Question: please answer the questions Sud 25. What is the amount Cynthia can take as a student loan interest deduction on her Form 1040. Schedule 17

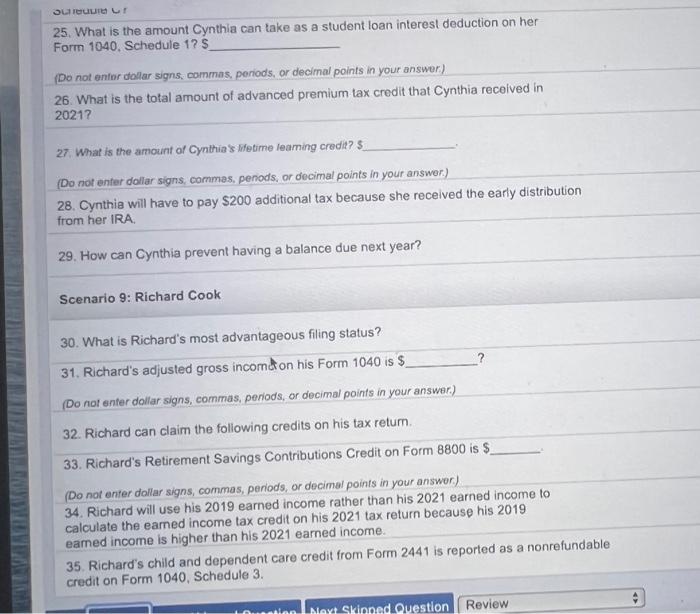

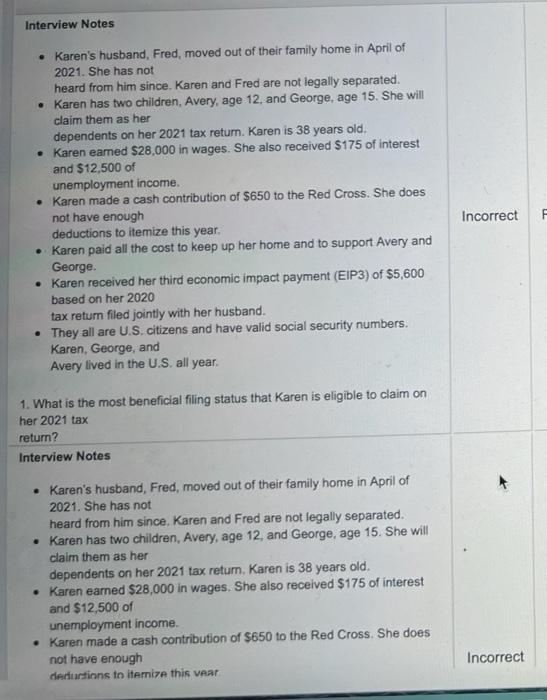

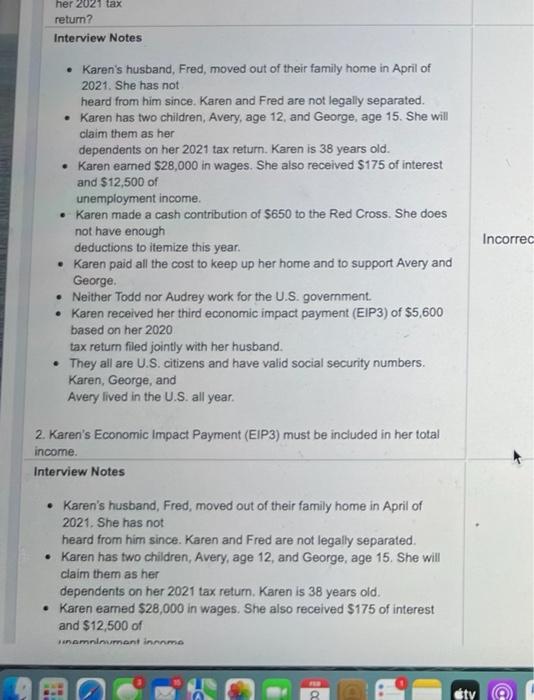

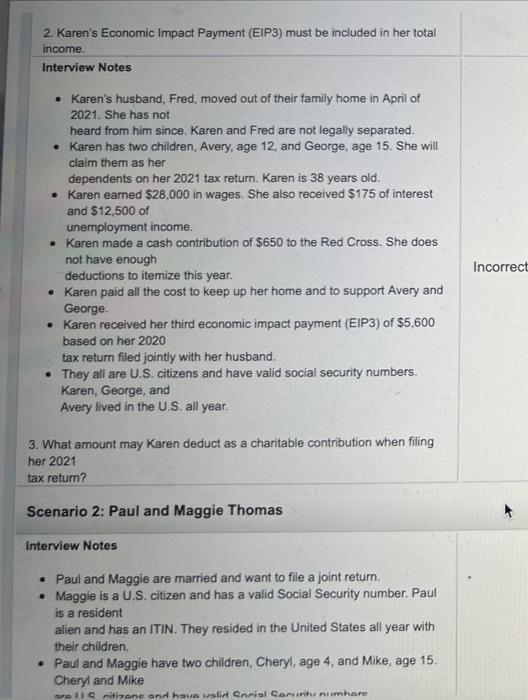

Sud 25. What is the amount Cynthia can take as a student loan interest deduction on her Form 1040. Schedule 17 (Do not enfor dollar signs, commes, periods, or decimal points in your answer) 26. What is the total amount of advanced premium tax credit that Cynthia received in 2021? 27. What is the amount of Cynthias hetime leaming credit? 5 (Do not enter dollar signs, commas, periods, or decimal points in your answer.) 28. Cynthia will have to pay $200 additional tax because she received the early distribution from her IRA 29. How can Cynthia prevent having a balance due next year? Scenario 9: Richard Cook 30. What is Richard's most advantageous filing status? 31. Richard's adjusted gross income on his Form 1040 is $ (Do not enter dollar signs, commas, periods, or decimal points in your answer.) 32. Richard can claim the following credits on his tax return 33. Richard's Retirement Savings Contributions Credit on Form 8800 is $ (Do not enter dollar signs, commas, periods, or decimal points in your answer) 34. Richard will use his 2019 earned income rather than his 2021 earned income to calculate the earned income tax credit on his 2021 tax return because his 2019 eamed income is higher than his 2021 earned income. 35. Richard's child and dependent care credit from Form 2441 is reported as a nonrefundable credit on Form 1040, Schedule 3. Next Skinned Question Review Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since, Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return. Karen is 38 years old. Karen eamed $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George. Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax return filed jointly with her husband. They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. Incorrect F 1. What is the most beneficial filing status that Karen is eligible to claim on her 2021 tax return? Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since. Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return, Karen is 38 years old. Karen earned $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this var Incorrect her 2021 tax return? Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since. Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return. Karen is 38 years old. Karen earned $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George Neither Todd nor Audrey work for the U.S. government Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax return filed jointly with her husband. They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. Incorrec 2. Karen's Economic Impact Payment (EIP3) must be included in her total income Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since. Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return, Karen is 38 years old. Karen eamed $28,000 in wages. She also received $175 of interest and $12,500 of inomninument inamo sty 0) 2. Karen's Economic Impact Payment (EIP3) must be included in her total income. Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return. Karen is 38 years old. Karen earned $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George. Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax return filed jointly with her husband. They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. Incorrect 3. What amount may Karen deduct as a charitable contribution when filing her 2021 tax return? Scenario 2: Paul and Maggie Thomas Interview Notes Paul and Maggie are married and want to file a joint retum. Maggie is a U.S. citizen and has a valid Social Security number. Paul is a resident allen and has an ITIN. They resided in the United States all year with their children Paul and Maggie have two children, Cheryl, age 4, and Mike, age 15. Cheryl and Mike sretinitiyane and have wolin Conial Corritunumhare Sud 25. What is the amount Cynthia can take as a student loan interest deduction on her Form 1040. Schedule 17 (Do not enfor dollar signs, commes, periods, or decimal points in your answer) 26. What is the total amount of advanced premium tax credit that Cynthia received in 2021? 27. What is the amount of Cynthias hetime leaming credit? 5 (Do not enter dollar signs, commas, periods, or decimal points in your answer.) 28. Cynthia will have to pay $200 additional tax because she received the early distribution from her IRA 29. How can Cynthia prevent having a balance due next year? Scenario 9: Richard Cook 30. What is Richard's most advantageous filing status? 31. Richard's adjusted gross income on his Form 1040 is $ (Do not enter dollar signs, commas, periods, or decimal points in your answer.) 32. Richard can claim the following credits on his tax return 33. Richard's Retirement Savings Contributions Credit on Form 8800 is $ (Do not enter dollar signs, commas, periods, or decimal points in your answer) 34. Richard will use his 2019 earned income rather than his 2021 earned income to calculate the earned income tax credit on his 2021 tax return because his 2019 eamed income is higher than his 2021 earned income. 35. Richard's child and dependent care credit from Form 2441 is reported as a nonrefundable credit on Form 1040, Schedule 3. Next Skinned Question Review Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since, Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return. Karen is 38 years old. Karen eamed $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George. Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax return filed jointly with her husband. They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. Incorrect F 1. What is the most beneficial filing status that Karen is eligible to claim on her 2021 tax return? Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since. Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return, Karen is 38 years old. Karen earned $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this var Incorrect her 2021 tax return? Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since. Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return. Karen is 38 years old. Karen earned $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George Neither Todd nor Audrey work for the U.S. government Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax return filed jointly with her husband. They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. Incorrec 2. Karen's Economic Impact Payment (EIP3) must be included in her total income Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since. Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return, Karen is 38 years old. Karen eamed $28,000 in wages. She also received $175 of interest and $12,500 of inomninument inamo sty 0) 2. Karen's Economic Impact Payment (EIP3) must be included in her total income. Interview Notes Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return. Karen is 38 years old. Karen earned $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George. Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax return filed jointly with her husband. They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. Incorrect 3. What amount may Karen deduct as a charitable contribution when filing her 2021 tax return? Scenario 2: Paul and Maggie Thomas Interview Notes Paul and Maggie are married and want to file a joint retum. Maggie is a U.S. citizen and has a valid Social Security number. Paul is a resident allen and has an ITIN. They resided in the United States all year with their children Paul and Maggie have two children, Cheryl, age 4, and Mike, age 15. Cheryl and Mike sretinitiyane and have wolin Conial Corritunumhare

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts