Question: please answer the three questions MY NOTES ASK YOUR TEACHER PRACTICE ANOTHE [-/1 Points) DETAILS WANEFMAC73.3.047 The following table shows the average returns for some

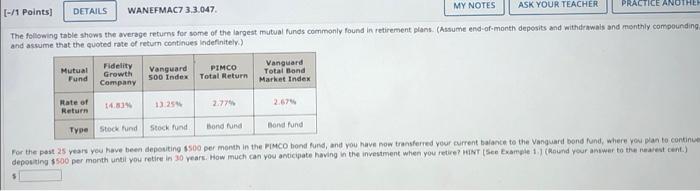

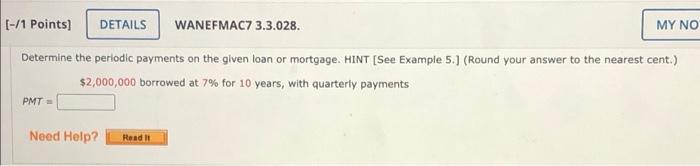

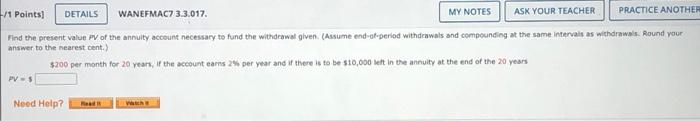

MY NOTES ASK YOUR TEACHER PRACTICE ANOTHE [-/1 Points) DETAILS WANEFMAC73.3.047 The following table shows the average returns for some of the largest mutual funds commonly found in retirement plans. (Asume end of month deposits and withdrawals and monthly compounding and assume that the quoted rate of return continues indefinitely.) Mutual Fund Fidelity Growth Company Vanguard Vanguard PIMCO Total Bond 500 index Total Return Market Index Rate of Return 143 13254 2.775 2.67% Stock fund Type Stock und Bond und Bond fund For the past 25 years you have been depositing 6500 per month in the PIMCO hond fund, and you have now transferred your current balance to the Vanguard bond lund, where you plan to continue depositing $500 per month until you retire in 30 years. How much can you anticipate having in the investment when you retire? HINTS Example 11 (Mound your answer to the nearest cant) (-/1 Points) DETAILS WANEFMAC7 3.3.028. MY NO Determine the periodic payments on the given loan or mortgage. HINT (See Example 5.) (Round your answer to the nearest cent.) $2,000,000 borrowed at 7% for 10 years, with quarterly payments PMT Need Help? Read DETAILS 11 Points) WANEFMAC73.3.017. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Find the present value of the annuity account necessary to fund the withdrawal given. (Assume end of period withdrawals and compounding at the same intervals as withdrawal. Round your answer to the nearest cent.) $200 per month for 20 years, if the account earns 24 per year and if there is to be $10,000 eft in the annuity at the end of the 20 years PV-5 Need Help

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts