Question: please answer the two questions! Thank you! i will give rating! QUESTION 43 Which of the following is a FALSE statement A Looking at the

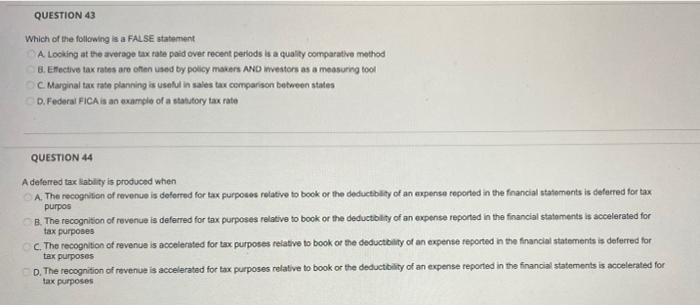

QUESTION 43 Which of the following is a FALSE statement A Looking at the average tax rate paid over recent periods is a quality comparative method B. Effective tax rates are often used by policy makers AND mvestors as a measuring tool C. Marginal tax rate planning is useful in sales tax comparison between states D. Federal FICA is an example of a statutory tax rate QUESTION 44 purpos A deferred tax lability is produced when A. The recognition of revenue is deferred for tax purposes relative to book or the deductibility of an expense reported in the fnancial statements is deterred for tax B. The recognition of revenue is deferred for tax purposes relative to book of the deductibility of an expense reported in the financial statements is ac s accelerated for C. The recognition of revenue is accelerated for tax purposes relative to book or the deductibility of an expense reported in the financial statements is deferred for D. The recognition of revenue is accelerated for tax purposes relative to book or the deductibility of an expense reported in the financial statements is accelerated for tax purposes tax purposes tex purposes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts