Question: please answer the third question As shown in table 1 the company raised $100mn through a 30 year bond (F.V.=$100) with a coupon of 10%.

please answer the third question

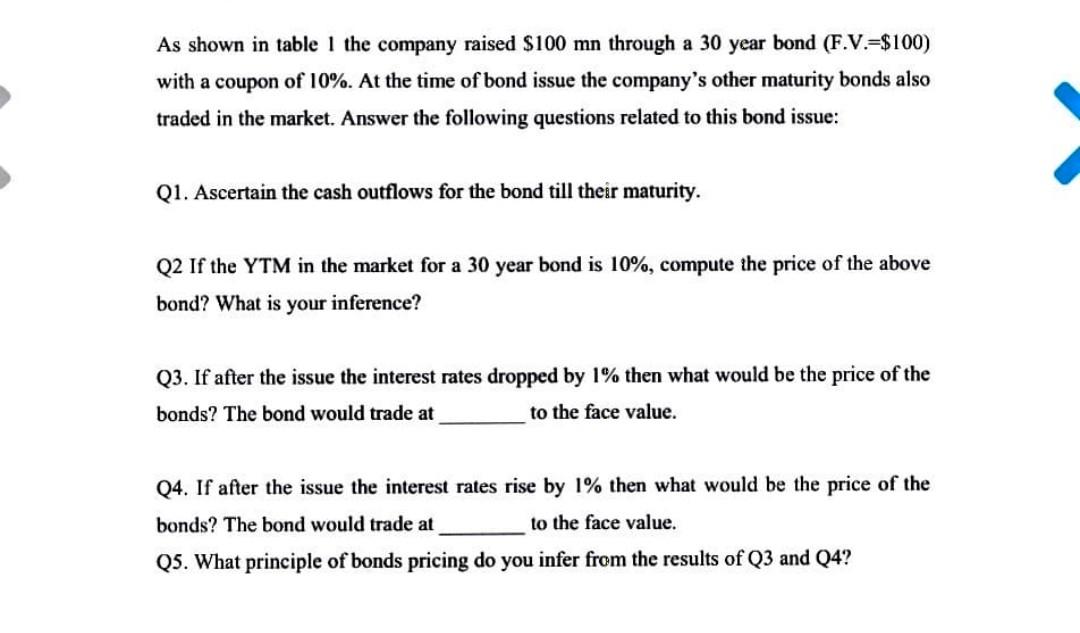

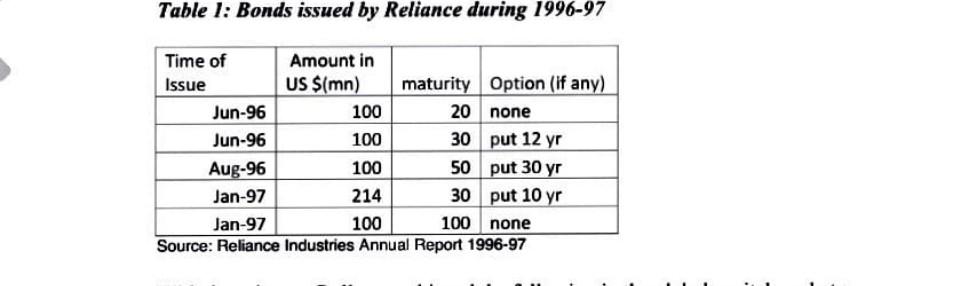

As shown in table 1 the company raised $100mn through a 30 year bond (F.V.=$100) with a coupon of 10%. At the time of bond issue the company's other maturity bonds also traded in the market. Answer the following questions related to this bond issue: Q1. Ascertain the cash outflows for the bond till their maturity. Q2 If the YTM in the market for a 30 year bond is 10%, compute the price of the above bond? What is your inference? Q3. If after the issue the interest rates dropped by 1% then what would be the price of the bonds? The bond would trade at to the face value. Q4. If after the issue the interest rates rise by 1% then what would be the price of the bonds? The bond would trade at to the face value. Q5. What principle of bonds pricing do you infer from the results of Q3 and Q4? Table 1: Bonds issued by Reliance during 1996-97 Source: Reliance Industries Annual Report 1996-97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts