Question: Please answer the second questions 1. A financial institution has the following portfolio of over-thecounter options on sterling: A traded option is a wailable with

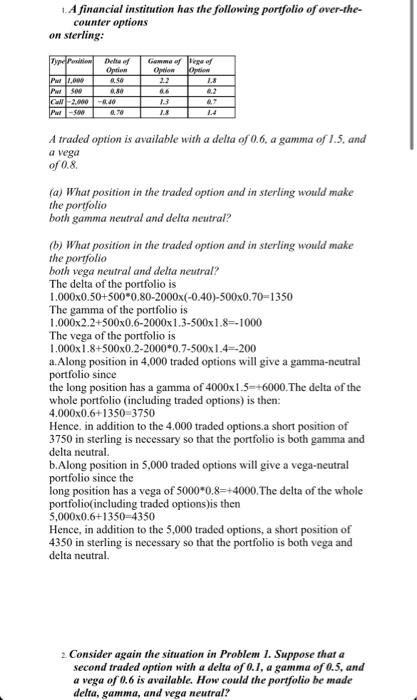

1. A financial institution has the following portfolio of over-thecounter options on sterling: A traded option is a wailable with a deffa of 0.6, a gamma of I.5. and a vega of 0.8. (a) What position in the traded option and in sterfing would make the portfolio both gamma neutral and delta newtral? (b) What position in the traded option and in sferling would make the porffolio both vega neutral and delta neutral? The delta of the portfolio is 1.0000.50+5000.802000(0.40)5000.70=1350 The gamma of the portfolio is 1.0002.2+5000.620001.35001.8=1000 The vega of the portfolio is 1.0001.8+5000.220000.75001.4=200 a.Along position in 4,000 traded options will give a gamma-neutral portfolio since the long position has a gamma of 40001.5=+6000. The delta of the whole portfolio (including traded options) is then: 4.0000.6+1350=3750 Hence. in addition to the 4.000 traded options.a short position of 3750 in sterling is necessary so that the portfolio is both gamma and delta neutral. b. Along position in 5.000 traded options will give a vega-neutral portfolio since the long position has a vega of 50000.8=+4000. The delta of the whole portfolio(including traded options)is then 5,0000.6+1350=4350 Hence, in addition to the 5,000 traded options, a short position of 4350 in sterling is necessary so that the portfolio is both vega and delta neutral. 2 Consider again the sifuation in Problem 1. Suppose that a second traded oprion with a delta of 0.1, a gamma of 0.5, and a vega of 0.6 is available. How could the portfolio be made delta, gamma, and vega neutral? 1. A financial institution has the following portfolio of over-thecounter options on sterling: A traded option is a wailable with a deffa of 0.6, a gamma of I.5. and a vega of 0.8. (a) What position in the traded option and in sterfing would make the portfolio both gamma neutral and delta newtral? (b) What position in the traded option and in sferling would make the porffolio both vega neutral and delta neutral? The delta of the portfolio is 1.0000.50+5000.802000(0.40)5000.70=1350 The gamma of the portfolio is 1.0002.2+5000.620001.35001.8=1000 The vega of the portfolio is 1.0001.8+5000.220000.75001.4=200 a.Along position in 4,000 traded options will give a gamma-neutral portfolio since the long position has a gamma of 40001.5=+6000. The delta of the whole portfolio (including traded options) is then: 4.0000.6+1350=3750 Hence. in addition to the 4.000 traded options.a short position of 3750 in sterling is necessary so that the portfolio is both gamma and delta neutral. b. Along position in 5.000 traded options will give a vega-neutral portfolio since the long position has a vega of 50000.8=+4000. The delta of the whole portfolio(including traded options)is then 5,0000.6+1350=4350 Hence, in addition to the 5,000 traded options, a short position of 4350 in sterling is necessary so that the portfolio is both vega and delta neutral. 2 Consider again the sifuation in Problem 1. Suppose that a second traded oprion with a delta of 0.1, a gamma of 0.5, and a vega of 0.6 is available. How could the portfolio be made delta, gamma, and vega neutral

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts