Question: please answer the questions Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him

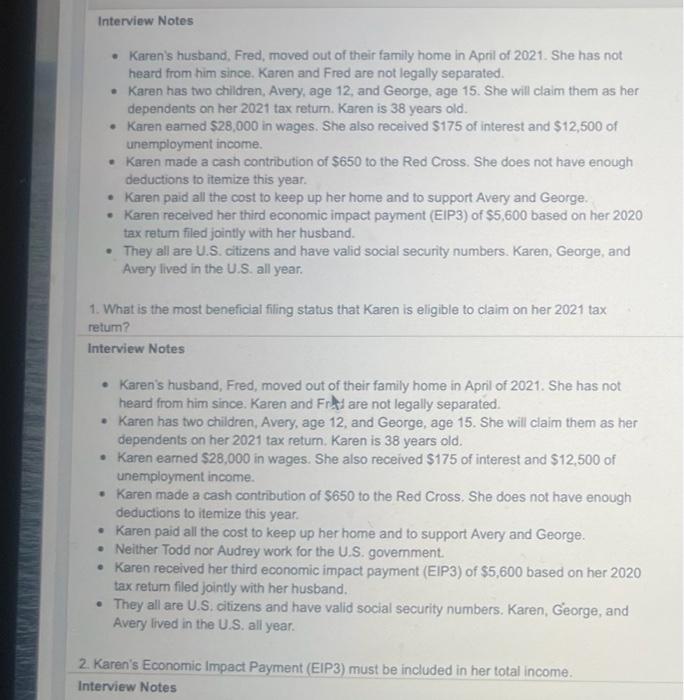

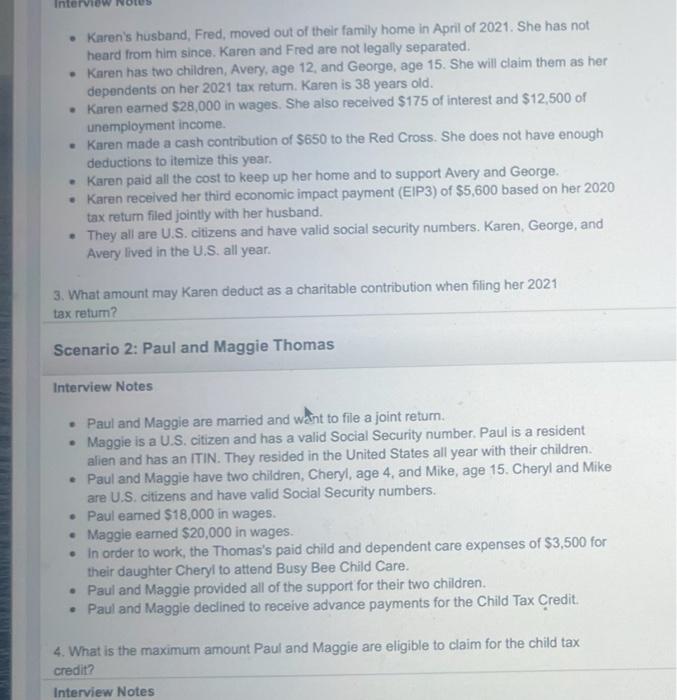

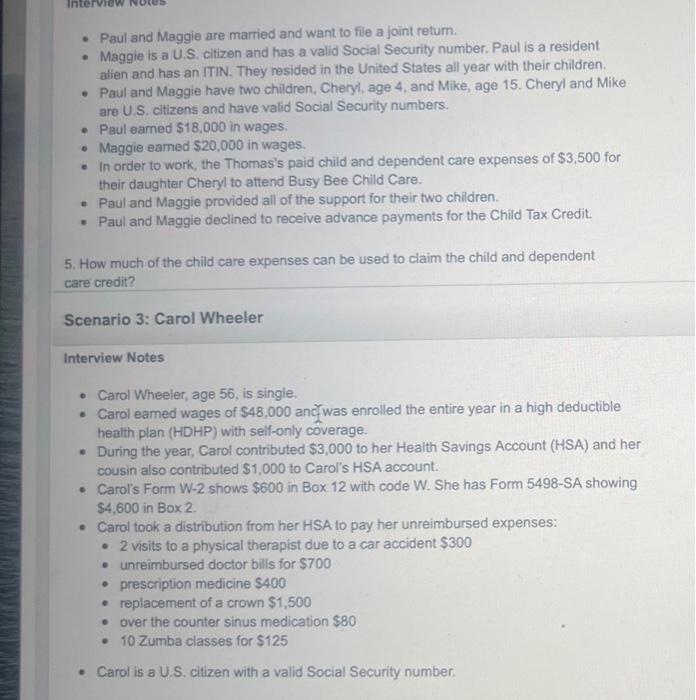

Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since, Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return, Karen is 38 years old. Karen eamed $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George. Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax retum filed jointly with her husband. They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. 1. What is the most beneficial filing status that Karen is eligible to claim on her 2021 tax return? Interview Notes a Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since, Karen and Frare not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return, Karen is 38 years old. Karen earned $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George. Neither Todd nor Audrey work for the U.S. goverment Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax return filed jointly with her husband, They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. 2. Karen's Economic Impact Payment (EIP3) must be included in her total income. Interview Notes Intern Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since, Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return. Karen is 38 years old. Karen earned $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George. Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax return filed jointly with her husband. They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. 3. What amount may Karen deduct as a charitable contribution when filing her 2021 tax return? Scenario 2: Paul and Maggie Thomas Interview Notes a Paul and Maggie are married and want to file a joint return. Maggie is a U.S. citizen and has a valid Social Security number. Paul is a resident alien and has an ITIN. They resided in the United States all year with their children. Paul and Maggie have two children, Cheryl, age 4, and Mike, age 15. Cheryl and Mike are U.S. citizens and have valid Social Security numbers. Paul earned $18,000 in wages. Maggie earned $20,000 in wages. In order to work, the Thomas's paid child and dependent care expenses of $3,500 for their daughter Cheryl to attend Busy Bee Child Care. Paul and Maggie provided all of the support for their two children. Paul and Maggle declined to receive advance payments for the Child Tax Credit. 4. What is the maximum amount Paul and Maggie are eligible to claim for the child tax credit? Interview Notes Paul and Maggie are married and want to fue a joint retum Maggie is a U.S. citizen and has a valid Social Security number. Paul is a resident alien and has an ITIN. They resided in the United States all year with their children. Paul and Maggie have two children, Cheryl, age 4, and Mike, age 15. Cheryl and Mike are U.S. citizens and have valid Social Security numbers. Paul earned $18,000 in wages. Maggie earned $20,000 in wages. In order to work, the Thomas's paid child and dependent care expenses of $3,500 for their daughter Cheryl to attend Busy Bee Child Care. Paul and Maggie provided all of the support for their two children. Paul and Maggie declined to receive advance payments for the Child Tax Credit 5. How much of the child care expenses can be used to claim the child and dependent care credit? Scenario 3: Carol Wheeler Interview Notes Carol Wheeler, age 56, is single. Carol eamed wages of $48,000 and was enrolled the entire year in a high deductible health plan (HDHP) with self-only coverage. . During the year, Carol contributed $3,000 to her Health Savings Account (HSA) and her cousin also contributed $1,000 to Carol's HSA account. Carol's Form W-2 shows $600 in Box 12 with code W. She has Form 5498-SA showing $4,600 in Box 2. Carol took a distribution from her HSA to pay her unreimbursed expenses: 2 visits to a physical therapist due to a car accident $300 .unreimbursed doctor bills for $700 prescription medicine $400 replacement of a crown $1,500 over the counter sinus medication $80 10 Zumba classes for $125 Carol is a U.S. citizen with a valid Social Security number Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since, Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return, Karen is 38 years old. Karen eamed $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George. Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax retum filed jointly with her husband. They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. 1. What is the most beneficial filing status that Karen is eligible to claim on her 2021 tax return? Interview Notes a Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since, Karen and Frare not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return, Karen is 38 years old. Karen earned $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George. Neither Todd nor Audrey work for the U.S. goverment Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax return filed jointly with her husband, They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. 2. Karen's Economic Impact Payment (EIP3) must be included in her total income. Interview Notes Intern Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since, Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return. Karen is 38 years old. Karen earned $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George. Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax return filed jointly with her husband. They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. 3. What amount may Karen deduct as a charitable contribution when filing her 2021 tax return? Scenario 2: Paul and Maggie Thomas Interview Notes a Paul and Maggie are married and want to file a joint return. Maggie is a U.S. citizen and has a valid Social Security number. Paul is a resident alien and has an ITIN. They resided in the United States all year with their children. Paul and Maggie have two children, Cheryl, age 4, and Mike, age 15. Cheryl and Mike are U.S. citizens and have valid Social Security numbers. Paul earned $18,000 in wages. Maggie earned $20,000 in wages. In order to work, the Thomas's paid child and dependent care expenses of $3,500 for their daughter Cheryl to attend Busy Bee Child Care. Paul and Maggie provided all of the support for their two children. Paul and Maggle declined to receive advance payments for the Child Tax Credit. 4. What is the maximum amount Paul and Maggie are eligible to claim for the child tax credit? Interview Notes Paul and Maggie are married and want to fue a joint retum Maggie is a U.S. citizen and has a valid Social Security number. Paul is a resident alien and has an ITIN. They resided in the United States all year with their children. Paul and Maggie have two children, Cheryl, age 4, and Mike, age 15. Cheryl and Mike are U.S. citizens and have valid Social Security numbers. Paul earned $18,000 in wages. Maggie earned $20,000 in wages. In order to work, the Thomas's paid child and dependent care expenses of $3,500 for their daughter Cheryl to attend Busy Bee Child Care. Paul and Maggie provided all of the support for their two children. Paul and Maggie declined to receive advance payments for the Child Tax Credit 5. How much of the child care expenses can be used to claim the child and dependent care credit? Scenario 3: Carol Wheeler Interview Notes Carol Wheeler, age 56, is single. Carol eamed wages of $48,000 and was enrolled the entire year in a high deductible health plan (HDHP) with self-only coverage. . During the year, Carol contributed $3,000 to her Health Savings Account (HSA) and her cousin also contributed $1,000 to Carol's HSA account. Carol's Form W-2 shows $600 in Box 12 with code W. She has Form 5498-SA showing $4,600 in Box 2. Carol took a distribution from her HSA to pay her unreimbursed expenses: 2 visits to a physical therapist due to a car accident $300 .unreimbursed doctor bills for $700 prescription medicine $400 replacement of a crown $1,500 over the counter sinus medication $80 10 Zumba classes for $125 Carol is a U.S. citizen with a valid Social Security number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts