Question: PLEASE ANSWER THEM ALL, WILL GIVE THUMBS UP TRUE OR FALSE. Record your answer on the separate answer sheet. 1. If Boeing's WACC goes down,

PLEASE ANSWER THEM ALL, WILL GIVE THUMBS UP

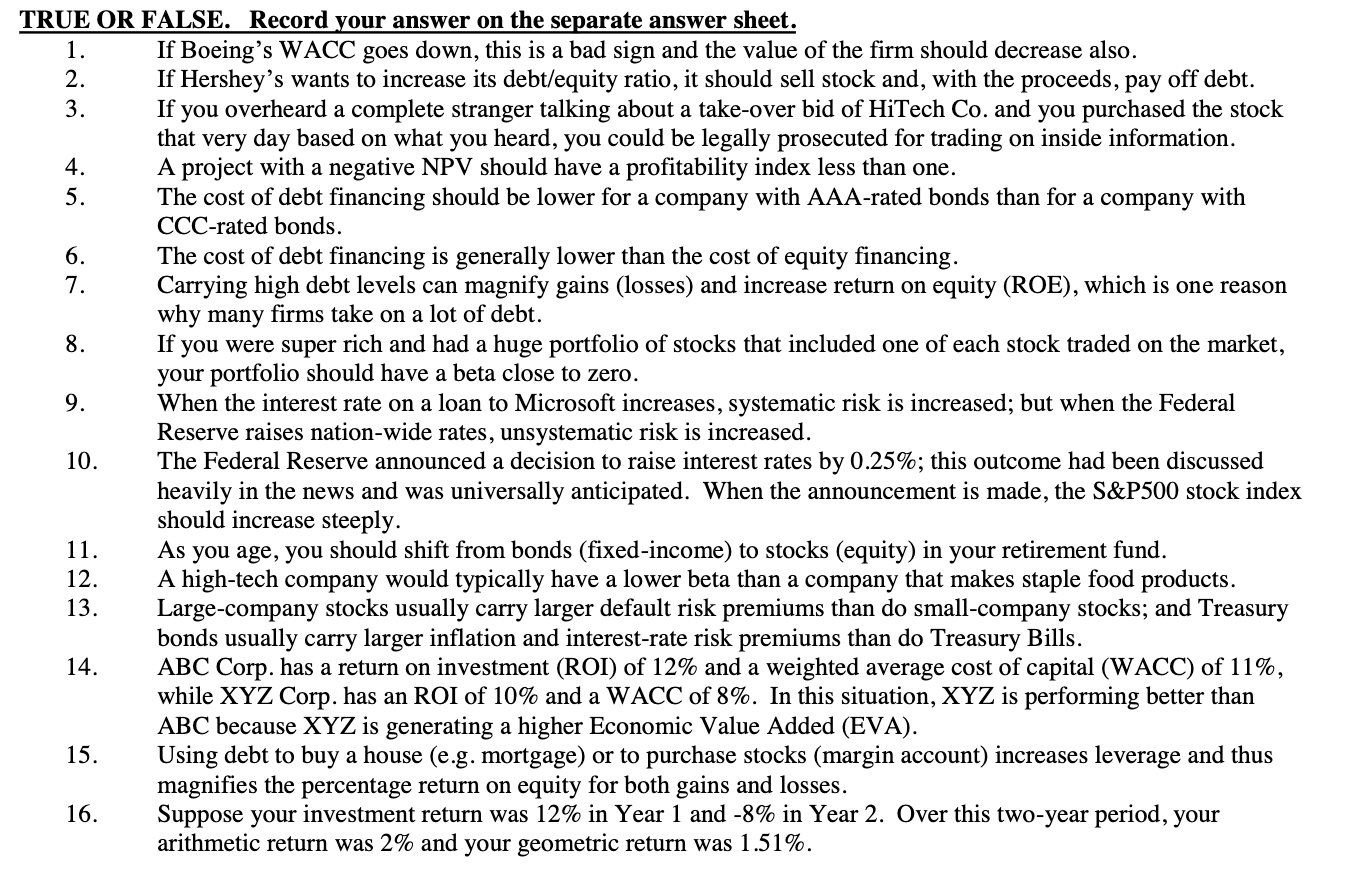

TRUE OR FALSE. Record your answer on the separate answer sheet. 1. If Boeing's WACC goes down, this is a bad sign and the value of the firm should decrease also. 2. If Hershey's wants to increase its debt/equity ratio, it should sell stock and, with the proceeds, pay off debt. 3. If you overheard a complete stranger talking about a take-over bid of HiTech Co. and you purchased the stock that very day based on what you heard, you could be legally prosecuted for trading on inside information. 4. A project with a negative NPV should have a profitability index less than one. 5. The cost of debt financing should be lower for a company with AAA-rated bonds than for a company with CCC-rated bonds. 6. The cost of debt financing is generally lower than the cost of equity financing. 7. Carrying high debt levels can magnify gains (losses) and increase return on equity (ROE), which is one reason why many firms take on a lot of debt. 8. If you were super rich and had a huge portfolio of stocks that included one of each stock traded on the market, your portfolio should have a beta close to zero. 9. When the interest rate on a loan to Microsoft increases, systematic risk is increased; but when the Federal Reserve raises nation-wide rates, unsystematic risk is increased. 10. The Federal Reserve announced a decision to raise interest rates by 0.25%; this outcome had been discussed heavily in the news and was universally anticipated. When the announcement is made, the S&P500 stock index should increase steeply. 11. As you age, you should shift from bonds (fixed-income) to stocks (equity) in your retirement fund. 12. A high-tech company would typically have a lower beta than a company that makes staple food products. 13. Large-company stocks usually carry larger default risk premiums than do small-company stocks; and Treasury bonds usually carry larger inflation and interest-rate risk premiums than do Treasury Bills. 14. ABC Corp. has a return on investment (ROI) of 12% and a weighted average cost of capital (WACC) of 11%, while XYZ Corp. has an ROI of 10% and a WACC of 8%. In this situation, XYZ is performing better than ABC because XYZ is generating a higher Economic Value Added (EVA). 15. Using debt to buy a house (e.g. mortgage) or to purchase stocks (margin account) increases leverage and thus magnifies the percentage return on equity for both gains and losses. 16. Suppose your investment return was 12% in Year 1 and -8% in Year 2. Over this two-year period, your arithmetic return was 2% and your geometric return was 1.51%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts