Question: Please answer them all 8-1 What is risk in the context of financial decision making? 8-2 Define return, and describe how to find the total

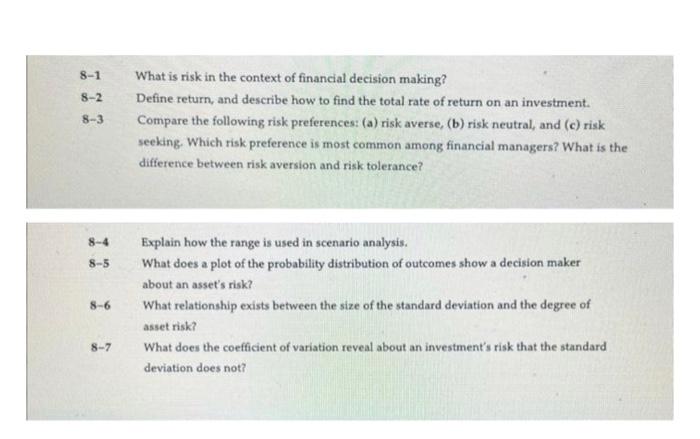

8-1 What is risk in the context of financial decision making? 8-2 Define return, and describe how to find the total rate of return on an investment. 8-3 Compare the following risk preferences: (a) risk averse, (b) risk neutral, and (c) risk seeking. Which risk preference is most common among financial managers? What is the difference between risk aversion and risk tolerance? 8-4 Explain how the range is used in scenario analysis. 8-5 What does a plot of the probability distribution of outcomes show a decision maker about an asset's risk? 8-6 What relationship exists between the size of the standard deviation and the degree of asset risk? 8-7 What does the coefficient of variation reveal about an investment's risk that the standard deviation does not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts