Question: Please answer these 3 questions clearly [a. b. c.] Ensure that your answers are correct. Will thumbs up if right. Thanks *Data is provided, up

Please answer these 3 questions clearly [a. b. c.] Ensure that your answers are correct. Will thumbs up if right. Thanks

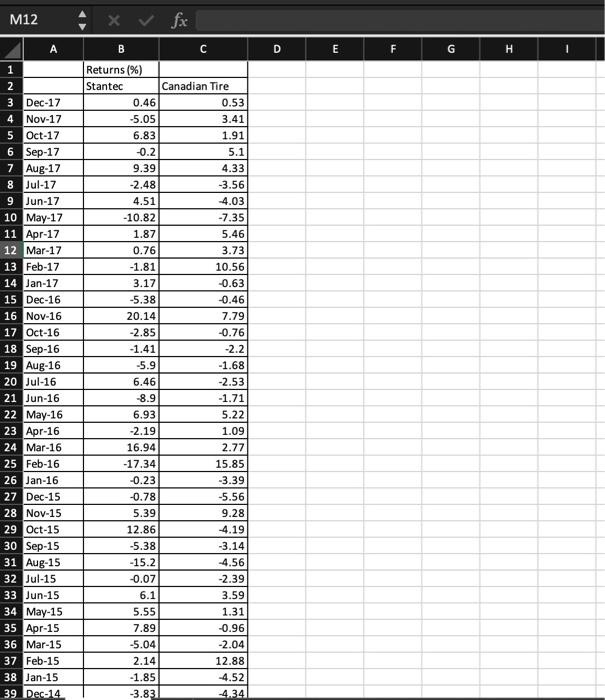

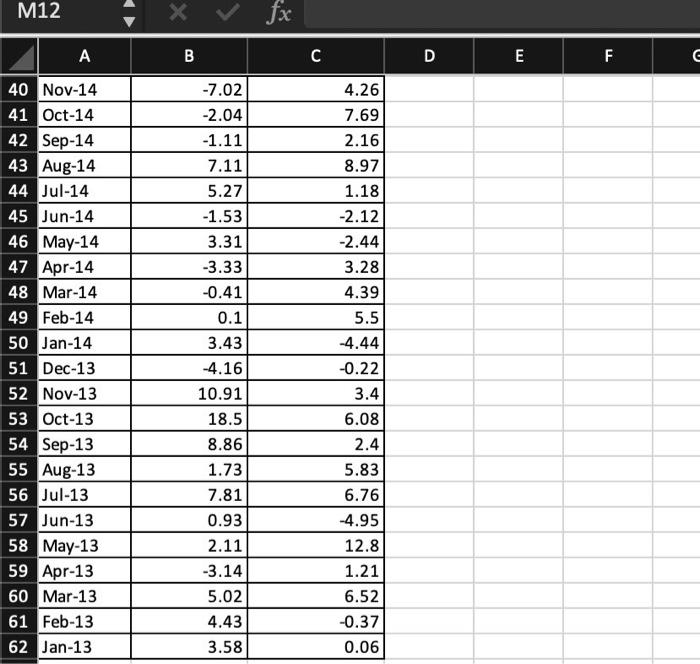

*Data is provided, up to 62*

![Please answer these 3 questions clearly [a. b. c.] Ensure that](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe33f179aee_47366fe33f116861.jpg)

M12 Use the accompanying data to complete parts a through c below. a. Compute the correlation of monthly returns between Stantec and Canadian Tire. b. Compute the annual standard deviation of Stantec and Canadian Tire. c. Compute the annual variance and standard deviation of a portfolio of 70% Stantec stock and 30% Canadian Tire stock. Click the icon to view the data table. a. The correlation of monthly returns between Stantec and Canadian Tire is (Round to five decimal places.) M12 \begin{tabular}{|l|l|r|r|} \hline & \multicolumn{1}{|c|}{ A } & \multicolumn{1}{|c|}{ B } & \multicolumn{1}{c|}{ C } \\ \hline 40 & Nov-14 & -7.02 & 4.26 \\ \hline 41 & Oct-14 & -2.04 & 7.69 \\ \hline 42 & Sep-14 & -1.11 & 2.16 \\ \hline 43 & Aug-14 & 7.11 & 8.97 \\ \hline 44 & Jul-14 & 5.27 & 1.18 \\ \hline 45 & Jun-14 & -1.53 & -2.12 \\ \hline 46 & May-14 & 3.31 & -2.44 \\ \hline 47 & Apr-14 & -3.33 & 3.28 \\ \hline 48 & Mar-14 & -0.41 & 4.39 \\ \hline 49 & Feb-14 & 0.1 & 5.5 \\ \hline 50 & Jan-14 & 3.43 & -4.44 \\ \hline 51 & Dec-13 & -4.16 & -0.22 \\ \hline 52 & Nov-13 & 10.91 & 3.4 \\ \hline 53 & Oct-13 & 18.5 & 6.08 \\ \hline 54 & Sep-13 & 8.86 & 2.4 \\ \hline 55 & Aug-13 & 1.73 & 5.83 \\ \hline 56 & Jul-13 & 7.81 & 6.76 \\ \hline 57 & Jun-13 & 0.93 & -4.95 \\ \hline 58 & May-13 & 2.11 & 12.8 \\ \hline 59 & Apr-13 & -3.14 & 1.21 \\ \hline 60 & Mar-13 & 5.02 & 6.52 \\ \hline 61 & Feb-13 & 3.58 & 0.37 \\ \hline 62 & Jan-13 & 0.06 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts