Question: Please answer the questions with your detailed explanations, it's much appreciated! 8.21 On 1 January 207 a building with a carrying amount of $700,000 was

Please answer the questions with your detailed explanations, it's much appreciated!

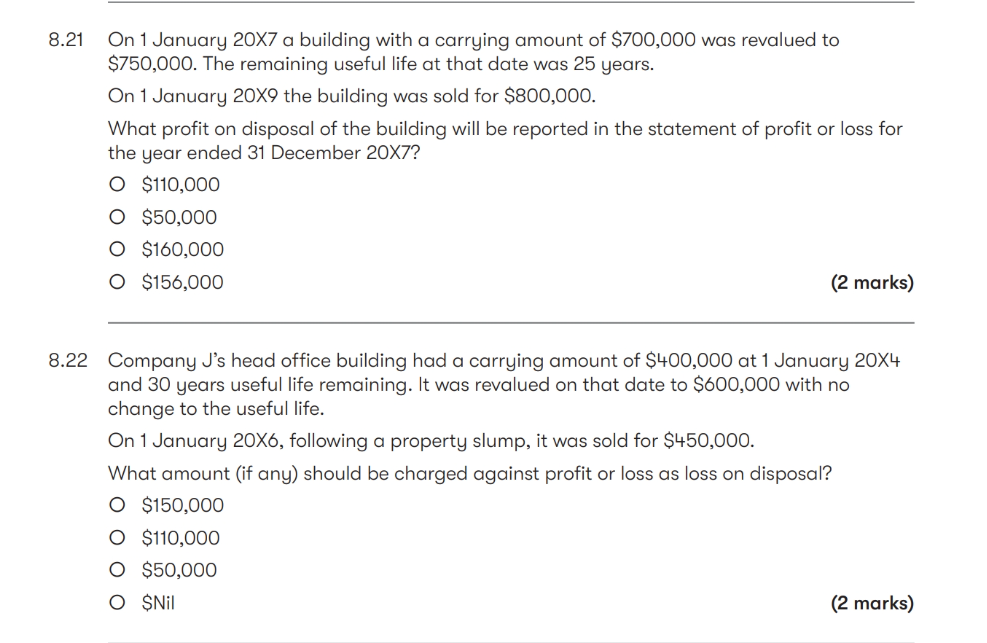

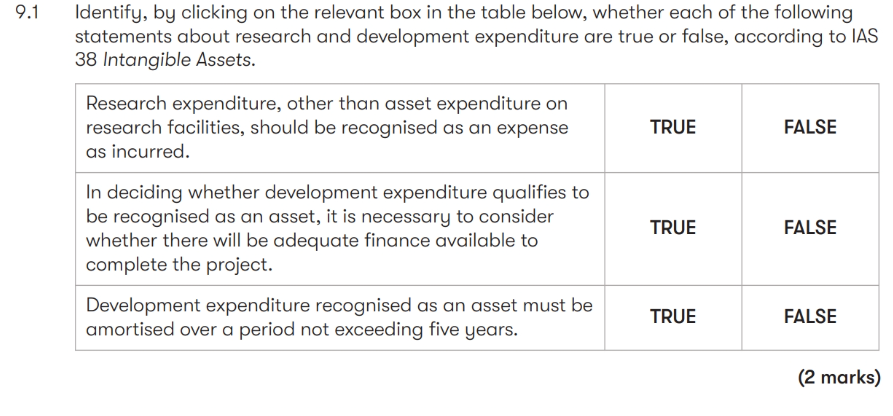

8.21 On 1 January 207 a building with a carrying amount of $700,000 was revalued to $750,000. The remaining useful life at that date was 25 years. On 1 January 20X9 the building was sold for $800,000. What profit on disposal of the building will be reported in the statement of profit or loss for the year ended 31 December 20X7? $110,000$50,000$160,000$156,000 (2 marks) 8.22 Company J's head office building had a carrying amount of $400,000 at 1 January 204 and 30 years useful life remaining. It was revalued on that date to $600,000 with no change to the useful life. On 1 January 20X6, following a property slump, it was sold for $450,000. What amount (if any) should be charged against profit or loss as loss on disposal? $150,000$110,000$50,000$Nil (2 marks) Identify, by clicking on the relevant box in the table below, whether each of the following statements about research and development expenditure are true or false, according to IAS 38 Intannihle scots (2 marks) 8.21 On 1 January 207 a building with a carrying amount of $700,000 was revalued to $750,000. The remaining useful life at that date was 25 years. On 1 January 20X9 the building was sold for $800,000. What profit on disposal of the building will be reported in the statement of profit or loss for the year ended 31 December 20X7? $110,000$50,000$160,000$156,000 (2 marks) 8.22 Company J's head office building had a carrying amount of $400,000 at 1 January 204 and 30 years useful life remaining. It was revalued on that date to $600,000 with no change to the useful life. On 1 January 20X6, following a property slump, it was sold for $450,000. What amount (if any) should be charged against profit or loss as loss on disposal? $150,000$110,000$50,000$Nil (2 marks) Identify, by clicking on the relevant box in the table below, whether each of the following statements about research and development expenditure are true or false, according to IAS 38 Intannihle scots (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts