Question: Please answer them all. Thank you so much COMPLETION 19. Equipment was purchased for $20,000, residual value is $1,000 and it is expected that the

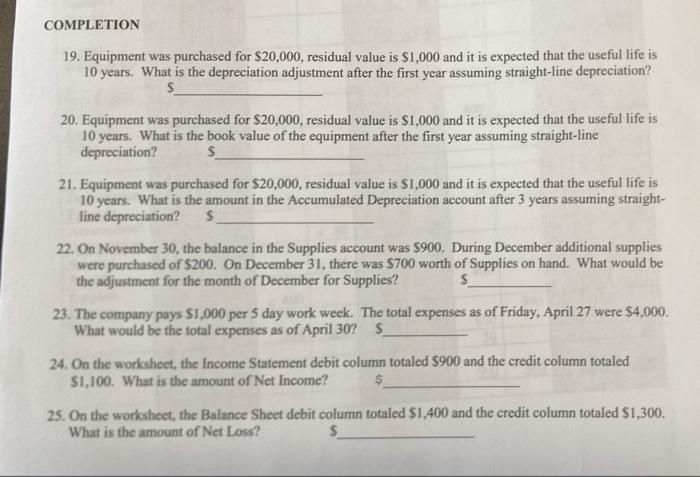

COMPLETION 19. Equipment was purchased for $20,000, residual value is $1,000 and it is expected that the useful life is 10 years. What is the depreciation adjustment after the first year assuming straight-line depreciation? S 20. Equipment was purchased for $20,000, residual value is $1,000 and it is expected that the useful life is 10 years. What is the book value of the equipment after the first year assuming straight-line depreciation? S 21. Equipment was purchased for $20,000, residual value is $1,000 and it is expected that the useful life is 10 years. What is the amount in the Accumulated Depreciation account after 3 years assuming straight- line depreciation? S 22. On November 30, the balance in the Supplies account was $900. During December additional supplies were purchased of $200. On December 31, there was $700 worth of Supplies on hand. What would be the adjustment for the month of December for Supplies? S 23. The company pays $1,000 per 5 day work week. The total expenses as of Friday, April 27 were $4,000. What would be the total expenses as of April 30? S 24. On the worksheet, the Income Statement debit column totaled $900 and the credit column totaled $1,100. What is the amount of Net Income? $ 25. On the worksheet, the Balance Sheet debit column totaled $1,400 and the credit column totaled $1,300. What is the amount of Net Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts