Question: please answer them without solving please give me the answer thank you A business combination between Company A and Company that renults in a newly

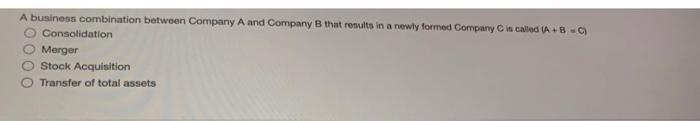

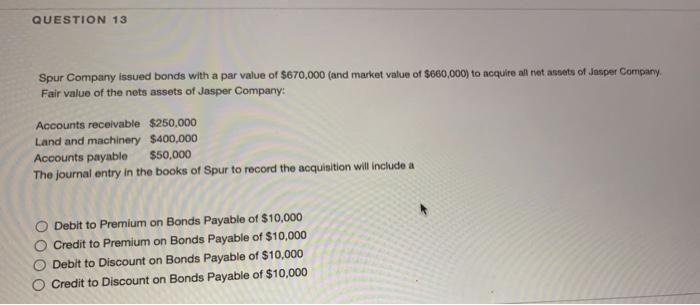

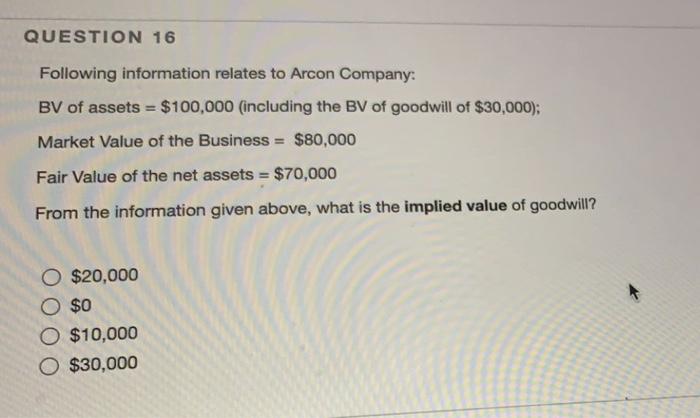

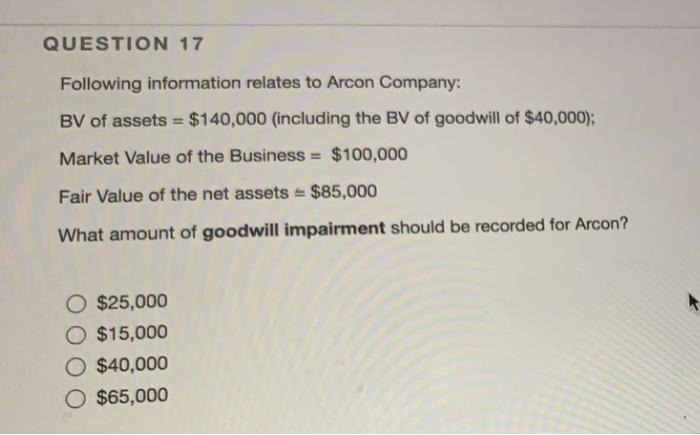

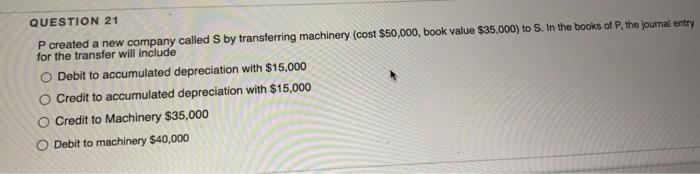

A business combination between Company A and Company that renults in a newly formed Company C in called A+B) Consolidation Merger Stock Acquisition Transfer of total assets QUESTION 13 Spur Company issued bonds with a par value of $670,000 (and market value of $660,000) to acquire all not assets of Jasper Company Fair value of the nets assets of Jasper Company: Accounts receivable $250,000 Land and machinery $400,000 Accounts payable $50,000 The journal entry in the books of Spur to record the acquisition will include a Debit to Premium on Bonds Payable of $10,000 Credit to Premium on Bonds Payable of $10,000 O Debit to Discount on Bonds Payable of $10,000 O Credit to Discount on Bonds Payable of $10,000 QUESTION 16 Following information relates to Arcon Company: BV of assets = $100,000 (including the BV of goodwill of $30,000); Market Value of the Business = $80,000 Fair Value of the net assets = $70,000 From the information given above, what is the implied value of goodwill? $20,000 $0 O $10,000 O $30,000 QUESTION 17 Following information relates to Arcon Company: BV of assets = $140,000 (including the BV of goodwill of $40,000); Market Value of the Business = $100,000 Fair Value of the net assets = $85,000 What amount of goodwill impairment should be recorded for Arcon? O $25,000 O $15,000 O $40,000 O $65,000 QUESTION 21 P created a new company called S by transferring machinery (cost $50,000, book value $35,000) to S. In the books of P, the journal entry for the transfer will include O Debit to accumulated depreciation with $15,000 Credit to accumulated depreciation with $15,000 Credit to Machinery $35,000 Debit to machinery $40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts