Question: please answer the questions Interview Notes Carol Wheeler, age 56, is single. Carol earned wages of $48,000 and was enrolled the entire year in a

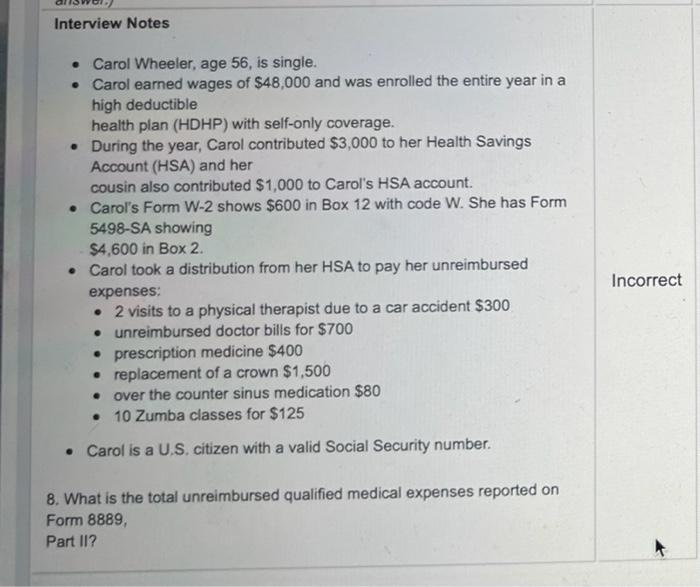

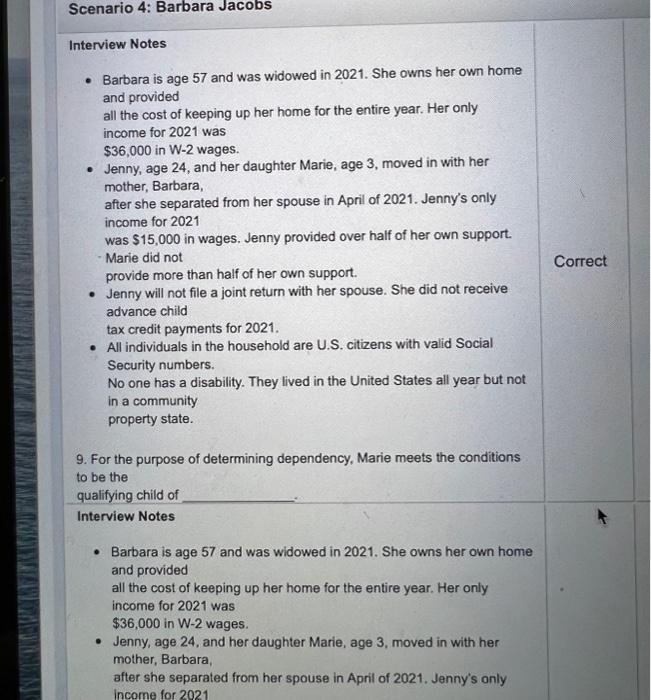

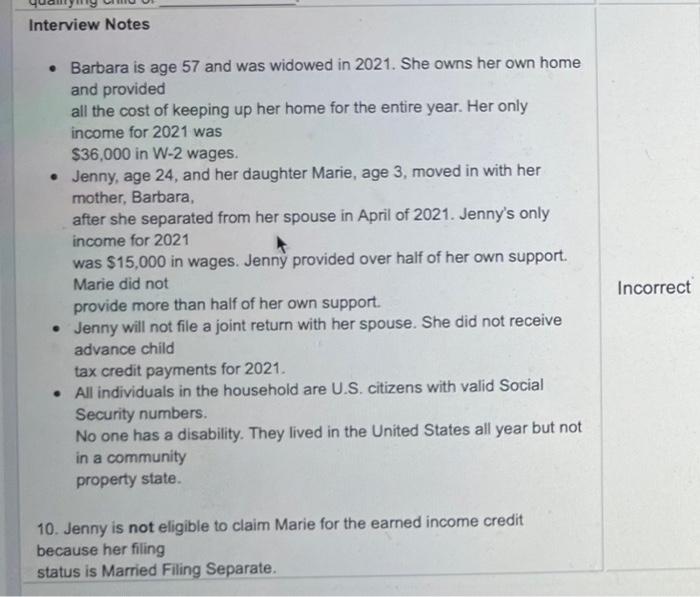

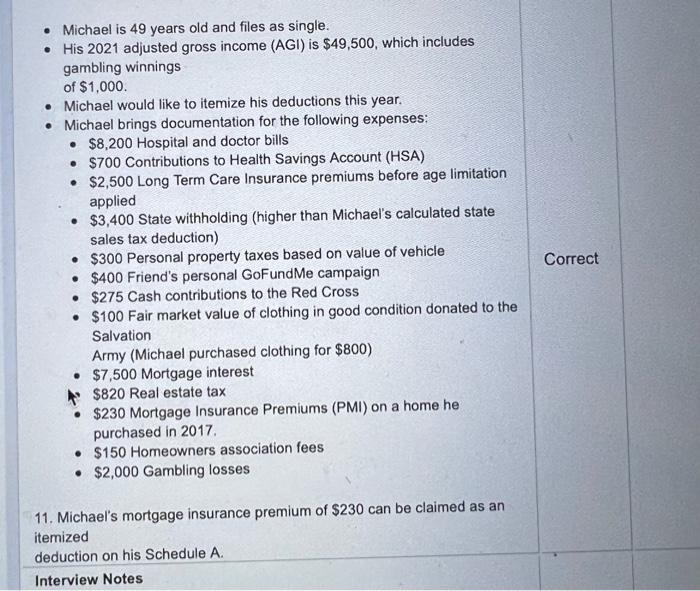

Interview Notes Carol Wheeler, age 56, is single. Carol earned wages of $48,000 and was enrolled the entire year in a high deductible health plan (HDHP) with self-only coverage. . During the year, Carol contributed $3,000 to her Health Savings Account (HSA) and her cousin also contributed $1,000 to Carol's HSA account. Carol's Form W-2 shows $600 in Box 12 with code W. She has Form 5498-SA showing $4,600 in Box 2 Carol took a distribution from her HSA to pay her unreimbursed expenses: 2 visits to a physical therapist due to a car accident $300 unreimbursed doctor bills for $700 prescription medicine $400 replacement of a crown $1,500 over the counter sinus medication $80 10 Zumba classes for $125 Incorrect Carol is a U.S. citizen with a valid Social Security number. 8. What is the total unreimbursed qualified medical expenses reported on Form 8889, Part 11? Scenario 4: Barbara Jacobs Interview Notes Barbara is age 57 and was widowed in 2021. She owns her own home and provided all the cost of keeping up her home for the entire year. Her only income for 2021 was $36,000 in W-2 wages. Jenny, age 24, and her daughter Marie, age 3, moved in with her mother, Barbara, after she separated from her spouse in April of 2021. Jenny's only income for 2021 was $15,000 in wages. Jenny provided over half of her own support. Marie did not provide more than half of her own support. Jenny will not file a joint return with her spouse. She did not receive advance child tax credit payments for 2021. All individuals in the household are U.S. citizens with valid Social Security numbers No one has a disability. They lived in the United States all year but not in a community property state. Correct 9. For the purpose of determining dependency, Marie meets the conditions to be the qualifying child of Interview Notes Barbara is age 57 and was widowed in 2021. She owns her own home and provided all the cost of keeping up her home for the entire year. Her only income for 2021 was $36,000 in W-2 wages. Jenny, age 24. and her daughter Marie, age 3, moved in with her mother, Barbara, after she separated from her spouse in April of 2021. Jenny's only Income for 2021 Interview Notes Barbara is age 57 and was widowed in 2021. She owns her own home and provided all the cost of keeping up her home for the entire year. Her only income for 2021 was $36,000 in W-2 wages. Jenny, age 24, and her daughter Marie, age 3, moved in with her mother, Barbara, after she separated from her spouse in April of 2021. Jenny's only income for 2021 was $15,000 in wages. Jenny provided over half of her own support. Marie did not provide more than half of her own support. Jenny will not file a joint return with her spouse. She did not receive advance child tax credit payments for 2021. All individuals in the household are U.S. citizens with valid Social Security numbers. No one has a disability. They lived in the United States all year but not in a community property state. Incorrect 10. Jenny is not eligible to claim Marie for the earned income credit because her filing status is Married Filing Separate. Michael is 49 years old and files as single. His 2021 adjusted gross income (AGI) is $49,500, which includes gambling winnings of $1,000 Michael would like to itemize his deductions this year. Michael brings documentation for the following expenses: $8,200 Hospital and doctor bills $700 Contributions to Health Savings Account (HSA) $2,500 Long Term Care Insurance premiums before age limitation applied $3,400 State withholding (higher than Michael's calculated state sales tax deduction) $300 Personal property taxes based on value of vehicle $400 Friend's personal GoFundMe campaign $275 Cash contributions to the Red Cross $100 Fair market value of clothing in good condition donated to the Salvation Army (Michael purchased clothing for $800) $7,500 Mortgage interest $820 Real estate tax $230 Mortgage Insurance Premiums (PMI) on a home he purchased in 2017 $150 Homeowners association fees $2,000 Gambling losses Correct 11. Michael's mortgage insurance premium of $230 can be claimed as an itemized deduction on his Schedule A. Interview Notes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts