Question: Please answer the second image down, and use the answered one as reference: Question 7 A 7% semiannual coupon bond matures in 4 years. The

Please answer the second image down, and use the answered one as reference:

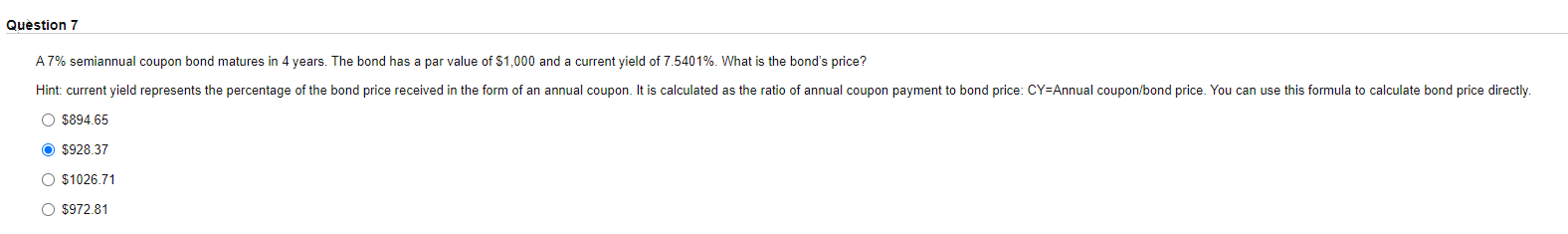

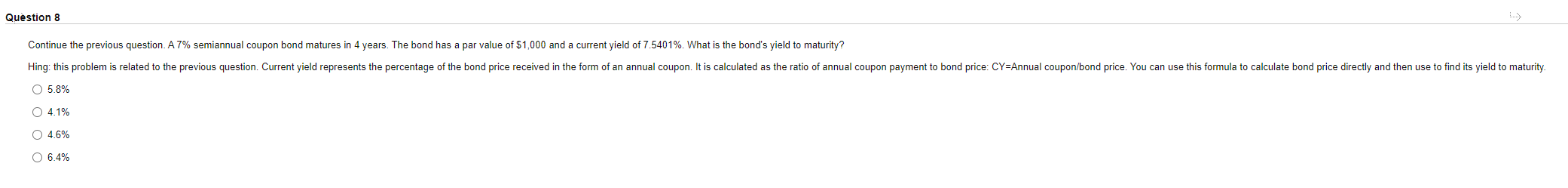

Question 7 A 7% semiannual coupon bond matures in 4 years. The bond has a par value of $1,000 and a current yield of 7.5401%. What is the bond's price? Hint: current yield represents the percentage of the bond price received in the form of an annual coupon. It is calculated as the ratio of annual coupon payment to bond price: CY=Annual coupon/bond price. You can use this formula to calculate bond price directly. $894.65 O $928.37 O $1026.71 O $972.81Question 8 Continue the previous question. A 7% semiannual coupon bond matures in 4 years. The bond has a par value of $1,000 and a current yield of 7.5401%. What is the bond's yield to maturity? Hing: this problem is related to the previous question. Current yield represents the percentage of the bond price received in the form of an annual coupon. It is calculated as the ratio of annual coupon payment to bond price: CY=Annual coupon/bond price. You can use this formula to calculate bond price directly and then use to find its yield to maturity. O 5.8% O 4.1% O 4.6% O 6.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts