Question: please answer them all!! thx :) For Problems 20-24, assume you just bought a 6.9% $1,000 bond for $920, immediately after the annual interest payment

please answer them all!! thx :)

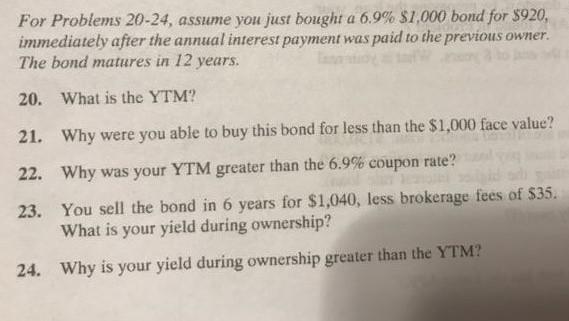

For Problems 20-24, assume you just bought a 6.9% $1,000 bond for $920, immediately after the annual interest payment was paid to the previous owner. The bond matures in 12 years. 20. What is the YTM? 21. Why were you able to buy this bond for less than the $1,000 face value? 22. Why was your YTM greater than the 6.9% coupon rate? 23. You sell the bond in 6 years for $1,040, less brokerage fees of $35. What is your yield during ownership? 24. Why is your yield during ownership greater than the YTM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts