Question: please answer the spencer co question ! the other one is there by accident On January 1, 2019 ABC Co. purchases a new machine that

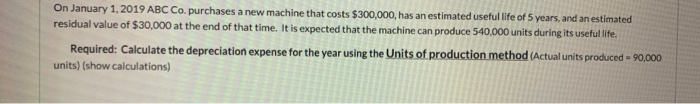

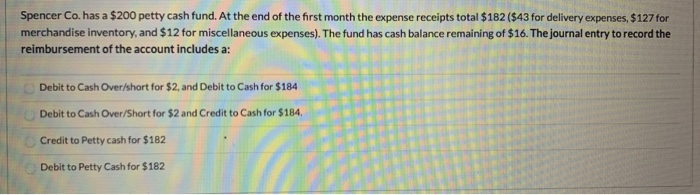

On January 1, 2019 ABC Co. purchases a new machine that costs $300,000, has an estimated useful life of 5 years, and an estimated residual value of $30.000 at the end of that time. It is expected that the machine can produce 540,000 units during its useful life. Required: Calculate the depreciation expense for the year using the Units of production method (Actual units produced 90,000 units) (show calculations) Spencer Co. has a $200 petty cash fund. At the end of the first month the expense receipts total $182 ($43 for delivery expenses, $127 for merchandise inventory, and $12 for miscellaneous expenses). The fund has cash balance remaining of $16. The journal entry to record the reimbursement of the account includes a: Debit to Cash Over/short for $2, and Debit to Cash for $184 Debit to Cash Over/Short for $2 and Credit to Cash for $184. Credit to Petty cash for $182 Debit to Petty Cash for $182

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts