Question: please answer the questions The allowance method that assumes a given percent of a company's credit sales for the period is uncollectible is: Multiple Choice

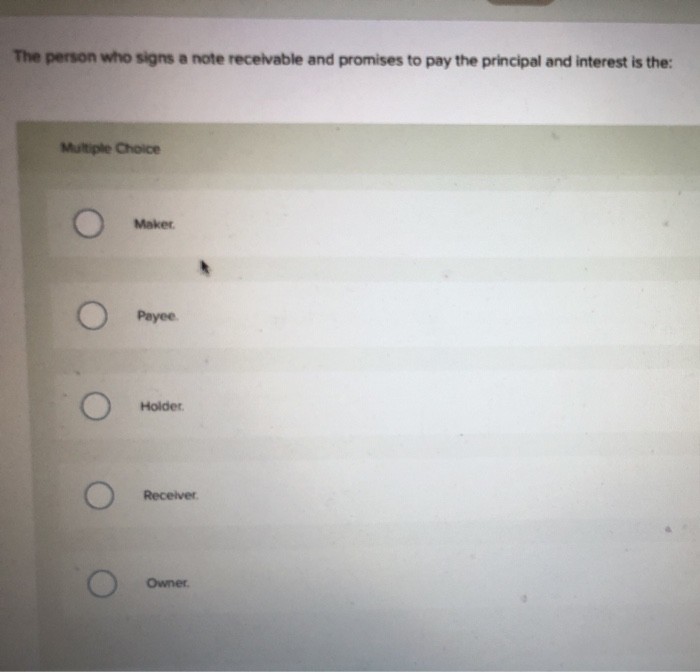

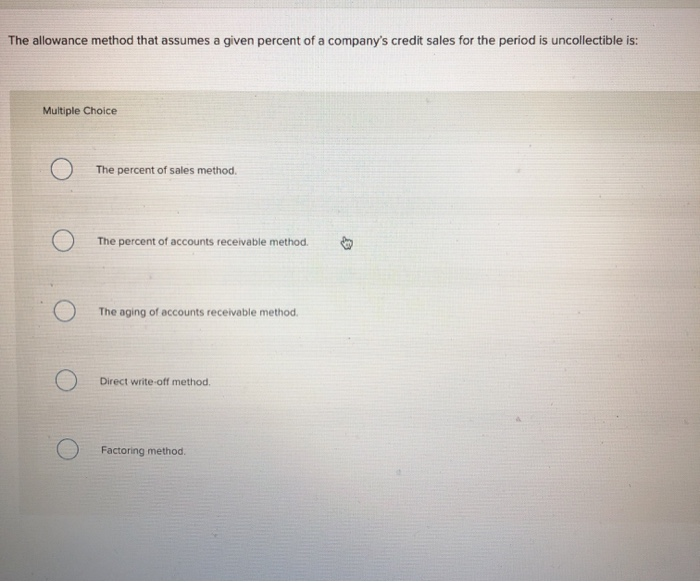

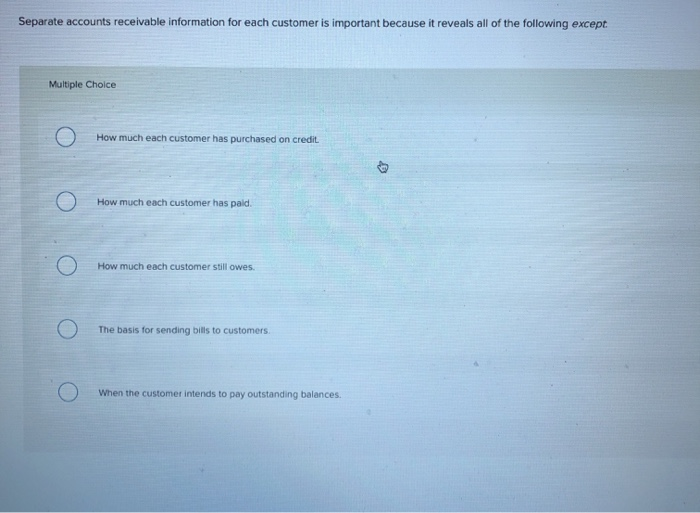

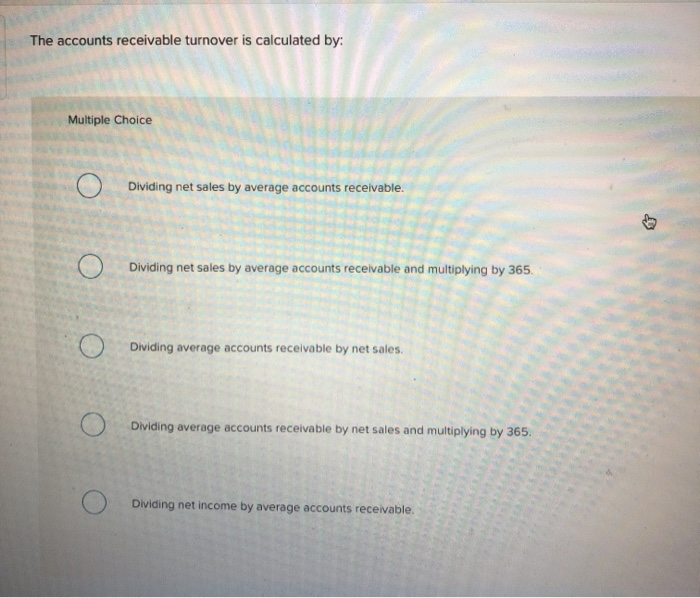

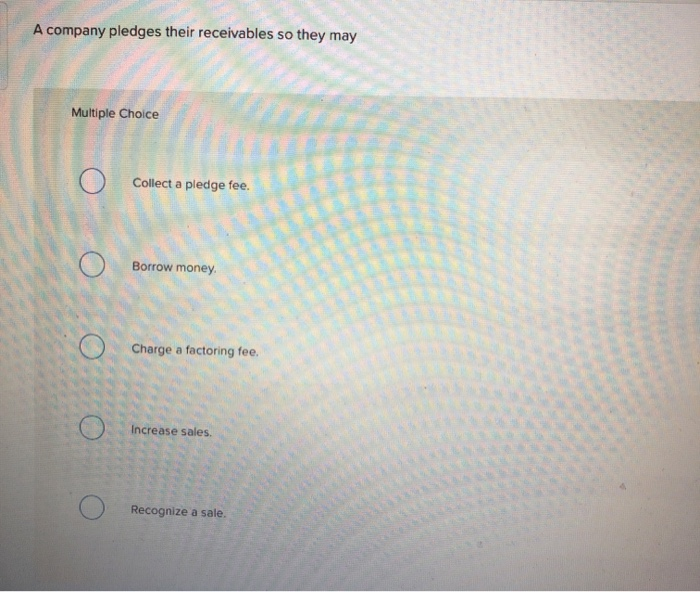

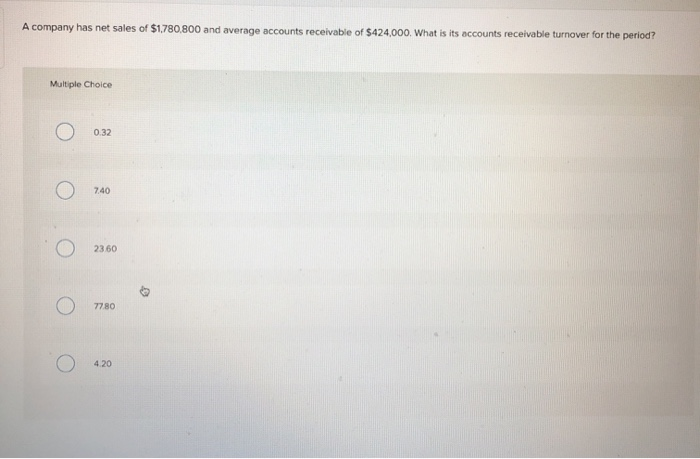

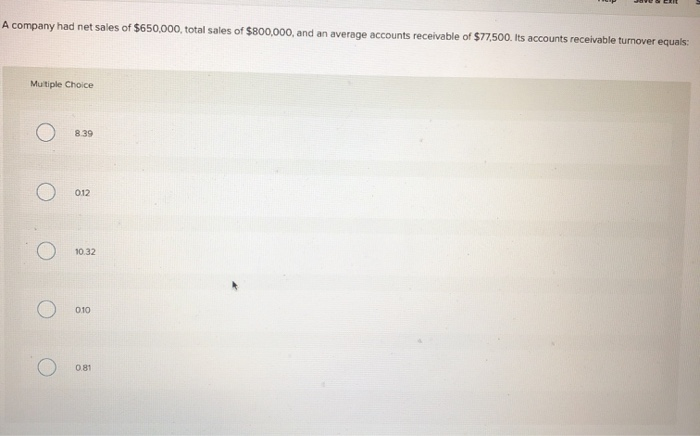

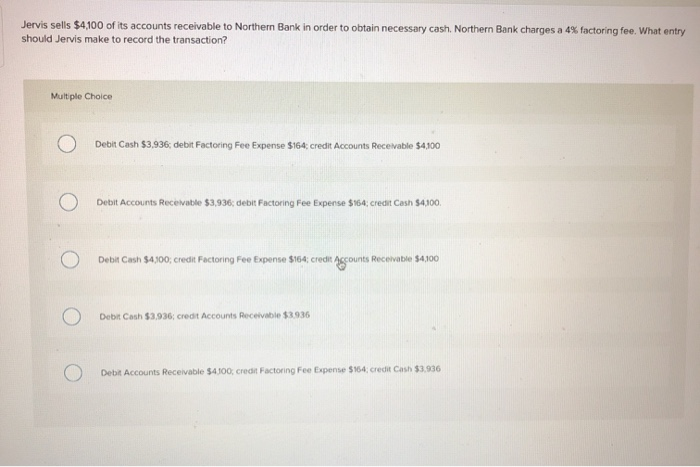

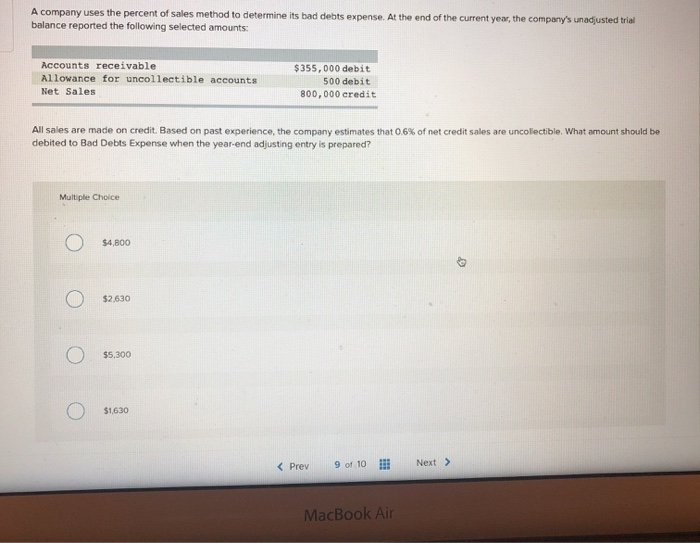

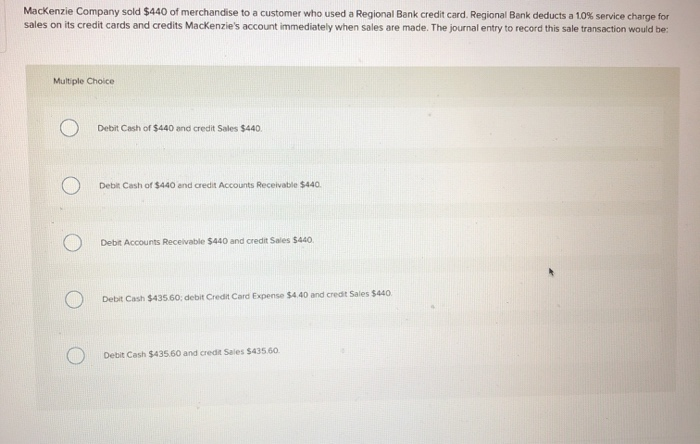

The allowance method that assumes a given percent of a company's credit sales for the period is uncollectible is: Multiple Choice The percent of sales method The percent of accounts receivable method. O The aging of accounts receivable method. Direct write-off method. O ) Factoring method. O Separate accounts receivable information for each customer is important because it reveals all of the following except. Multiple Choice 0 How much each customer has purchased on credit 0 C) How much each customer has paid. 0 O How much each customer still owes. 0 The basis for sending bills to customers. 0 When the customer intends to pay outstanding balances. The accounts receivable turnover is calculated by: 0 Dividing net sales by average accounts receivable. 0 Dividing net sales by average accounts receivable and multiplying by 365 0 O Dividing average accounts receivable by net sales. 0 O Dividing average accounts receivable by net sales and multiplying by 365. 0 Dividing net income by average accounts receivable. A company pledges their receivables so they may Multiple Choice Collect a pledge fee. Borrow money 0 Charge a factoring fee. 0 Increase sales Recognize a sale A company has net sales of $1,780,800 and average accounts receivable of $424,000. What is its accounts receivable turnover for the period? company had net sales of $650,000, total sales of $800,000, and an average accounts receivable of $77,500. Its accounts receivable turnover equals: Jervis sells $4,100 of its accounts receivable to Northern Bank in order to obtain necessary cash. Northern Bank charges a 4% factoring fee. What entry should Jervis make to record the transaction? Multiple Choice Debit Cash $3.936, debit Factoring Fee Expense $164. credit Accounts Receivable $4,100 O O O Debit Accounts Receivable $3.936, debit Factoring Fee Expense $164. Credit Cash 54100 O Debit Cash $4900, credit Factoring Fee Expense $164 credit Accounts Receivable $4100 O O Debit Cash $3,936: credit Accounts Receivable 3936 O O O Debit Accounts Receivable $4100 credit Factoring Fee Expense $154. Credit Cash 53.836 A company uses the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts: Accounts receivable Allowance for uncollectible accounts Net Sales $355,000 debit 500 debit 800,000 credit All sales are made on credit. Based on past experience, the company estimates that 0.6% of net credit sales are uncolectible. What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared? Multiple Choice O O 0 $4,800 O $2,630 O O $5,300 O $1,630 MacBook Air Mackenzie Company sold $440 of merchandise to a customer who used a Regional Bank credit card. Regional Bank deducts a 10% service charge for sales on its credit cards and credits Mackenzie's account immediately when sales are made. The journal entry to record this sale transaction would be: Multiple Choice O Debit Cash of $440 and credit Sales $440. O Debit Cash of $440 and credit Accounts Receivable $440 Debit Accounts Receivable $440 and credit Sales $440 Oo oo O Debit Cash $435 60; debit Credit Card Expense $4.40 and credit Sales $440. Debit Cash $43560 and credit Sales 543560

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts