Question: Please answer the two (2) questions utilizing your textbook, all other course materials provided, lectures and independent research if necessary.Provide answers' to the questions -

Please answer the two (2) questions utilizing your textbook, all other course materials provided, lectures and independent research if necessary.Provide answers' to the questions - indicating your knowledge of the subject matter supported by specific cases, examples and similar.All sources MUST be cited.

Question 1

European Union - explain the purpose and goals of Article 101 of the TFEU (Treaty on the Functioning of the European Union)? What are some exemptions from Article 101? Provide a detailed explanation and cases or examples to support your answer.

Question 2

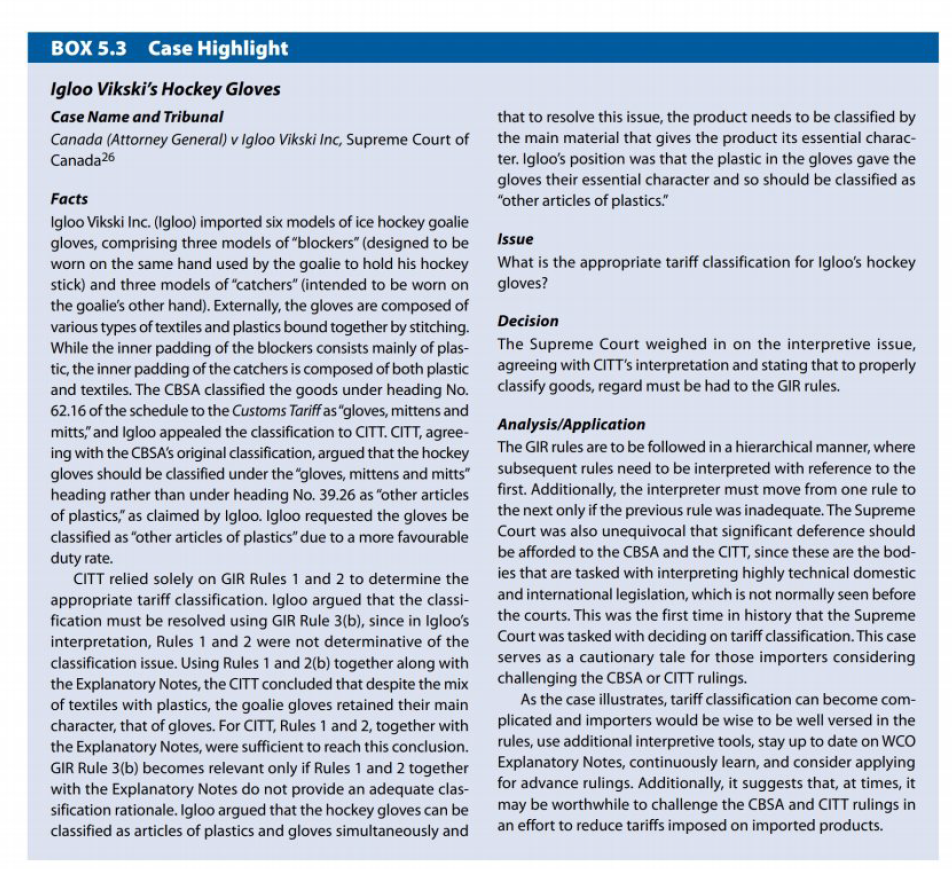

Provide a detailed explanation and note the significance of Igloo Vikski's Hockey Gloves - Canada (Attorney General) v. Igloo Vikski Inc., Supreme Court of Canada. Textbook Box 5.3, page 147.

BOX 5.3 Case Highlight Igloo Vikski's Hockey Gloves Case Name and Tribunal Canada (Attorney General) v Igloo Vikski Inc, Supreme Court of Canada? Facts Igloo Vikski Inc. (Igloo) imported six models of ice hockey goalie gloves, comprising three models of \"blockers\" (designed to be worn on the same hand used by the goalie to hold his hockey stick) and three models of \"catchers\" (intended to be worn on the goalie's other hand). Externally, the gloves are composed of various types of textiles and plastics bound together by stitching. While the inner padding of the blockers consists mainly of plas- tic, the inner padding of the catchers is composed of both plastic and textiles. The CBSA classified the goods under heading No. 62.16 of the schedule to the Customs Tariff as "gloves, mittens and mitts;\" and Igloo appealed the classification to CITT. CITT, agree- ing with the CBSA's original classification, argued that the hockey gloves should be classified under the \"gloves, mittens and mitts\" heading rather than under heading No. 39.26 as "other articles of plastics,\" as claimed by Igloo. Igloo requested the gloves be classified as "other articles of plastics\" due to a more favourable duty rate. CITT relied solely on GIR Rules 1 and 2 to determine the appropriate tariff classification. Igloo argued that the classi- fication must be resolved using GIR Rule 3(b), since in Igloo's interpretation, Rules 1 and 2 were not determinative of the classification issue. Using Rules 1 and 2(b) together along with the Explanatory Notes, the CITT concluded that despite the mix of textiles with plastics, the goalie gloves retained their main character, that of gloves. For CITT, Rules 1 and 2, together with the Explanatory Notes, were sufficient to reach this conclusion. GIR Rule 3(b) becomes relevant only if Rules 1 and 2 together with the Explanatory Notes do not provide an adequate clas- sification rationale. Igloo argued that the hockey gloves can be classified as articles of plastics and gloves simultaneously and that to resolve this issue, the product needs to be classified by the main material that gives the product its essential charac- ter. Igloo's position was that the plastic in the gloves gave the gloves their essential character and so should be classified as \"other articles of plastics.\" Issue What is the appropriate tariff classification for Igloo's hockey gloves? Decision The Supreme Court weighed in on the interpretive issue, agreeing with CITT's interpretation and stating that to properly classify goods, regard must be had to the GIR rules. Analysis/Application The GIR rules are to be followed in a hierarchical manner, where subsequent rules need to be interpreted with reference to the first. Additionally, the interpreter must move from one rule to the next only if the previous rule was inadequate. The Supreme Court was also unequivocal that significant deference should be afforded to the CBSA and the CITT, since these are the bod- ies that are tasked with interpreting highly technical domestic and international legislation, which is not normally seen before the courts. This was the first time in history that the Supreme Court was tasked with deciding on tariff classification. This case serves as a cautionary tale for those importers considering challenging the CBSA or CITT rulings. As the case illustrates, tariff classification can become com- plicated and importers would be wise to be well versed in the rules, use additional interpretive tools, stay up to date on WCO Explanatory Notes, continuously learn, and consider applying for advance rulings. Additionally, it suggests that, at times, it may be worthwhile to challenge the CBSA and CITT rulings in an effort to reduce tariffs imposed on imported products

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts