Question: please answer the required (a,b,c and d) ASAP 20.00 5.75 vouchers EXERCISE 4.1 4.1 The following are the transactions of B. Tremaine, general dealer, for

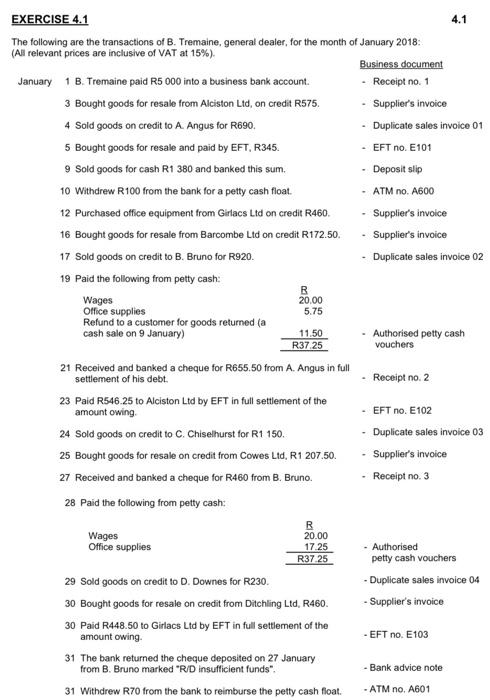

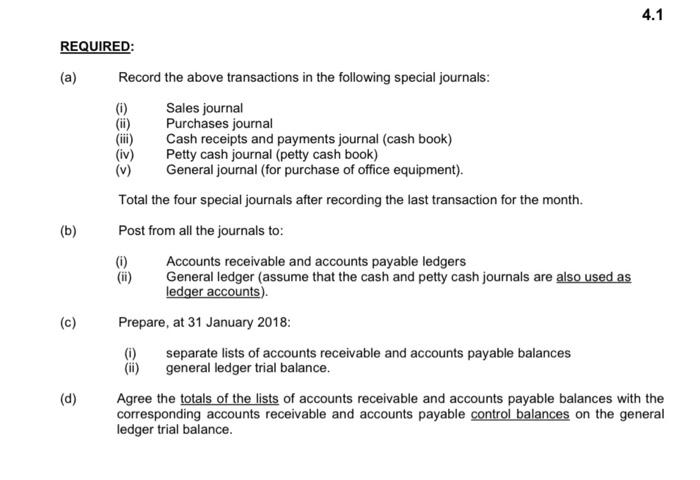

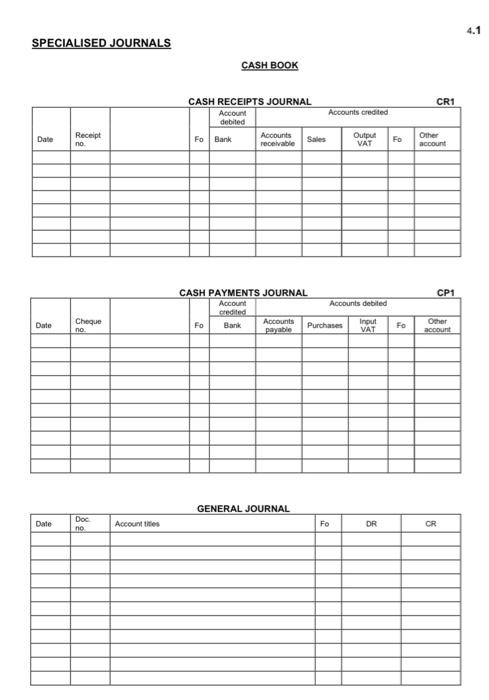

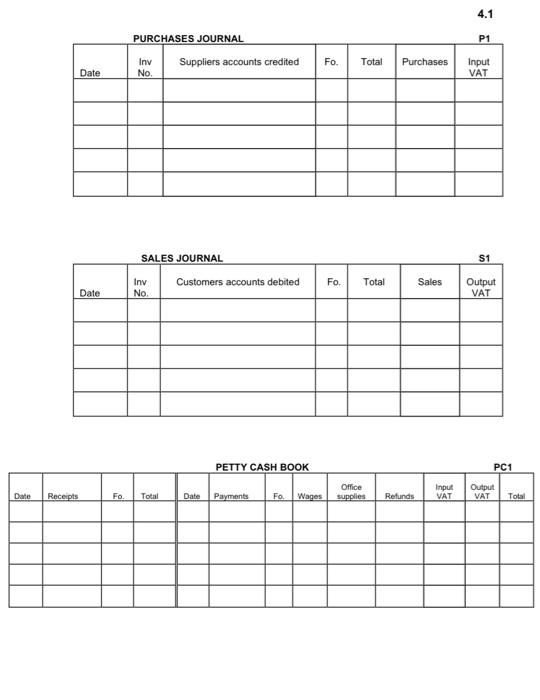

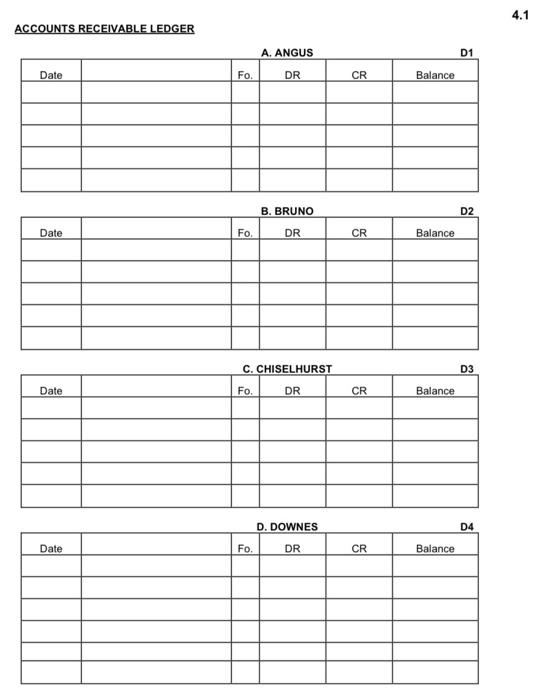

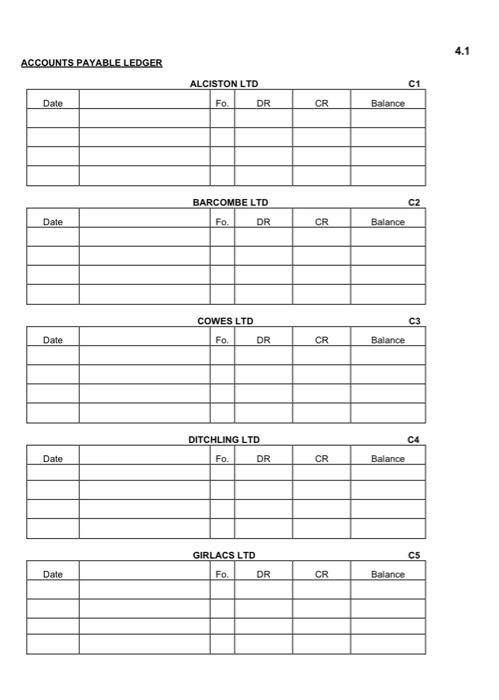

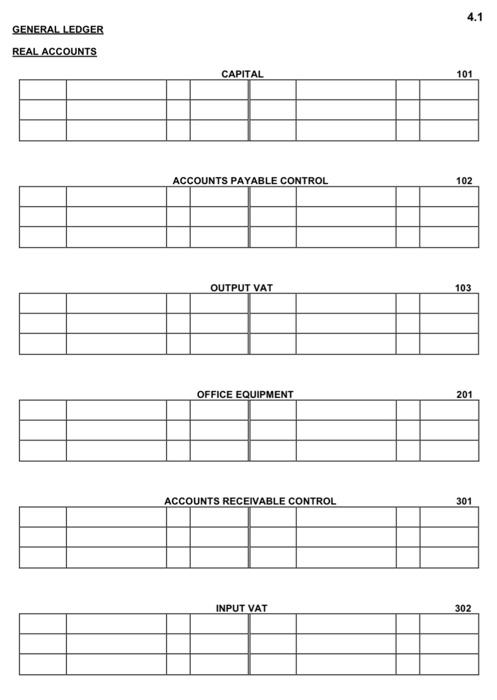

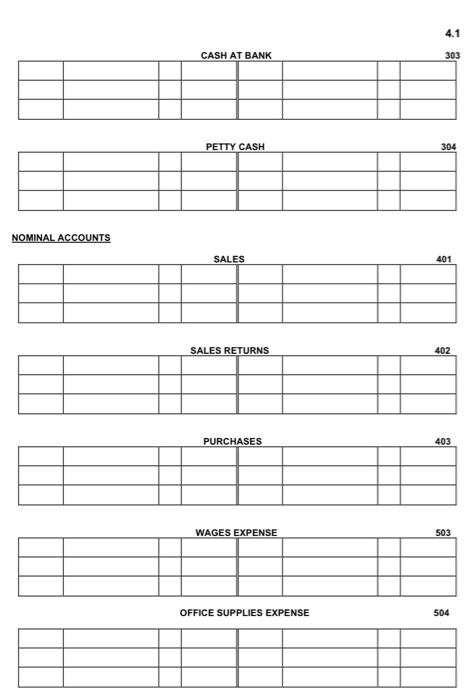

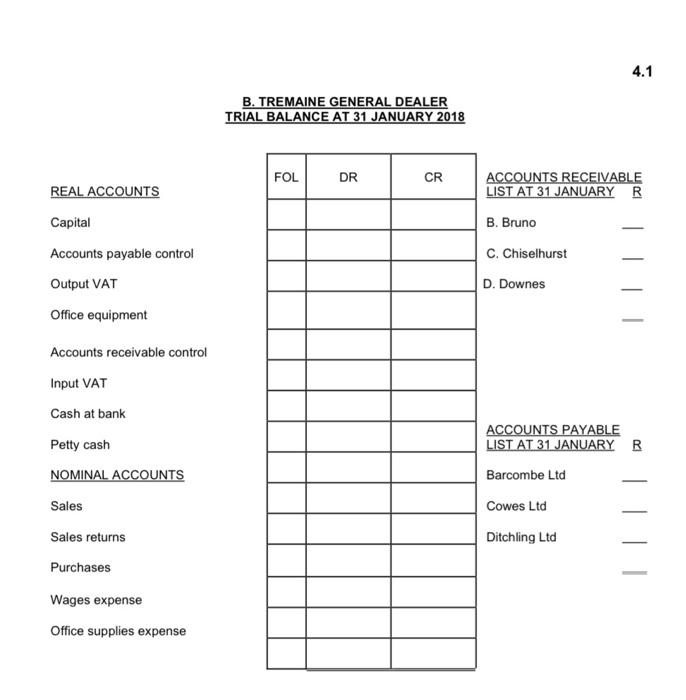

20.00 5.75 vouchers EXERCISE 4.1 4.1 The following are the transactions of B. Tremaine, general dealer, for the month of January 2018: (Al relevant prices are inclusive of VAT at 15%). Business document January 1 B. Tremaine paid R5 000 into a business bank account. Receipt no. 1 3 Bought goods for resale from Alciston Ltd, on credit R575. Supplier's invoice 4 Sold goods on credit to A. Angus for R690. Duplicate sales involce 01 5 Bought goods for resale and paid by EFT, R345. - EFT no. E101 9 Sold goods for cash R1 380 and banked this sum. Deposit slip 10 Withdrew R100 from the bank for a petty cash float. - ATM no A600 12 Purchased office equipment from Girlacs Ltd on credit R460 Supplier's invoice 16 Bought goods for resale from Barcombe Ltd on credit R172.50 Supplier's invoice 17 Sold goods on credit to B. Bruno for R920. Duplicate sales invoice 02 19 Paid the following from petty cash: Wages Office supplies Refund to a customer for goods returned (a cash sale on 9 January) 11.50 - Authorised petty cash R37.25 21 Received and banked a cheque for R655.50 from A. Angus in full settlement of his debt. Receipt no 2 23 Paid R546.25 to Alciston Ltd by EFT in full settlement of the amount owing EFT no. E102 24 Sold goods on credit to C. Chiselhurst for R1 150. Duplicate sales invoice 03 25 Bought goods for resale on credit from Cowes Ltd. R1 207.50. Supplier's invoice 27 Received and banked a cheque for R460 from B. Bruno. Receipt no. 3 28 Paid the following from petty cash: R Wages 20.00 Office supplies 17 25 Authorised R3725 petty cash vouchers 29 Sold goods on credit to D. Downes for R230. - Duplicate sales invoice 04 30 Bought goods for resale on credit from Ditchling Ltd, R450. - Supplier's invoice 30 Paid R448.50 to Girlacs Ltd by EFT in full settlement of the amount owing - EFT no. E103 31 The bank returned the cheque deposited on 27 January from B. Bruno marked "R/D insufficient funds" - Bank advice note 31 Withdrew R70 from the bank to reimburse the petty cash float. - ATM no. A601 4.1 es REQUIRED: (a) Record the above transactions in the following special journals: Sales journal Purchases journal Cash receipts and payments journal (cash book) Petty cash journal (petty cash book) (v) General journal (for purchase of office equipment). Total the four special journals after recording the last transaction for the month. (b) Post from all the journals to: (0) Accounts receivable and accounts payable ledgers General ledger (assume that the cash and petty cash journals are also used as ledger accounts). (c) Prepare, at 31 January 2018: (0) separate lists of accounts receivable and accounts payable balances general ledger trial balance. (d) Agree the totals of the lists of accounts receivable and accounts payable balances with the corresponding accounts receivable and accounts payable control balances on the general ledger trial balance. 4.1 SPECIALISED JOURNALS CASH BOOK CR1 Accounts credited CASH RECEIPTS JOURNAL Account debited Fo Bank Accounts Sales receivable Date Receipt no Output VAT Fo Other account CP1 CASH PAYMENTS JOURNAL Account Accounts debited credited Fo Bank Accounts Purchases Input payable VAT Date Cheque no FO Other account GENERAL JOURNAL Date Doc no Accounties Fo DR CR Date Receipts Date Date PURCHASES JOURNAL Inv No. SALES JOURNAL Inv No. Fo. Total Suppliers accounts credited Customers accounts debited PETTY CASH BOOK Date Payments Fo. Wages Fo. Total Fo. Total Office supplies Purchases Refunds Sales 4.1 P1 Input VAT S1 Output VAT PC1 Input Output VAT VAT Total 4.1 ACCOUNTS RECEIVABLE LEDGER A. ANGUS D1 Date Fo. DR CR Balance B. BRUNO D2 Date Fo. DR CR Balance C. CHISELHURST D3 Date Fo. DR CR Balance D. DOWNES D4 Date Fo. DR CR Balance 4.1 ACCOUNTS PAYABLE LEDGER C1 AL CISTON LTD Fo DR Date CR Balance BARCOMBE LTD C2 Date Fo. DR CR Balance COWES LTD C3 Date Fo DR CR Balance DITCHLING LTD C4 Date Fo. DR CR Balance C5 GIRLACS LTD Fo. DR Date CR Balance 4.1 GENERAL LEDGER REAL ACCOUNTS CAPITAL 101 ACCOUNTS PAYABLE CONTROL 102 OUTPUT VAT 103 OFFICE EQUIPMENT 201 A ACCOUNTS RECEIVABLE CONTROL 301 INPUT VAT 302 4.1 CASH AT BANK 303 PETTY CASH 304 NOMINAL ACCOUNTS SALES 401 SALES RETURNS 402 PURCHASES 403 WAGES EXPENSE 503 OFFICE SUPPLIES EXPENSE 504 4.1 B. TREMAINE GENERAL DEALER TRIAL BALANCE AT 31 JANUARY 2018 FOL DR CR REAL ACCOUNTS Capital ACCOUNTS RECEIVABLE LIST AT 31 JANUARY R B. Bruno C. Chiselhurst D. Downes Accounts payable control Output VAT Office equipment Accounts receivable control Input VAT Cash at bank Petty cash NOMINAL ACCOUNTS ACCOUNTS PAYABLE LIST AT 31 JANUARY R Barcombe Ltd Cowes Ltd Ditchling Ltd Sales Sales returns Purchases Wages expense Office supplies expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts