Question: Please answer the two questions step by step P6-25 Bond valuation: Semiannual interest Calculate the value of each of the bonds shown in the following

Please answer the two questions step by step

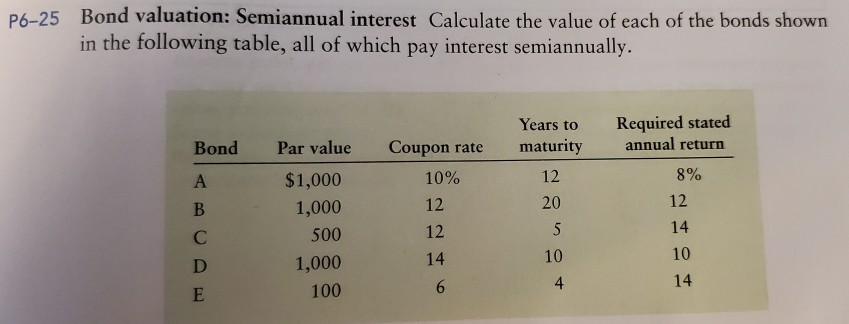

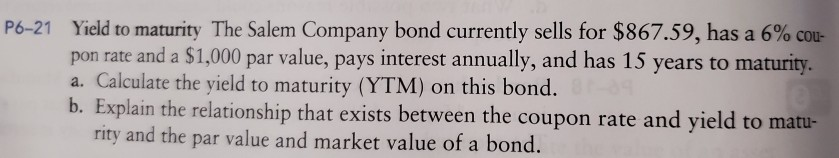

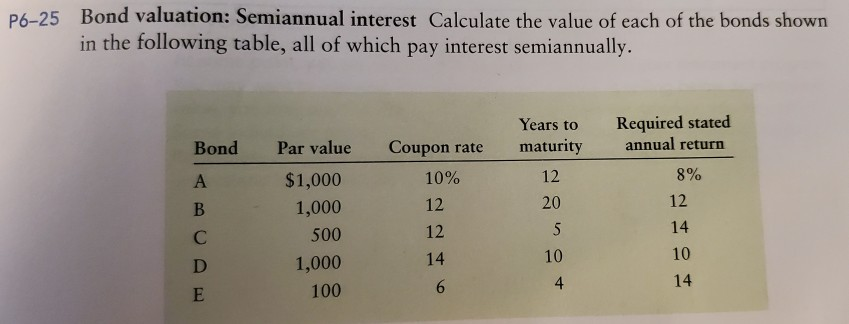

P6-25 Bond valuation: Semiannual interest Calculate the value of each of the bonds shown in the following table, all of which pay interest semiannually. . Years to maturity Required stated annual return Bond Par value 12 8% 12 B 20 Coupon rate 10% 12 12 14 6 $1,000 1,000 500 1,000 100 5 14 D E 10 10 14 4 P6-21 Yield to maturity The Salem Company bond currently sells for $867.59, has a 6% cou- pon rate and a $1,000 par value, pays interest annually, and has 15 years to maturity. a. Calculate the yield to maturity (YTM) on this bond. b. Explain the relationship that exists between the coupon rate and yield to matu- rity and the par value and market value of a bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts