Question: please answer There is a two-year zero-coupon bond with a face value of $100. Suppose that there is a bank that is offering o lend

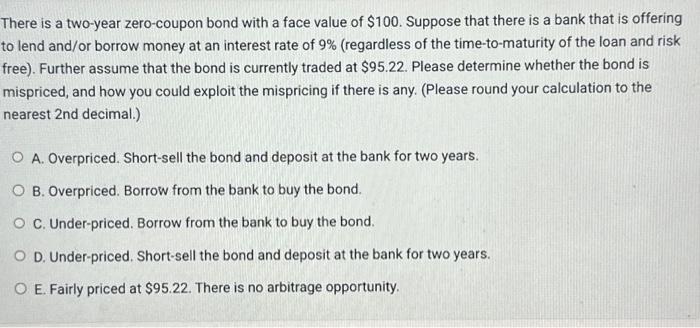

There is a two-year zero-coupon bond with a face value of $100. Suppose that there is a bank that is offering o lend and/or borrow money at an interest rate of 9% (regardless of the time-to-maturity of the loan and risk free). Further assume that the bond is currently traded at $95.22. Please determine whether the bond is mispriced, and how you could exploit the mispricing if there is any. (Please round your calculation to the nearest 2 nd decimal.) A. Overpriced. Short-sell the bond and deposit at the bank for two years. B. Overpriced. Borrow from the bank to buy the bond. C. Under-priced. Borrow from the bank to buy the bond. D. Under-priced. Short-sell the bond and deposit at the bank for two years. E. Fairly priced at $95.22. There is no arbitrage opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts