Question: please answer the two questions step by step p6-10 Bond interest payments before and after taxes Charter Corp. has issued 2,500 rate of 7%. debentures

please answer the two questions step by step

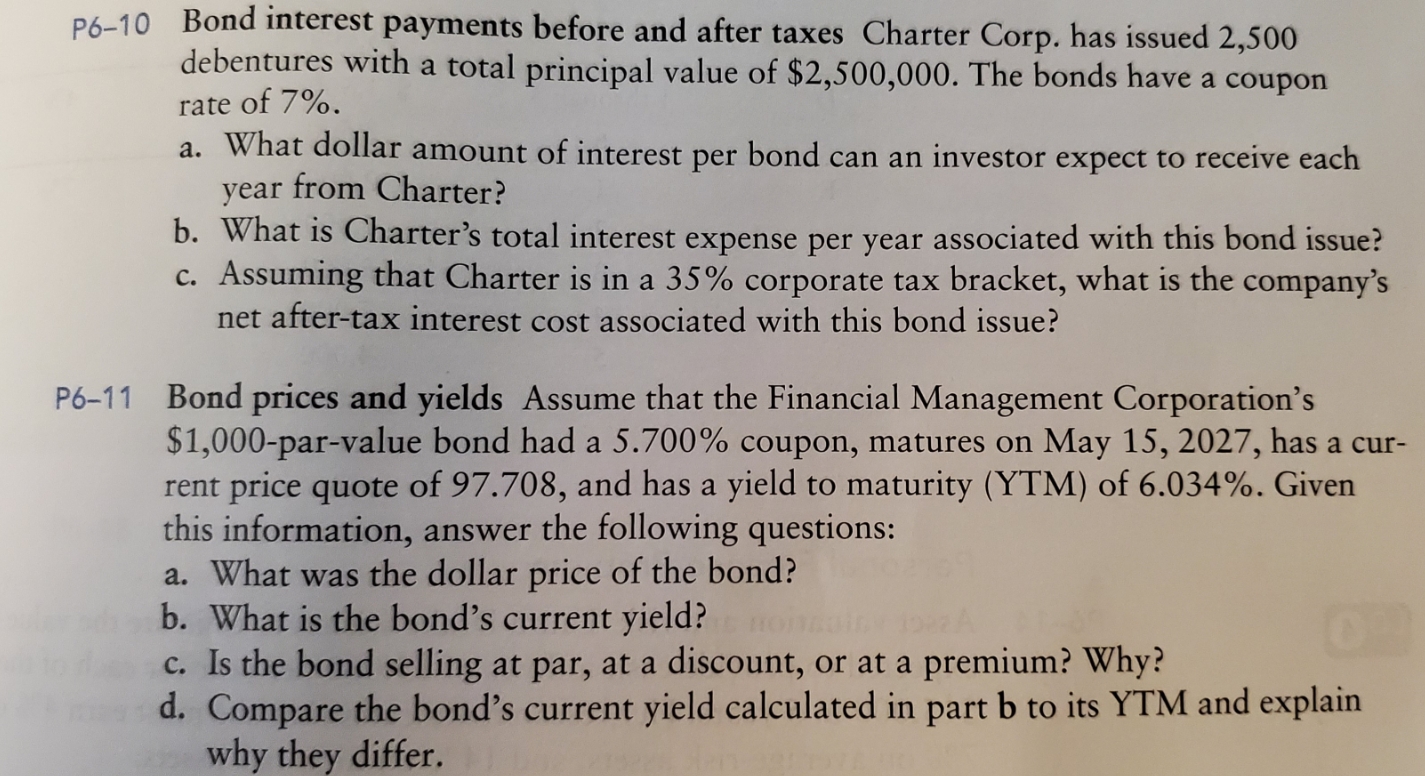

p6-10 Bond interest payments before and after taxes Charter Corp. has issued 2,500 rate of 7%. debentures with a total principal value of $2,500,000. The bonds have a coupon a. What dollar amount of interest per bond can an investor expect to receive each year from Charter? b. What is Charter's total interest expense per year associated with this bond issue? c. Assuming that Charter is in a 35% corporate tax bracket, what is the company's net after-tax interest cost associated with this bond issue? P6-11 Bond prices and yields Assume that the Financial Management Corporation's $1,000-par-value bond had a 5.700% coupon, matures on May 15, 2027, has a cur- rent price quote of 97.708, and has a yield to maturity (YTM) of 6.034%. Given this information, answer the following questions: a. What was the dollar price of the bond? b. What is the bond's current yield? c. Is the bond selling at par, at a discount, or at a premium? Why? d. Compare the bond's current yield calculated in part b to its YTM and explain why they differ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts