Question: please answer the questions under task in excell, thank you! Preliminary Note: As you work on this part of the case, remember that many of

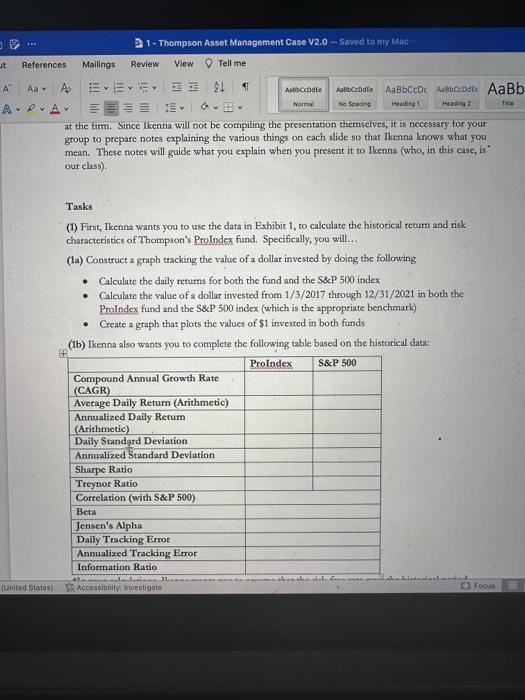

Preliminary Note: As you work on this part of the case, remember that many of the performance-evaluation calculations were covered in class. The instructor will place relevant links and info in the iCollege folder for the case as needed. Peter Landman is the investment officer for a local college, and has been tasked with deciding how best to invest a $20 million gift to the college. The gift will be incorporated into the university's already sizable portfolio of assets. Peter is considering hiring Thompson Asset Management to serve as an active portfolio manager for these new funds. In doing so, Peter is considering assigning the $20 million to one of two funds that Thompson offers: The Thompson Pro Index Fund and the Thompson Pro Value Fund. While a young firm, Thompson has had a solid record of both performance and growth. This would be Thompson's first institutional mandate though, and so Peter has some concems. To evaluate the two different choices (and 'Thompson as a whole), Peter sends an email to Ikenna Khakpoum who is a senior consultant at a Florida-based pension plan consulting firm. Ikenn''s firm provides a variety of services - such as manager search, asset allocation, actuarial analysis - to defined-benefit plun sponsors. Thus, Peter is retaining Ikenna's services in evaluating Thompson's performance. Peter has forwarded to Ikenna the performance data (see Exhibits 1 through 5 ) that he has received from Thompson, and he has asked Ikenna to evaluate Thompson as a potential asset manager for the college. Examining the exhibits, Ikenna notes that Thompson's Index fund consists of investments in either the S\&P 500 or a Money Market fund (which will eam the risk free rate of retum). Note that Exhibit 2 describes this fund's strategy. Meanwhile, the Value fund consists of investments in a number of different specific firms. The investments are static in terms of shates (Exhibit 3), but not in terms of weights as the market values for these firms fluctuates (Exhibit 4) based on chatiges in the market prices (Exhibit 5) of these stocks. Ulimatcly, Peter wants Ikenns to make a final recommendation on whether or not Thompson should be hired by the college, as well as which of the funds the college should consider putting money into (or what proportion of the moncy into cach, if both). He has asked Ikenna to conduct an analysis of the funds' performances and then prepare a PowerPoint-based presentation of the results. The 1The people who operate Excel at 50% magnification are either superhuman or monsters, and m sull noc sure which... at the tirm. Since Ikenna will not be compiling the presentation themselves, it is necessary for your group to prepare notes explaining the various things on each slide so that Ikenna knows what you mean. These notes will guide what you explain when you present it to Ikenna (who, in this casc, is our chass). Tasks (1) First, Ikenna wants you to use the data in Exhibit 1, to calculate the historical retum and risk characteristics of Thompson's Prolndex fund. Specifically, you will... (la) Construet a graph tracking the value of a dollar invested by doing the following - Calculate the daily retums for both the fund and the S\&P 500 index - Calculate the value of a dollar invested from 1/3/2017 through 12/31/2021 in both the ProIndex fund and the S\&P 500 index (which is the appropriate benchmark) - Create a graph that plots the values of $1 invested in both funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts