Question: Please answer the questions in the format above. Options for dropdown: 1. Fill in the blank 2. Fill in the blank 3. More, Less, Equally

Please answer the questions in the format above.

Please answer the questions in the format above.

Options for dropdown:

1. Fill in the blank

2. Fill in the blank

3. More, Less, Equally

4. More, Less, Equally

5. Fill in the blank

6. Fill in the blank

7. NYSE, CAC, Either, Neither

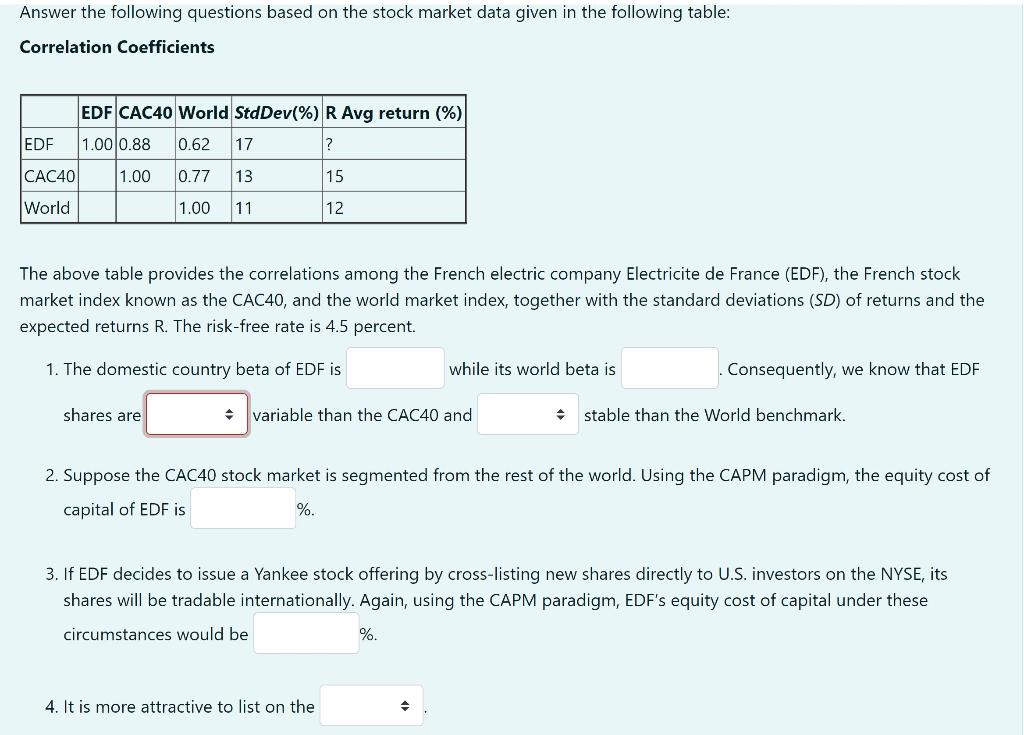

Answer the following questions based on the stock market data given in the following table: Correlation coefficients EDF CAC40 World Std Dev(%) R Avg return (%) 1.00 0.88 0.62 17 EDF ? CAC40 1.00 0.77 13 15 World 1.00 11 12 The above table provides the correlations among the French electric company Electricite de France (EDF), the French stock market index known as the CAC40, and the world market index, together with the standard deviations (SD) of returns and the expected returns R. The risk-free rate is 4.5 percent. 1. The domestic country beta of EDF is while its world beta is Consequently, we know that EDF shares are variable than the CAC40 and stable than the World benchmark. 2. Suppose the CAC40 stock market is segmented from the rest of the world. Using the CAPM paradigm, the equity cost of capital of EDF is %. 3. If EDF decides to issue a Yankee stock offering by cross-listing new shares directly to U.S. investors on the NYSE, its shares will be tradable internationally. Again, using the CAPM paradigm, EDF's equity cost of capital under these circumstances would be %. 4. It is more attractive to list on the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts