Question: please answer the whole question and explain step by step include formulas and if you are calculating in excel please show all functions and steps

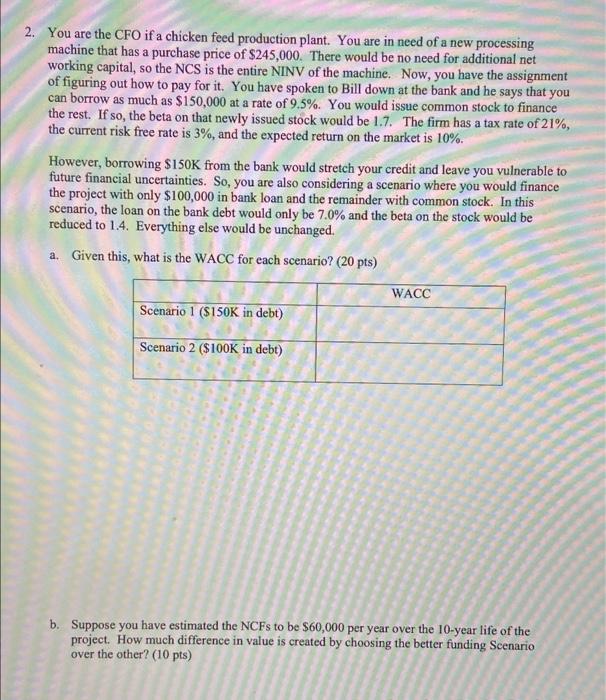

2. You are the CFO if a chicken feed production plant. You are in need of a new processing machine that has a purchase price of $245,000. There would be no need for additional net working capital, so the NCS is the entire NINV of the machine. Now, you have the assignment of figuring out how to pay for it. You have spoken to Bill down at the bank and he says that you can borrow as much as $150,000 at a rate of 9.5%. You would issue common stock to finance the rest. If so, the beta on that newly issued stock would be 1.7. The firm has a tax rate of 21%, the current risk free rate is 3%, and the expected return on the market is 10%. However, borrowing $150K from the bank would stretch your credit and leave you vulnerable to future financial uncertainties. So, you are also considering a scenario where you would finance the project with only $100,000 in bank loan and the remainder with common stock. In this scenario, the loan on the bank debt would only be 7.0% and the beta on the stock would be reduced to 1.4. Everything else would be unchanged. a. Given this, what is the WACC for each scenario? (20 pts) WACC Scenario 1 (S150K in debt) Scenario 2 ($100K in debt) b. Suppose you have estimated the NCFs to be $60,000 per year over the 10-year life of the project . How much difference in value is created by choosing the better funding Scenario over the other? (10 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts