term Debt (15 points) 1. (2 points) a. What is the book value of Juniper's total long-term debt at the end of fiscal year 2021 ? (1 point) b. What amount of total long-term debt does Juniper expect to repay during fiscal year 2022? (1 point) 2. (2 points) Were Juniper's long-term debt (on average) issued at par, discount or premium? How can you tell? UNDERLINE or CIRCLE (DO NOT HIGHLIGHT YOUR ANSWER) Par Discount Premium Because 3. (3 points) a. What is the fair value of Juniper's total long-term debt at the end of fiscal year 2021 ? (1 point) b. From the information provided, can you assess, as of December 31, 2021, whether (on average) the interest rates for Juniper have gone up, gone down, or stayed the same since the issuance of the senior notes? Be specific as to the reason. ( 2 points) UNDERLINE or CIRCLE (DO NOT HIGHLIGHT YOUR ANSWER) b. How would Juniper's investment in OpenLight affect Juniper's Net Income for fiscal 2022? (2 points) c. At the end of fiscal 2022, what would be the amount of Investment in OpenLight on Juniper's balance sheet? (2 points) d. What is the effect of Juniper's investment in OpenLight on Juniper's Investing cash flows for fiscal 2022? ( 2 points) UNDERLINE or CIRCLE (DO NOT HIGHLIGHT YOUR ANSWER) Investment in OpenLight Investment in OpenLight Investment in OpenLight No Effect (90) 90 (19.2) Part II - Accounts Receivable (6 points) 1. (1 point) As of the end of fiscal 2021, what amount does Juniper consider uncollectible from its customers? 2. (5 points) a. Based on the information in Schedule II, what was Juniper's bad debt expense for fiscal 2020? How did it affect the 2020 income statement? ( 2 points) UNDERLINE or CIRCLE (DO NOT HIGHLIGHT YOUR ANSWER) Bad debt expense = It increased decreased did not change Net Income b. What was Juniper's bad debt expense for fiscal 2021? How did it affect the 2021 income statement? ( 2 points) UNDERLINE or CIRCLE (DO NOT HIGHLIGHT YOUR ANSWER) Bad debt expense = It increased decreased did not change Net Income c. Provide one explanation for the difference in bad debt expense between fiscal 2020 and fiscal 2021. (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts