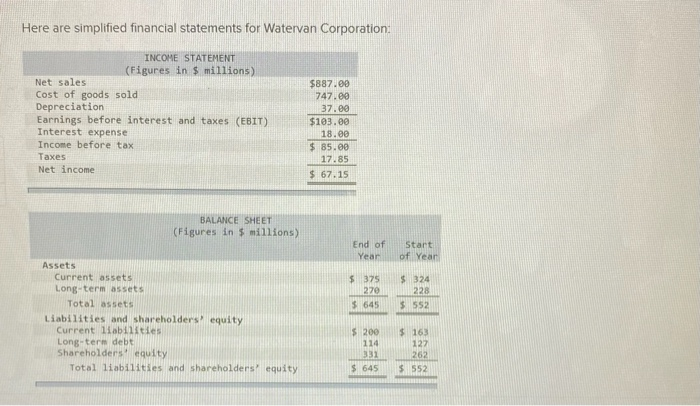

Question: please answer the questions Here are simplified financial statements for Watervan Corporation: INCOME STATEMENT (Figures in $ millions) Net sales Cost of goods sold Depreciation

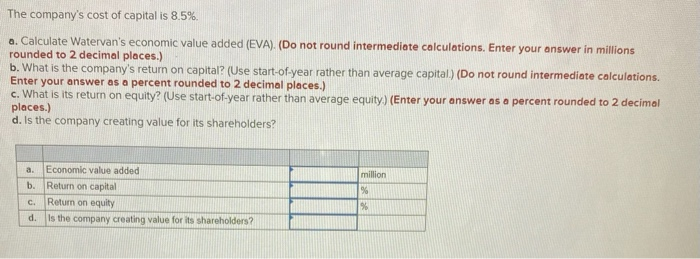

Here are simplified financial statements for Watervan Corporation: INCOME STATEMENT (Figures in $ millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes Net income $887.00 747.00 37.00 $103.00 18.00 $ 85.00 17.85 $ 67.15 BALANCE SHEET (Figures in 5 millions) End of Year start of Year $ 375 270 $ 645 $ 324 228 $ 552 Assets Current assets Long-term assets Total assets Liabilities and shareholders equity Current liabilities Long-term debt Shareholders' equity Total liabilities and shareholders equity $ 200 114 331 $ 163 127 262 $ 552 $ 645 The company's cost of capital is 8.5%. a. Calculate Watervan's economic value added (EVA). (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. What is the company's return on capital? (Use start-of-year rather than average capital) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is its return on equity? (Use start-of-year rather than average equity) (Enter your answer as a percent rounded to 2 decimal places.) d. Is the company creating value for its shareholders? a. million % Economic value added b. Return on capital c. Return on equity d. Is the company creating value for its shareholders? %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts