Question: Please answer the whole question. Problems A, B, C, D, E, and F. Please show procedure. It would be highlt appreciated. 5-8 It is now

Please answer the whole question. Problems A, B, C, D, E, and F. Please show procedure. It would be highlt appreciated.

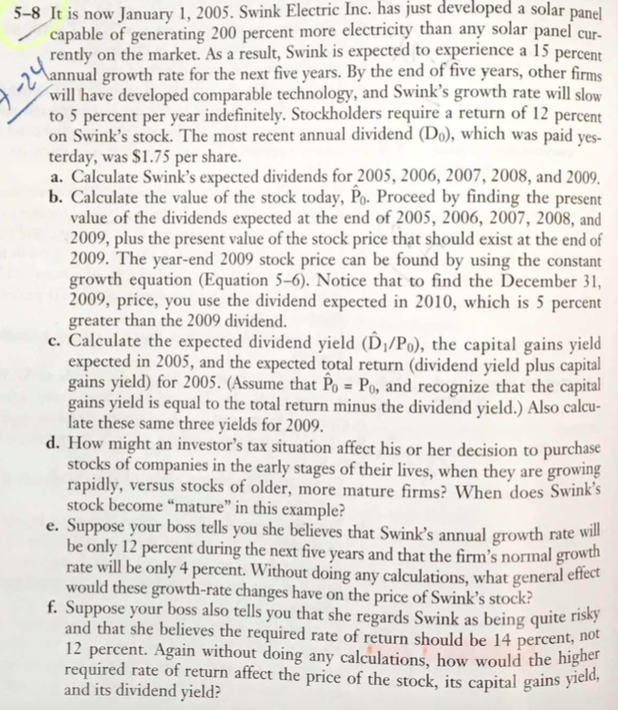

5-8 It is now January 1, 2005. Swink Electric Inc. just a solar panel capable of generating 200 percent more electricity than any solar panel cu rently on the market. As a result, Swink is expected to experience a 15 percen annual growth rte for the next five years. By the end of five years, other firms will have developed comparable technology, and Swink's growth rate will slow to 5 percent per year indefinitely. Stockholders require a return of 12 percent on Swink's stock. The most recent annual dividend (Do, which was paid yes- has developed terday, was $1.75 per share a. Calculate Swink's expected dividends for 2005, 2006, 2007, 2008, and 2009, b. Calculate the value of the stock today, Po. Proceed by finding the present value of the dividends expected at the end of 2005, 2006, 2007, 2008, and of 2009. The year-end 2009 stock price can be found by using the constant growth equation (Equation 5-6). Notice that to find the December 31 2009, price, you use the dividend expected in 2010, which is 5 percent 2009, plus the present value of the stock price that should exist at the end greater than the 2009 dividend. c. Calculate the expected dividend yield (Di/Po), the capital gains yield expected in 2005, and the expected total return (dividend yield plus capital gains yield) for 2005. (Assume that Po = Po, and recognize that the capital gains yield is equal to the total return minus the dividend yield.) Also calcu- late these same three yields for 2009. d. How might an investor's tax situation affect his or her decision to purchase stocks of companies in the early stages of their lives, when they are growing rapidly, versus stocks of older, more mature firms? When does S stock become "mature" in this example? wink e. Suppose your boss tells you she believes that Swink's annual growth rate wil be only 12 percent during the next five years and that the firm's normal growt rate will be only 4 percent. Without doing any calculations, what general would these growth-rate changes have on the price of Swink's stock f. Suppose your boss also tells you that she regards Swink as being quite r and that she believes the required rate of return should be 14 percent, 12 percent. Again without doing any calculations, how would the required rate of return affect the price of the stock, its capital gains y and its dividend vield? not ield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts