Question: please answer them You would like to be a millionaire when you retire in 40 years, and how much you must invest today to reach

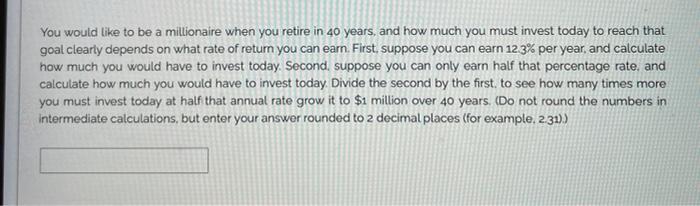

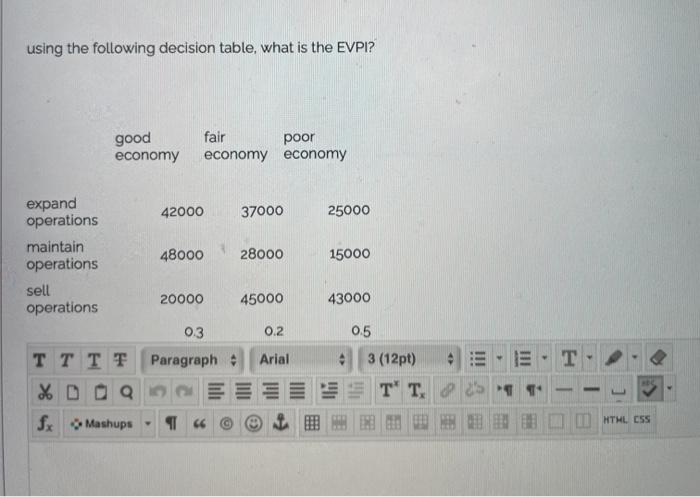

You would like to be a millionaire when you retire in 40 years, and how much you must invest today to reach that goal clearly depends on what rate of return you can earn. First, suppose you can earn 12 3% per year, and calculate how much you would have to invest today. Second, suppose you can only earn half that percentage rate, and calculate how much you would have to invest today. Divide the second by the first to see how many times more you must invest today at half that annual rate grow it to $1 million over 40 years. (Do not round the numbers in Intermediate calculations, but enter your answer rounded to 2 decimal places (for example. 2.31)) using the following decision table, what is the EVPI? good economy fair poor economy economy 42000 37000 25000 expand operations maintain operations sell operations 48000 28000 15000 20000 45000 43000 0.2 0.3 Paragraph . Arial 0.5 3 (12pt) T' T P 35 T fx Mashups - HTML CSS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts