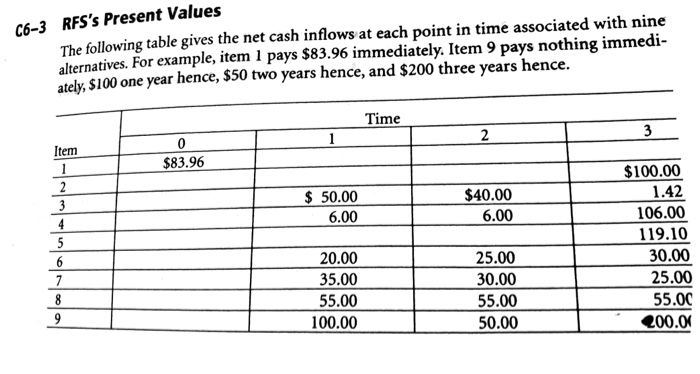

Question: please answer the questions C6-3 RFS's Present Values The following table gives the net cash inflows at each point in time associated with nine alternatives.

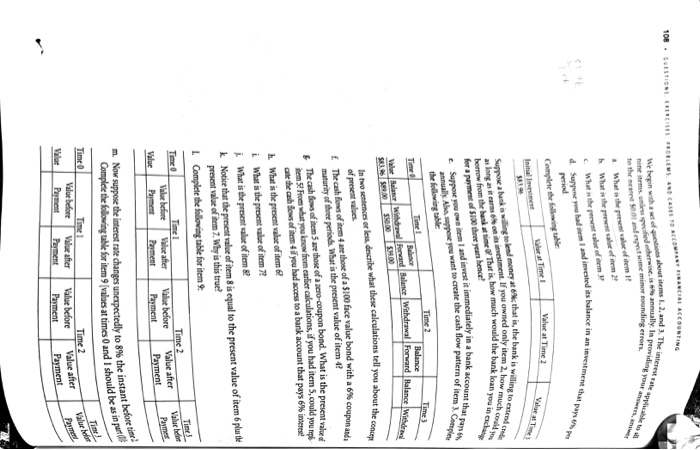

C6-3 RFS's Present Values The following table gives the net cash inflows at each point in time associated with nine alternatives. For example, item 1 pays $83.96 immediately. Item 9 pays nothing immedi- ately, $100 one year hence, $50 two years hence, and $200 three years hence. Time 2 $83.96 $ 50.00 6.00 $40.00 6.00 20.00 35.00 55.00 100.00 25.00 30.00 55.00 50.00 $100.00 1.42 106.00 119.10 30.00 25.00 55.00 200.00 BLUSER TOBOLESTIERBEITES ewwa Wg you , We begin with a about items 1. 2. and 3. The in se derha nnually. In to them and e re wounding error What is the pr o fitemi! What the filem What the p a rtem Su h adlanded its balance an event that the ight Complete the f Value at Time 2 Vile Initialement $100 that is, the bank is willing to e nd ment. If you owned only item 2. how mu och the bank loan you in each h Supposal is willing to lend money that is, the as long as it was not you owned only item the same That is how much would the bat foram of 5100 three years hence? Suppor t and investimmediately in a bank annually ha v e you become cash flow pattern diately in a bank account that ons want to create the cash flow pattern of item em Cone Time) Balance Balance Withdrawal Forward Balance Withers the Ralan N 5 o 50.00 Forward Balance Withdrawal 50.00 S ons tell you about the cop In or less describe what these calculations tell you about of presents The cash flow of them are those of a $100 face value bond with a 6% COMO maturity of the periods. What is the present value of item ? The cash flow oftem 5 are those of a zero-coupon bond. What is the present vale hem from what you know from earlier calculations, if you had item 5. could you real ale the cash flow often if you had access to a bank account that pays 6% interese What is the present value of item? i What is the presentabe of item 7? i What is the present alue of item2 Notice that the present value of item 8 is equal to the present value of item 6 plus the presenta ofitem 7. Why is this true? Complete the following table for item Timeo Valur before Payment Value after Payment Time 2 Value before Value after Payment Payment Value beter Paymes Value he instant before time? uld be as in parte m. Now suppose the interest rate changes unexpectedly to 8% the instant Complete the following table for item 9 values at times and I should be Timeo Time! Time 2 Value before Value after Value before Value after Value Payment Payment Payment Payment T ! Bu bir C6-3 RFS's Present Values The following table gives the net cash inflows at each point in time associated with nine alternatives. For example, item 1 pays $83.96 immediately. Item 9 pays nothing immedi- ately, $100 one year hence, $50 two years hence, and $200 three years hence. Time 2 $83.96 $ 50.00 6.00 $40.00 6.00 20.00 35.00 55.00 100.00 25.00 30.00 55.00 50.00 $100.00 1.42 106.00 119.10 30.00 25.00 55.00 200.00 BLUSER TOBOLESTIERBEITES ewwa Wg you , We begin with a about items 1. 2. and 3. The in se derha nnually. In to them and e re wounding error What is the pr o fitemi! What the filem What the p a rtem Su h adlanded its balance an event that the ight Complete the f Value at Time 2 Vile Initialement $100 that is, the bank is willing to e nd ment. If you owned only item 2. how mu och the bank loan you in each h Supposal is willing to lend money that is, the as long as it was not you owned only item the same That is how much would the bat foram of 5100 three years hence? Suppor t and investimmediately in a bank annually ha v e you become cash flow pattern diately in a bank account that ons want to create the cash flow pattern of item em Cone Time) Balance Balance Withdrawal Forward Balance Withers the Ralan N 5 o 50.00 Forward Balance Withdrawal 50.00 S ons tell you about the cop In or less describe what these calculations tell you about of presents The cash flow of them are those of a $100 face value bond with a 6% COMO maturity of the periods. What is the present value of item ? The cash flow oftem 5 are those of a zero-coupon bond. What is the present vale hem from what you know from earlier calculations, if you had item 5. could you real ale the cash flow often if you had access to a bank account that pays 6% interese What is the present value of item? i What is the presentabe of item 7? i What is the present alue of item2 Notice that the present value of item 8 is equal to the present value of item 6 plus the presenta ofitem 7. Why is this true? Complete the following table for item Timeo Valur before Payment Value after Payment Time 2 Value before Value after Payment Payment Value beter Paymes Value he instant before time? uld be as in parte m. Now suppose the interest rate changes unexpectedly to 8% the instant Complete the following table for item 9 values at times and I should be Timeo Time! Time 2 Value before Value after Value before Value after Value Payment Payment Payment Payment T ! Bu bir

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts