Question: Please answer the questions with the required steps. Use the spreadsheet template shown below to complete the answer. 2. Business partners Baliva, Masi, and Romalati

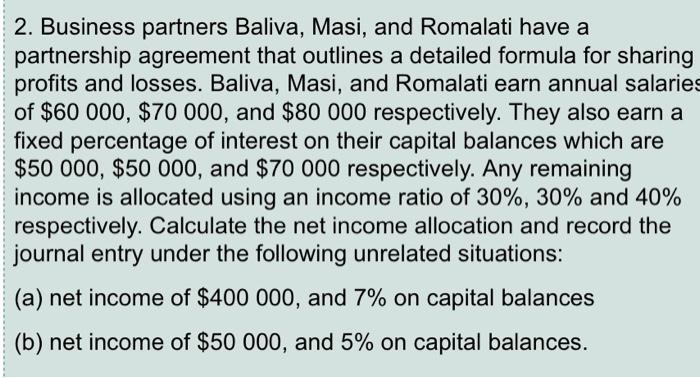

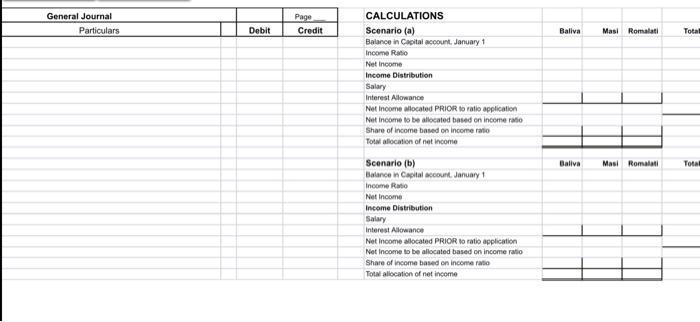

2. Business partners Baliva, Masi, and Romalati have a partnership agreement that outlines a detailed formula for sharing profits and losses. Baliva, Masi, and Romalati earn annual salaries of $60 000, $70 000, and $80 000 respectively. They also earn a fixed percentage of interest on their capital balances which are $50 000, $50 000, and $70 000 respectively. Any remaining income is allocated using an income ratio of 30%, 30% and 40% respectively. Calculate the net income allocation and record the journal entry under the following unrelated situations: (a) net income of $400 000, and 7% on capital balances (b) net income of $50 000, and 5% on capital balances.

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Answer I In the above case there are 3 partners namely Baliva Masi and Romalati who are entitled to ... View full answer

Get step-by-step solutions from verified subject matter experts