Question: please answer these 3 questions mentioned in this photo QUESTION 3: Identify each of the following statements as true or false, and explain your answers.

please answer these 3 questions mentioned in this photo

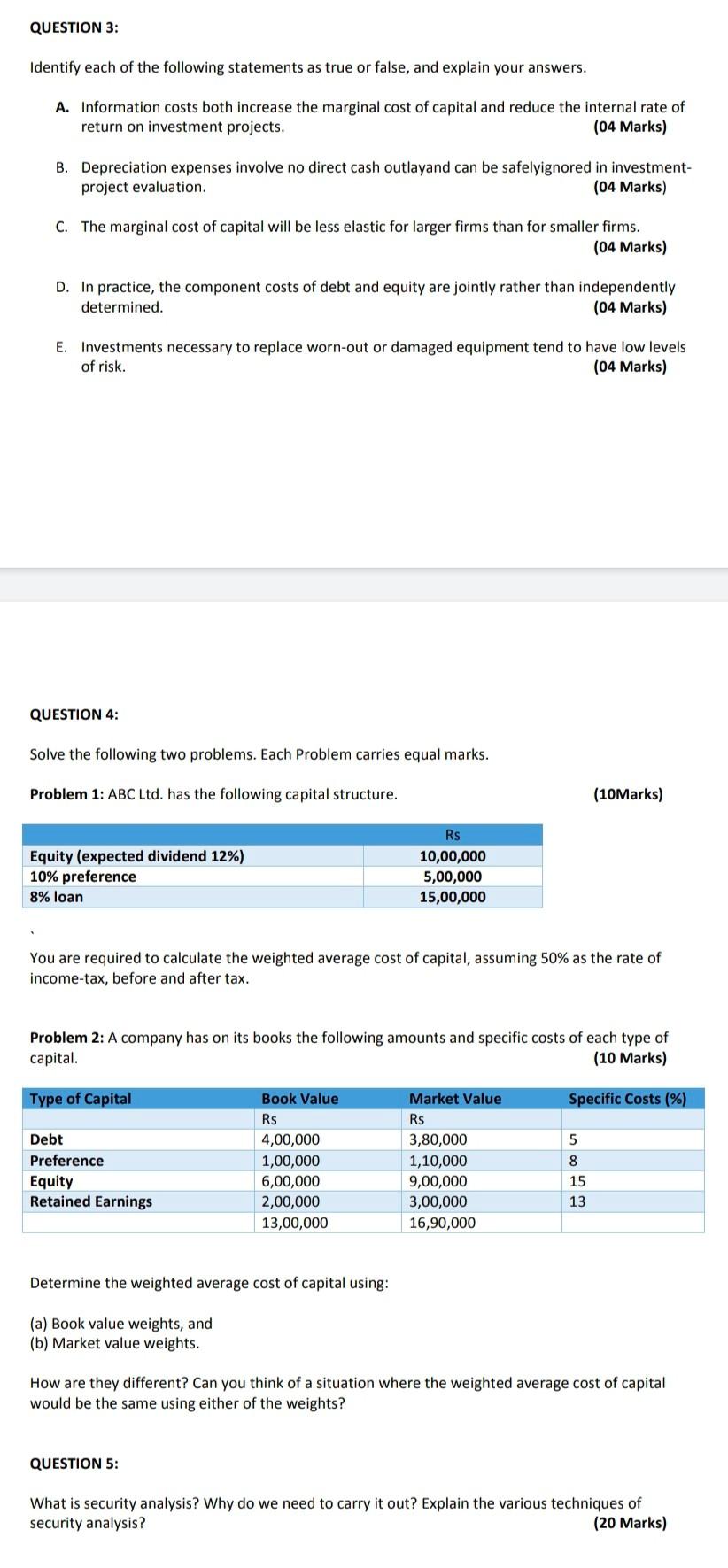

QUESTION 3: Identify each of the following statements as true or false, and explain your answers. A. Information costs both increase the marginal cost of capital and reduce the internal rate of return on investment projects. (04 Marks) B. Depreciation expenses involve no direct cash outlayand can be safelyignored in investment- project evaluation. (04 Marks) C. The marginal cost of capital will be less elastic for larger firms than for smaller firms. (04 Marks) D. In practice, the component costs of debt and equity are jointly rather than independently determined. (04 Marks) E. Investments necessary to replace worn-out or damaged equipment tend to have low levels of risk. (04 Marks) QUESTION 4: Solve the following two problems. Each Problem carries equal marks. Problem 1: ABC Ltd. has the following capital structure. (10 Marks) Equity (expected dividend 12%) 10% preference 8% loan Rs 10,00,000 5,00,000 15,00,000 You are required to calculate the weighted average cost of capital, assuming 50% as the rate of income-tax, before and after tax. Problem 2: A company has on its books the following amounts and specific costs of each type of capital. (10 Marks) Type of Capital Specific Costs (%) Debt Preference Equity Retained Earnings Book Value Rs 4,00,000 1,00,000 6,00,000 2,00,000 13,00,000 Market Value Rs 3,80,000 1,10,000 9,00,000 3,00,000 16,90,000 8 15 13 Determine the weighted average cost of capital using: (a) Book value weights, and (b) Market value weights. How are they different? Can you think of a situation where the weighted average cost of capital would be the same using either of the weights? QUESTION 5: What is security analysis? Why do we need to carry it out? Explain the various techniques of security analysis? (20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts